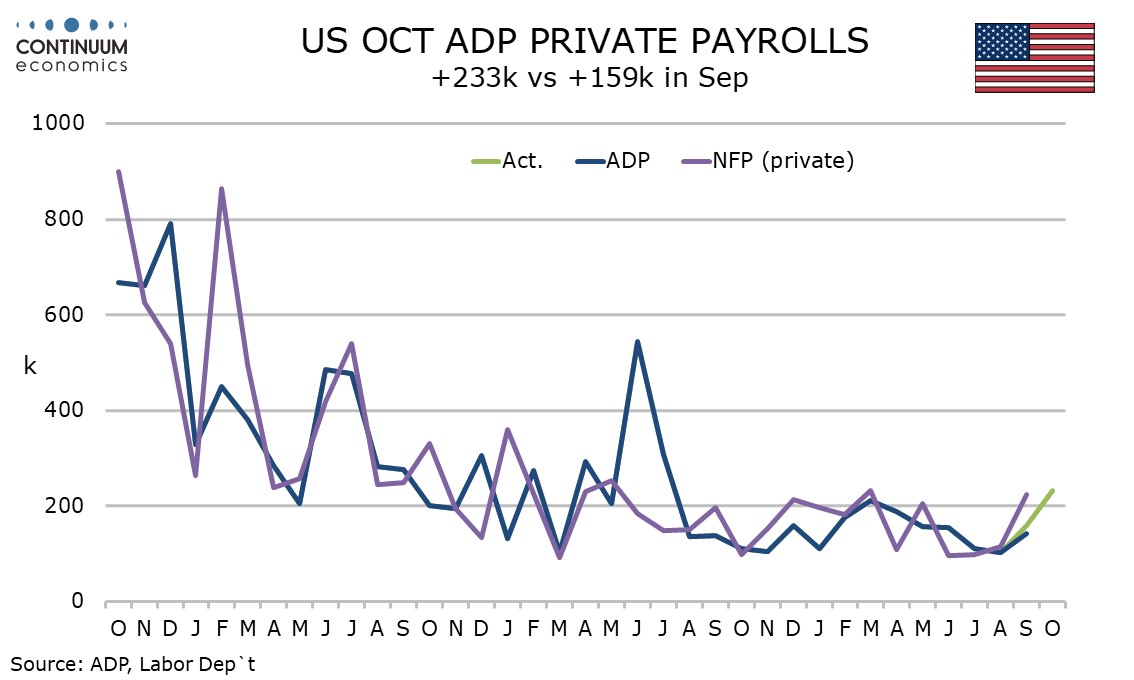

U.S. October ADP Employment - Suggests underlying strength, even if payrolls prove more sensitive to weather

ADP’s October estimate for private sector employment growth of 233k is well above consensus and suggests underlying strength in the labor market. However ADP is not a reliable enough guide to payrolls to have us revising our forecast for a below trend 75k (40k in the private sector) increase in the non-farm payroll.

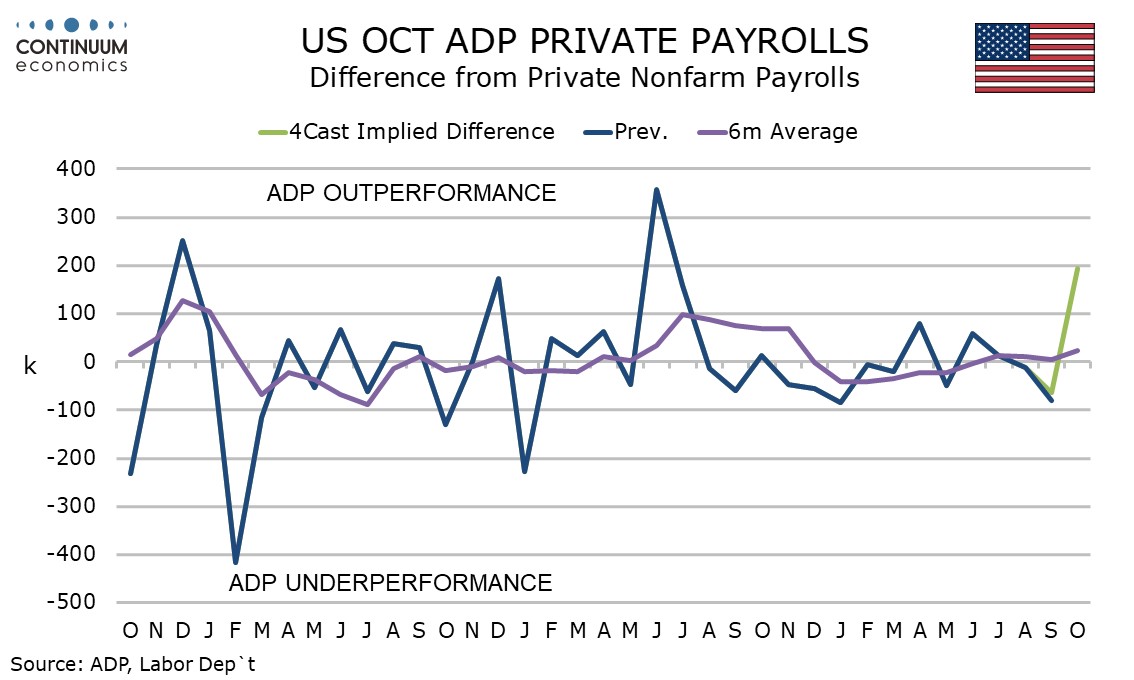

Even with an upward revision to 159k from 143k, September’s ADP gain is significantly softer than a 223k September rise in private sector non-farm payrolls, and ADP underperformance may be followed by ADP outperformance in October. Payrolls may prove more sensitive to weather, notably Hurricanes Helene and Milton, than ADP data has been. Initial claims picked up in response to the hurricanes, though reversed once the hurricanes had passed. If payrolls do turn out to be weak, the weakness is likely to be temporary.

ADP employment growth was strong with the exception of a 19k decline in manufacturing, and if ADP data has captured 33k strikers at Boeing then manufacturing is also firm on an underlying basis. Construction rose by 37k and private services by 211k. Wage growth slowed marginally to 4.6% yr/yr from 4.7% for job stayers and more significantly to 6.2% from 6.6% for job changers, which in contrast to the strong rise in employment, suggests that jobs are becoming less easy to find.