FX Daily Strategy: APAC, December 11th

AUD still likely to be well supported on soldi employment data

USD risks on claims mostly to the upside

BoJ needs to intervene to halt JPY weakness

EUR/CHF may settle into a range near term

AUD still likely to be well supported on soldi employment data

USD risks on claims mostly to the upside

BoJ needs to intervene to halt JPY weakness

EUR/CHF may settle into a range near term

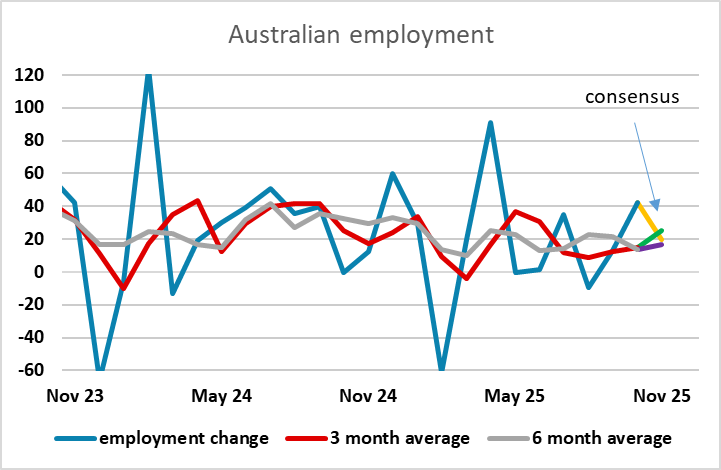

Thursday kicks off with the Australian November employment report. The market consensus is for a rise of 20k, which would maintain the positive underlying trend. We continue to see plenty of potential AUD upside as yield spreads have moved significantly in the AUD’s favour in recent months as the Australian data has improved. There are still risks associated with any dip in risk sentiment, but a broadly stable risk environment and continued soli data should allow AUD/USD to challenge the highs of the year above 0.67 before the end of the year.

Otherwise, there isn’t a lot on the calendar other than the usual Thursday claims data from the US, with the US trade data likely to be ignored simply because it’s from September. Claims may nevertheless get some attention as the weak ADP data provided some reason to expect soft employment data, but last week’s initial claims data showed a sharp dip. This was likely related to Thanksgiving, so we would expect a sharp rebound, but the risks are to the USD upside if initial claims remain low, while there should be no USD negative reaction on higher claims.

JPY weakness has continued this week but EUR/JPY just failed to make another all time high on Wednesday after a test early in the day. PM Takaichi protested JPY strength early in the day, but the Japanese authorities have to now put their money where their mouth is if they want to halt JPY declines. There is no good fundamental reason for further JPY weakness, with yield spreads and risk premia both pointing to significant JPY gains from here, and a rate hike from the BoJ now widely expected next week. But the government needs to show real opposition to turn the trend. History shows that determined official opposition to JPY trends is effective in marking the extremes.

The CHF also saw some relief from recent weakness on Wednesday, with EUR/CHF falling back from a test of 0.94. The SNB meeting on Thursday is very unlikely to produce a change in policy, but there is likely to be the normal indication that they are prepared to intervene in the FX market if necessary. There is no real evidence that they have done so of late, but the strong support at 0.92 in EUR/CHF does hint at some official involvement. 0.92-0.94 may now be an effective range near term.