FX Daily Strategy: N America, Oct 30th

BoJ leave rates unchanged…

…but risk of a 2025 hike looks greater than the market is pricing in

European data may support EUR/CHF

Equities in focus with more tech earnings due

BoJ expected to leave rates unchanged…

…but risk of a 2025 hike looks greater than the market is pricing in

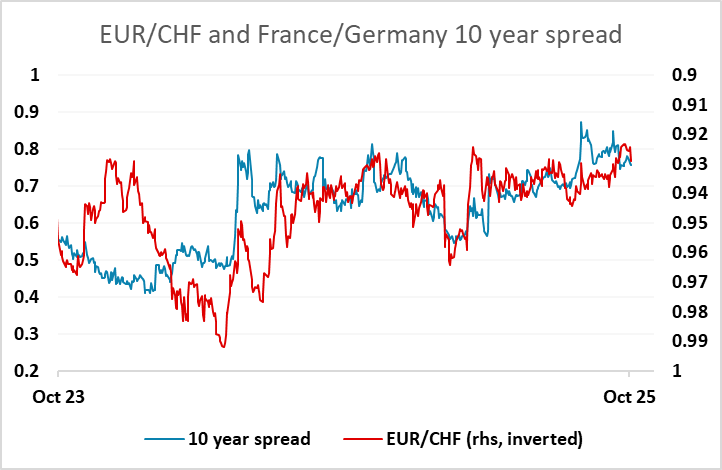

European data may support EUR/CHF

Equities in focus with more tech earnings due

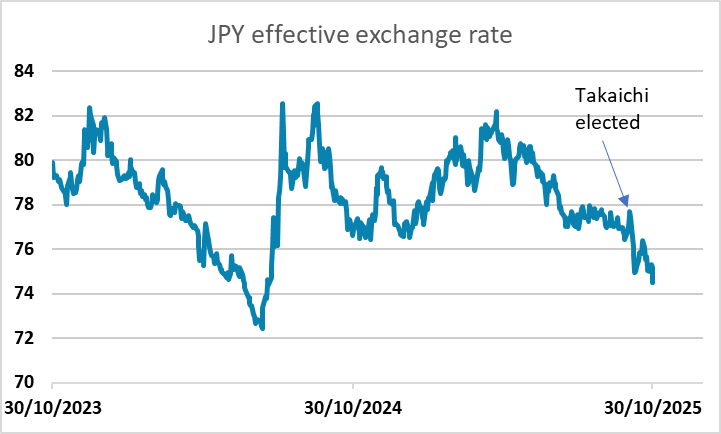

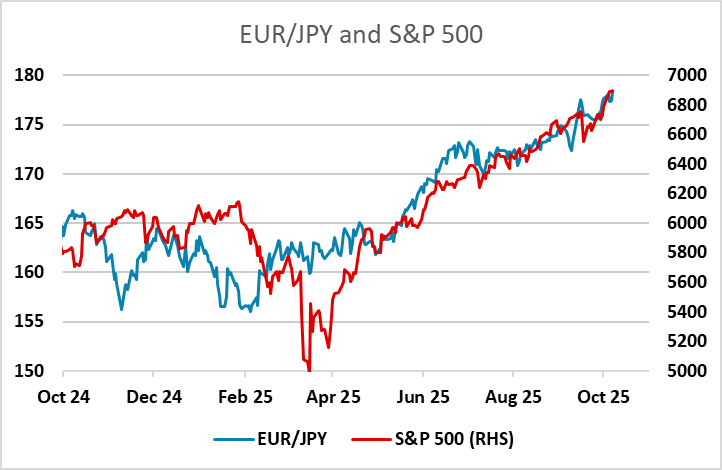

The BoJ has kept rates unchanged at 0.5% as per forecast. The vote was 7-2 with mostly unchanged economic forecast, 0.1% higher for 2026 core-core CPI. They continue to see inflation sustainably reaching the 2% target in the medium term and downside risk for economic growth. There has been no mentioning of the potential disruption of new fiscal policy as we do not believe this has been fully strategized yet. Overnight the Fed sounded a little more hawkish than expected and the lack of certainty on a December hike has pushed up US yields and the USD. Gains have been most notable against the JPY, which fell back after the BoJ left rates unchanged and BoJ governor Ueda sounded as if he was in no hurry to hike in December either. The probability of a December hike from the BoJ is now priced as around 25% from near 50% before the BoJ. Equities showed no clear directional reaction to the quarterly results from Microsoft, Alphabet and Meta, which produced mixed responses in their individual share prices. But the rise in US yields post-Fed means there has been a decline in implied equity risk premia, so valuations look a little more extended than before. There is optimism on the Trump/Xi talks, although no clear-cut result as yet despite some upbeat comments from Trump. Trump said he had agreed to trim tariffs on China in exchange for Beijing resuming U.S. soybean purchases, keeping rare earths exports flowing and cracking down on the illicit trade of fentanyl. But further details were scant. All in all the overnight news is USD positive and JPY negative, with the EUR supported by better than expected Eurozone Q3 preliminary GDP data this morning.

There is also the ECB meeting, but this looks likely to be a damp squib, with little chance of any indication that th ECB is considering moving rates any time soon. The solid Eurozone GDP data this morning, with particular strength in France, might be seen as positive for EUR/CHF, as evidence of relative strength in France could reduce concerns about French fiscal problems, albeit marginally. EUR/CHF managed a significant bounce on Wednesday, and once again looks well supported at 0.92 unless we see some major risk upset.

Otherwise, Thursday sees Q3 earnings from Apple and Amazon after the close, which could affect the equity market. Strength in equities has undermined the JPY throughout this year, and the break higher this week looks a step too far given that it is based on optimism around US/China trade, but concerns about US/China trade had barely made a dent in equity market strength.