CAD, AUD, JPY flows: Tariffs the focus

Trump's indication that tariffs on Canada and Mexico would be introduced as planned on March 4 undermines risk sentiment with CAD vulnerable and JPY favoured

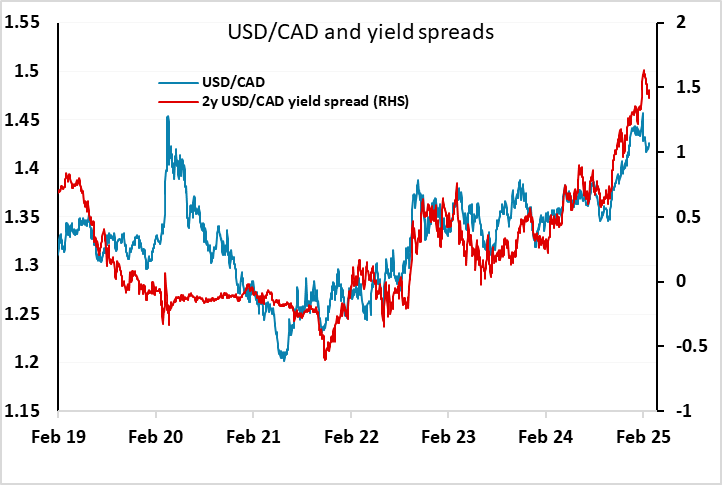

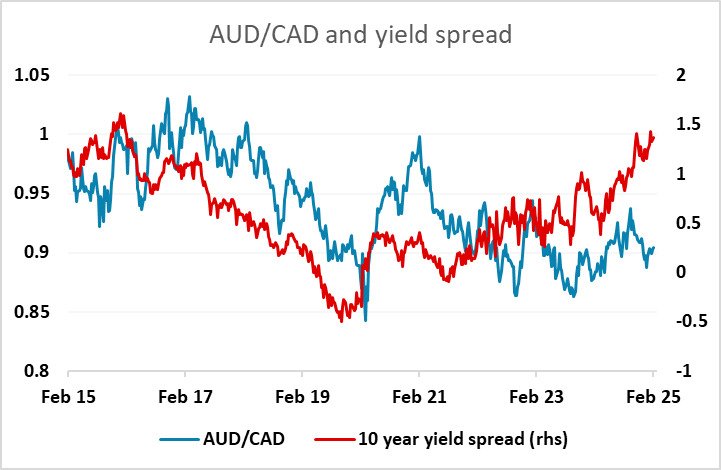

A quiet start to what looks like being a quiet day in Europe, with no data or events of significance scheduled. The main news overnight is Trump’s indication that tariffs on Canada and Mexico will be introduced as planned on March 4. While the FX market reaction has been modest, the USD is slightly firmer against the CAD and equities and bond yields are both lower overnight. The market is still very unsure whether to take Trump at his word, after the unexpected imposition and subsequent rapid removal of tariffs last time. However, the risks look to be clearest for the CAD, while other risky currencies are also likely to suffer if Trump follows through with his threats. We see AUD/CAD as likely to gain in most scenarios, as the AUD looks better placed to gain in risk friendly conditions but is unlikely to fall against the CAD if tariffs are imposed.

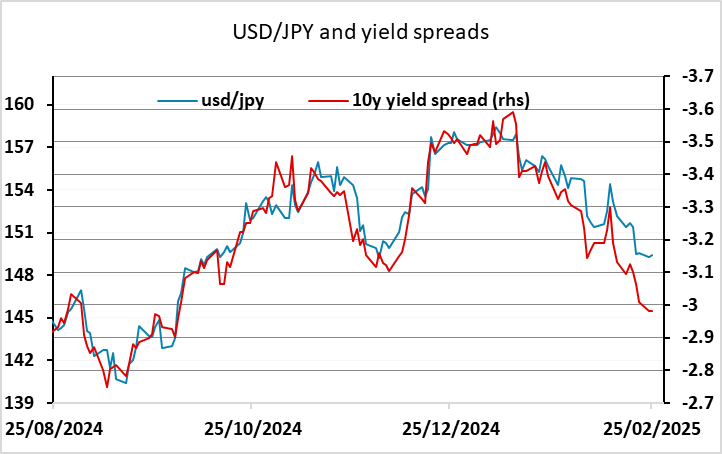

Otherwise, USD/JPY still looks clearly biased lower based on yield spreads, but awaits a trigger to break the key technical level at 148.64, while EUR/JPY has a similar support area from 154.40 to 155.50. The USD has not generally gained much on tariff risks, and a tariff announcement that undermined equities would most likely benefit the JPY more than anything else.