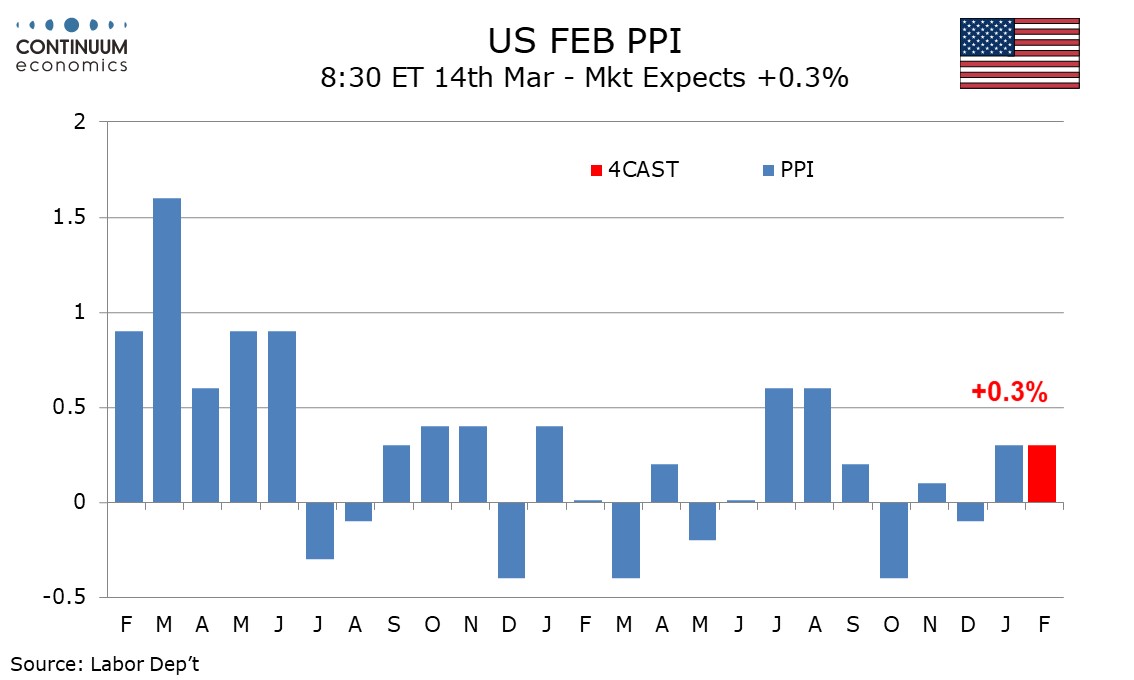

Preview: Due March 14 - U.S. February PPI - Strong January core rates unlikely to be repeated

We expect a 0.3% increase in February’s PPI, matching January’s increase, but with 0.2% increases in the core rates ex food and energy and ex food, energy and trade, slowing from above trend January increases of 0.5% and 0.6% respectively as the New Year saw what we expect to be one-time price hikes.

January’s increase ex food, energy and trade was the highest since a matching 0.6% gain in January 2023, suggesting the January strength is likely to be a one-time bounce. February 2023 saw a 0.3% rise ex food, energy and trade. We expect a 0.2% rise this February, matching December’s gain and stronger than 0.1% gains seen in October and November.

A 0.2% rise ex food and energy would be stronger than in the last five months of 2023 which followed a trade-led 0.6% rise in July. January 2023 was above trend at 0.3% even with a sharp fall in trade, and followed by a 0.2% increase in February 2023. A 0.2% rise this February would leave the yr/yr pace unchanged at a modest 2.0% while ex food, energy and trade falls to 2.4% from 2.6%.

We expect services PPI to rise by 0.2% with goods ex food and energy up by 0.1%. We expect overall PPI to be lifted to a 0.3% increase by a correction in energy from four straight declines outweighing a third straight decline in food. Yr/yr PPI would then increase to 1.2% from 0.9%.