USD, EUR flows: USD strengthens against EUR without yield spread support

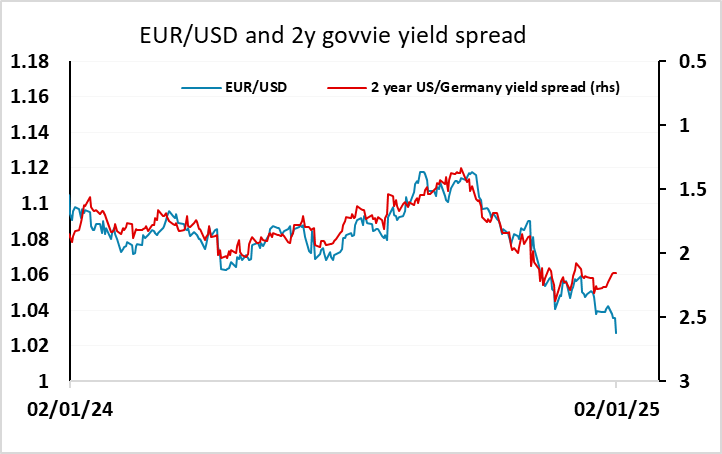

EUR/USD continues decline despite steady front end yield spreads. Playbook from first Trump presidency suggests caution

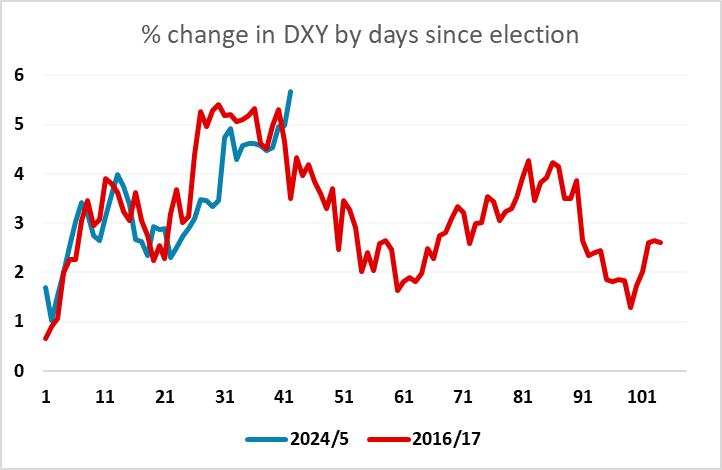

A quiet overnight session has seen the USD edge a little lower after Thursday’s gains, but the EUR and GBP remain significantly lower over the last 24 hours. EUR/USD is showing a clear break from the yield spread correlation that held through 2024, and while monetary policy is certainly still going to matter through 2025, we may well see other factors start to have an impact this year. The declines in EUR/USD seen this year are being attributed by some to fears of Trump tariffs, and that may be the case, but analysis suggests that even if Trump does impose significant tariffs on Europe, the growth impact will be greater on the US. It should also be remembered that there were similar concerns after the first Trump election win, and the USD gained strongly initially, but fell back through most of 2017 and 2018. The USD gains up to now have broadly matched those seen in 2016/17, but with the USD at much higher levels now than it was then, and gaining without the support of yield spread moves, we would be wary of expecting further gains from current levels.