FX Daily Strategy: APAC, Oct 30th

BoJ expected to leave rates unchanged…

…but risk of a hike looks greater than the market is pricing in

European data may support EUR/CHF

Equities in focus with more tech earnings due

BoJ expected to leave rates unchanged…

…but risk of a hike looks greater than the market is pricing in

European data may support EUR/CHF

Equities in focus with more tech earnings due

Thursday kicks off with the BoJ meeting, and while the market is pricing in only around a 15% chance of a 25bp rate hike, the risk is probably a little greater than that. The BoJ have shown themselves as being willing to surprise the market under BoJ governor Ueda, and it is clear that the direction of travel is towards higher rates. However, in recent comments Ueda has tended to say that the BoJ are in no major hurry, as they don’t see a big risk to delaying the next hike, so on balance we don’t expect them to act this time around.

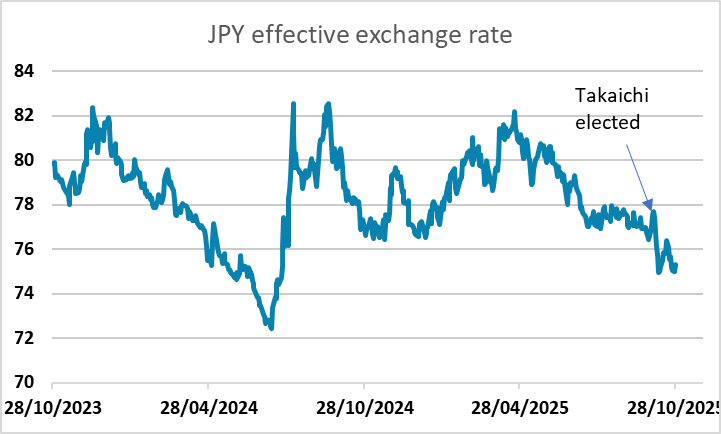

But the market assumption that the BoJ will stand pat because the new government favours more expansionary monetary policy looks misguided. Indeed, we believe a BoJ hike is now more rather than less likely to hiem than it was before the new administration came to power. First, it is likely that fiscal policy will be more expansionary under the new government, allowing a faster pace of monetary tightening consistent with the inflation target. Second, the JPY has weakened substantially since the election of Takaichi, and that will increase inflation, other things equal, plus a BoJ hike might be seen as desirable to help stabilise the currency. Third, the BoJ may want to emphasise its independence, although most expect a less confrontational approach to relations with the new government. On balance, we expect a hike to be delayed until December, but even if it is, if Ueda prepares a rate hike with his comments, the JPY could benefit, as even a December hike is a little less than halfway priced in. For USD/JPY, we therefore see the risks as mainly on the downside, even if there is a knee-jerk positive reaction to a no change decision.

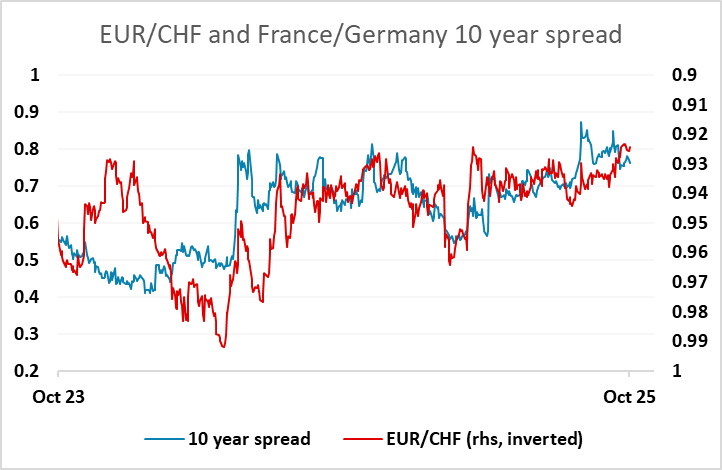

There is also the ECB meeting, but this looks likely to be a damp squib, with little chance of any indication that th ECB is considering moving rates any time soon. It is more likely that the Eurozone data could have an impact, with preliminary Q3 GDP and October CPI data due from Spain and Germany. We see a flat q/q outcome for EZ GDP, with some divergences among the member states. The consensus is a more positive 0.1% gain, with France at 0.2% and Germany at zero. Such an outcome might be seen as positive for EUR/CHF, as evidence of relative strength in France could reduce concerns about French fiscal problems, albeit marginally. EUR/CHF managed a significant bounce on Wednesday, and once again looks well supported at 0.92 unless we see some major risk upset.

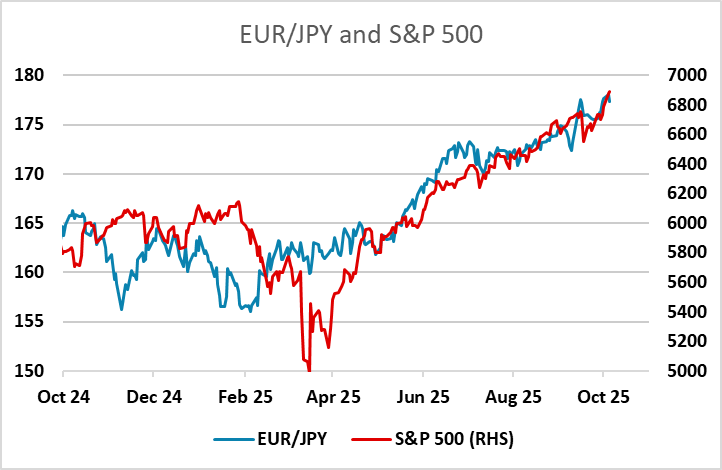

Otherwise, Thursday sees Q3 earnings from Apple and Amazon after the close, which could affect the equity market. Strength in equities has undermined the JPY throughout this year, and the break higher this week looks a step too far given that it is based on optimism around US/China trade, but concerns about US/China trade had barely made a dent in equity market strength.