EUR, JPY flows: IFO awaited, JPY stays weak

IFO likely to show May PMI was an anomaly. JPY weak but may be due a pause

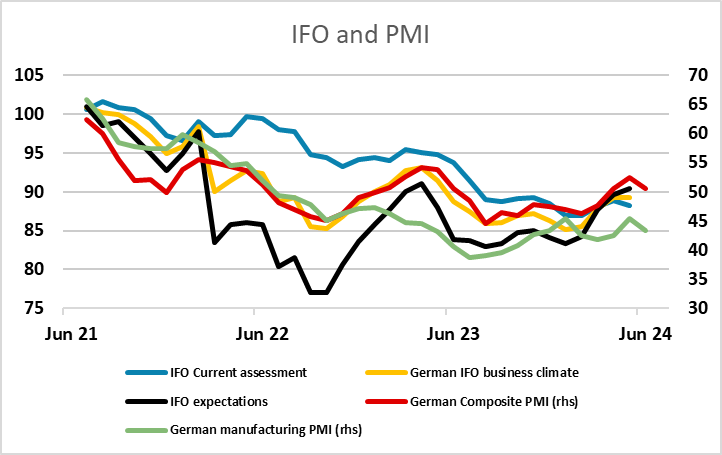

The German IFO survey is the main data on Monday, and is a little more significant than usual due to the weakness seen in the PMI survey released last week. The IFO business climate index has generally stuck close to the composite PMI in the last couple of years, but underperformed in May. The PMI strength in May followed by the dip in June suggests May was an anomaly. The modest increase in the IFO survey expected by the consensus would bring the two surveys back into line, and probably would have limited impact. But the risks for the EUR may be more the downside on a weak number than on the upside on a strong number after the stronger than expected US PMI last week.

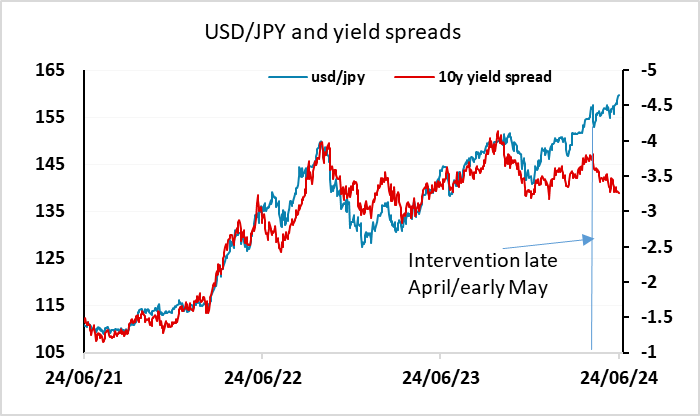

JPY weakness remained the main theme overnight, with the 160 level in sight on USD/JPY and no sign of intervention from the BoJ. We have has seven consecutive days of gains in USD/JPY, without much support from data or movements in yields, which suggests there are a lot of momentum and carry based positions in place that could be vulnerable if the BoJ did decide to intervene. There has only been one period this year when we have seen 8 consecutive days of gains in USD/JPY, which was back in March, so a pause may be due, but without intervention or some significant decline in equities it’s hard to see a major reversal.