FX Daily Strategy: Asia, September 19th

GBP focus on BoE decision

Rate cut unlikely but GBP may fall if more than 2 dissents

NZD may suffer from weaker GDP

AUD could test the highs of the year

GBP focus on BoE decision

Rate cut unlikely but GBP may fall if more than 2 dissents

NZD may suffer from weaker GDP

AUD could test the highs of the year

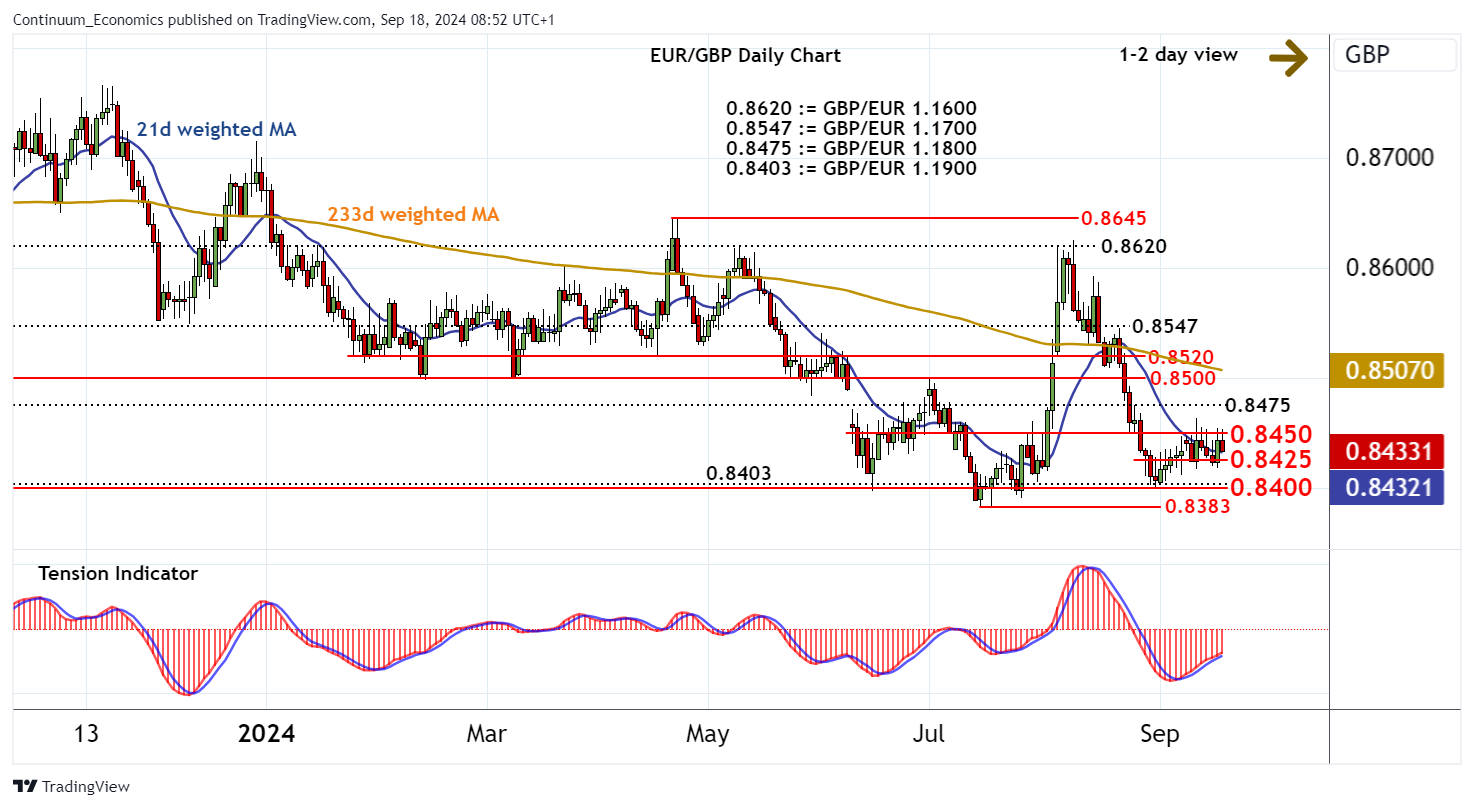

After the FOMC on Wednesday we have the BoE MPC meeting on Thursday. The UK August CPI data on Wednesday was seen by the market as a reason to further reduce the chances of a BoE rate cut at this month’s meeting, but in reality showed mixed signs. Services inflation rose back 0.4 ppt to 5.6%, up from a two-year low but was still below the BoE projection and was almost solely driven by a swing in (very volatile) airfares without which services would have fallen (well) below 5% - this also accounting for the rise in the core rate. Indeed, the core would have fallen (well) below 3% without airfares. Moreover, restaurant inflation hit a new cycle low amid generally softer price pressures in which eight (of 12) CPI components fell. As a result, the overall CPI headline rate stayed to 2.2% in August this chiming with the consensus and two notches under BoE thinking.

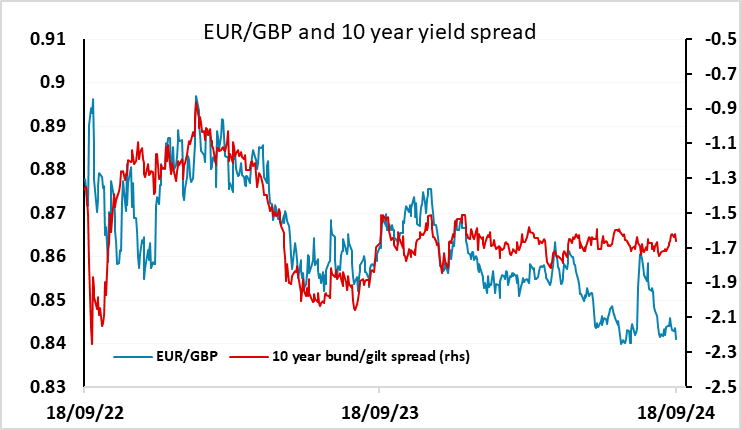

The data (especially ex-volatile services) do not rule out a further rate cut at today’s MPC decision, but it does still seem probable that rates will be left unchanged. In that case the focus will be on rhetoric and the closeness of the vote – it may see at least 2-3 dissents in favour of further immediate easing. The market consensus is for 2 dissents – any more and GBP should edge a little lower. But it continues to look difficult for EUR/GBP to break the 0.84-0.8450 range near term.

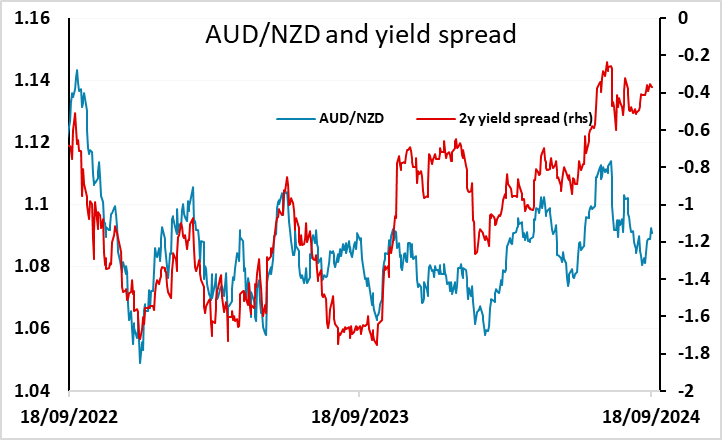

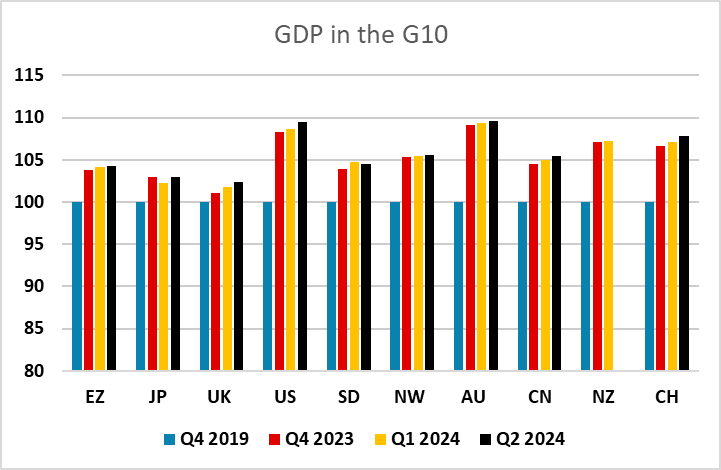

Before the UK data we have the Australian employment data, and before that the NZ Q2 GDP data. The NZ data is expected to show a Q2 decline, supporting the recent more dovish RBNZ stance. Although NZ growth has been solid by international standards since the pandemic, it has stalled this year, and the data will likely support the market consensus of a further 250bps of easing by the end of 2025. The market is currently pricing a 25bp cut in October as most likely, but a 50bp cut is priced as better than a 30% chance, so weak data may shift expectations in that direction. The NZD has been performing well against the AUD in recent weeks, helped by concerns about the impact of a weak China on Australia, but risks look to be to the upside for AUD/NZD.

The focus in the Australian employment numbers may be on the unemployment rate, which has been edging up this year even though the employment numbers have continued to show steady growth. If this stabilises at 4.2% and the equity market performs well after the FOMC, there is every chance of AUD/USD breaking the highs of the year at 0.6839.