FX Daily Strategy: APAC, August 28th

USD becalmed as Fed expectations unlikely to move far

USD continues to follow similar path to Trump 1.0

GBP/JPY toppish as risk premia risks are on the upside

NOK/SEK bouncing from strong support with more upside scope

US GDP and claims data of interest

Claims likely more important after last week’s rise

EUR/USD could continue to edge lower as confidence weakens

Scope for SEK to gain if July improvement in confidence is sustained

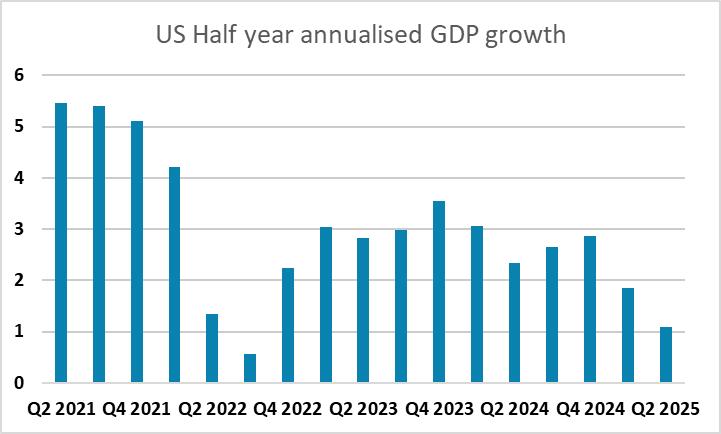

Thursday is another relatively quiet day on the calendar. There will be some interest in the Q2 US GDP revision, and in the US weekly jobless claims data after the rise in both initial and continuing claims reported in the previous week. While the 3% annualised GDP growth in Q2 looks good in isolation, it followed a decline in Q1 and the annualised rate for H1 2025 over H2 2024 was only 1.1%. The market consensus anticipates a small upward revision to the Q2 data to 3.1% annualised. We anticipate 3.2%, but following a 0.5% decline in Q1 the data shouldn’t be seen as strong. The Q3 data will be important to determine whether we are seeing a prolonger slowdown or the sort of dip we saw in mid-2022 which didn’t last long.

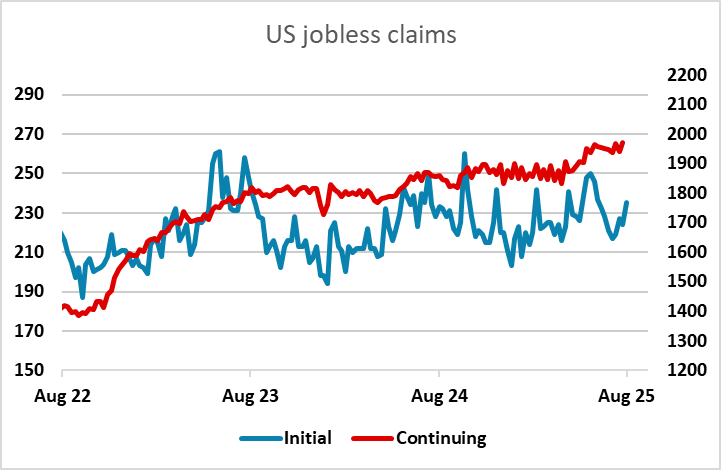

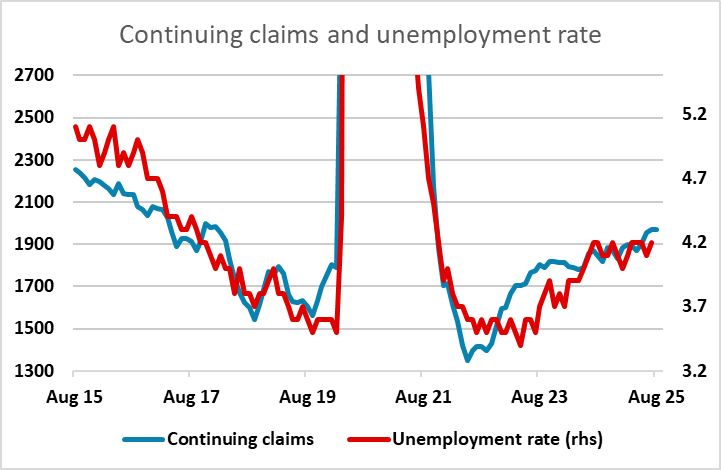

While the PMI data suggests the economy is performing well in Q3, confidence in the economy could be undermined if the claims data continues to edge higher as it did last week. The initial claims data has had several short-lived upward blips in the last few years, but the continuing claims data may be more important, as this has shown a clear uptrend this year and is correlated in the longer run with the unemployment rate. The USD has been firm in the first half of the week, shaking off the softer tone seen after Powell’s Jackson Hole speech last week, but gains could fade if the claims numbers continue to edge higher.

Before the US data we have the European Commission survey for the EU, and we would expect to see some weakness in consumer confidence as the French and German confidence numbers have both softened in the last month. The French situation is of the greatest concern, as French Prime Minister Francois Bayrou risks being ousted after he called for a vote of confidence next month over his plans to cut France's public deficit. The EUR was a little softer on Wednesday and could continue to slide if the EU Commission data also shows a more negative tone. EUR/USD is something of a supertanker, and has taken a long time to turn after the rise following the announcement of reciprocal tariffs in April, but now it has started to edge down it will take positive news to prevent further losses.

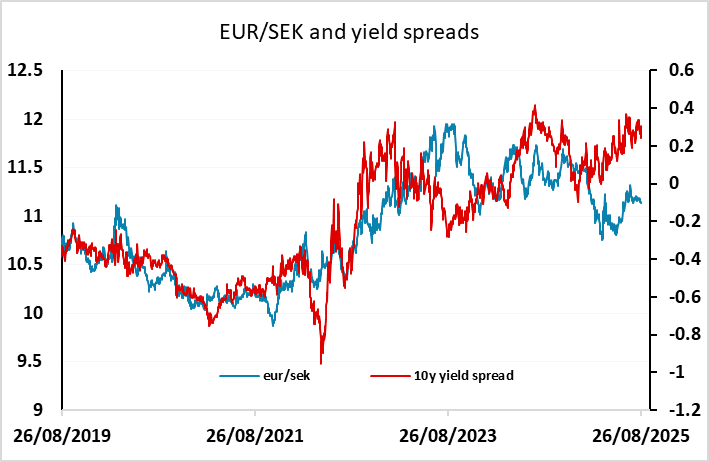

In Sweden there is the August business and consumer confidence survey. Last month saw a sharp rise in consumer confidence, and another number as strong as July could lead to some SEK gains against the EUR given the weaker French and German confidence numbers this week. We still see longer term SEK weakness, but primarily against the NOK, and this doesn’t preclude some short term SEK gains.