FX Daily Strategy: APAC, July 22nd

Market focus to remain on tariffs

USD under pressure as yields drop

JPY likely to be the best performer on lower US yields

NOK remains good long term value

Market focus to remain on tariffs

USD under pressure as yields drop

JPY likely to be the best performer on lower US yields

NOK remains good long term value

Tuesday is another exceptionally quiet data for data, so the market is likely to continue to look for clues on whether there is any progress in trade talks or whether the EU will see 30% tariffs imposed form August 1st. Monday saw yields drop a little on pessimism around trade talks, and it remains quite likely that the talks will go up to and probably somewhat beyond the August 1st deadline, if past Trump brinkmanship is any guide. If so, we could see an extension of the correction lower in the USD and higher in the JPY seen on Monday.

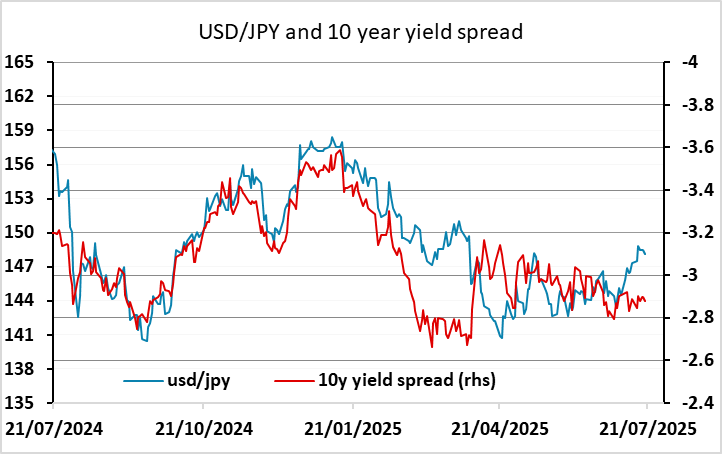

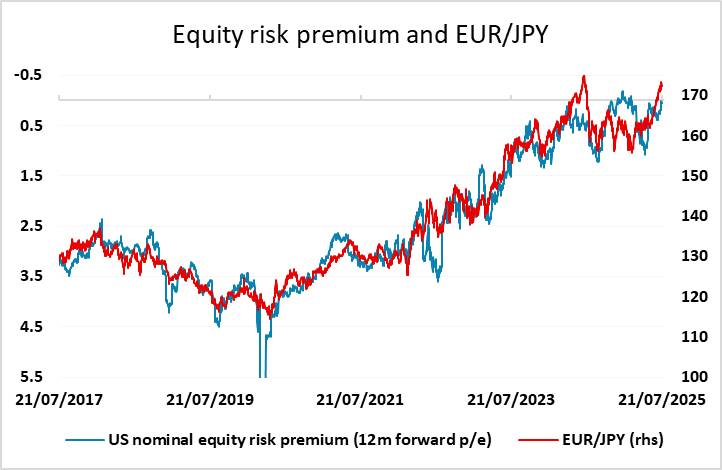

The USD was generally lower on Monday, although the JPY led the way, with lower US yields seemingly the main driver. Lower US yields are the most reliable indicator of JPY strength as these typically lead both to lower yield spreads with Japan and higher equity risk premia, but current levels of US yields (and Japanese yields and US equities) already suggest scope for a further JPY correction towards 144 in USD/JPY and 168 in EUR/JPY.

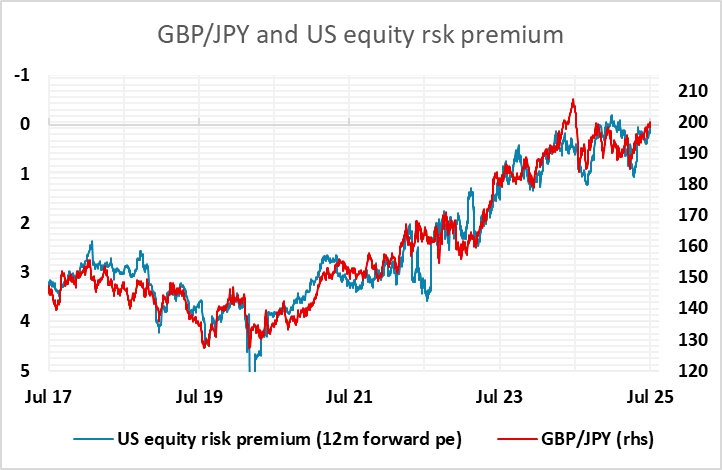

GBP/JPY is the JPY cross which has the best consistent correlation with equity risk premia, and while EUR/JPY looks a little expensive based on its correlation with risk premia, GBP/JPY looks broadly fair on this basis (although still much too high from a fundamental perspective). This suggests that if we see a further correction lower in EUR/JPY we may also see a correction lower in EUR/GBP. This would make some sense if tension around trade is the catalyst for JPY strength, as the UK is seen to be in a relatively favourable position with the US.

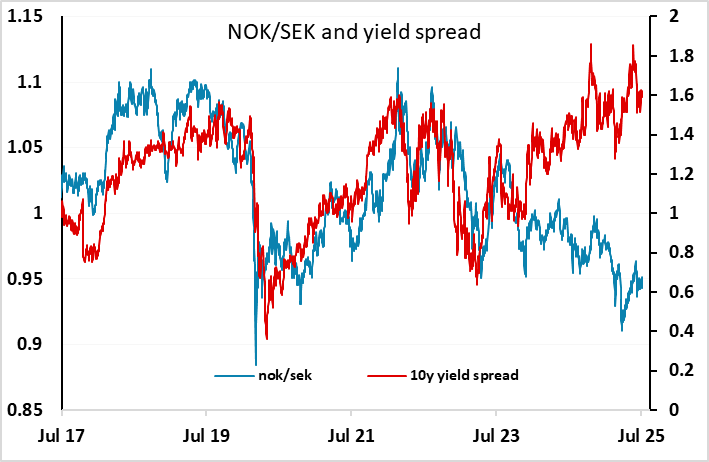

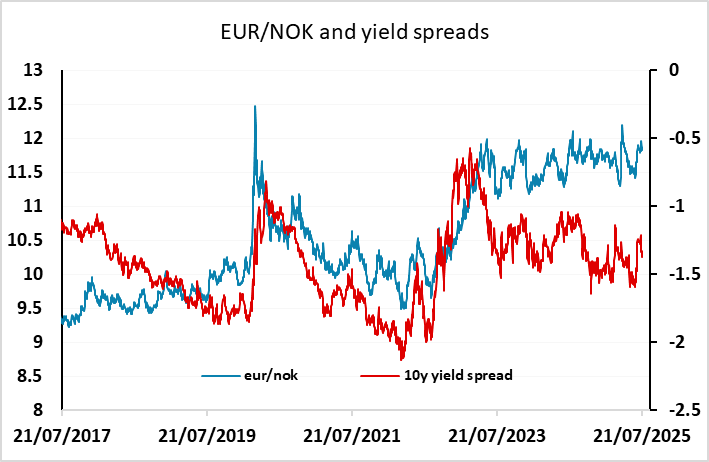

The other significant move on Monday was further weakening in the NOK which had staged something of a recovery on Friday. There wasn’t an obvious trigger for this, and while the NOK still looks to represent very good value relative to yield spreads, this has been true for nigh n a year, so an immediate recovery seems unlikely. Having said this, any drop to 0.93 in NOK/SEK is likely to attract buyers, and EUR/NOK near 12 also represents very good medium term value given that there is still a significant yield pick up available in the NOK.