FX Daily Strategy: APAC, Sep 23rd

PMI data the focus but US and UK data of limited interest

Eurozone data seen as more relevant, but unlikely to move far

SEK may benefit from Riksbank keeping rates on hold

JPY weakness remains extreme

PMI data the focus but US and UK data of limited interest

Eurozone data seen as more relevant, but unlikely to move far

SEK may benefit from Riksbank keeping rates on hold

JPY weakness remains extreme

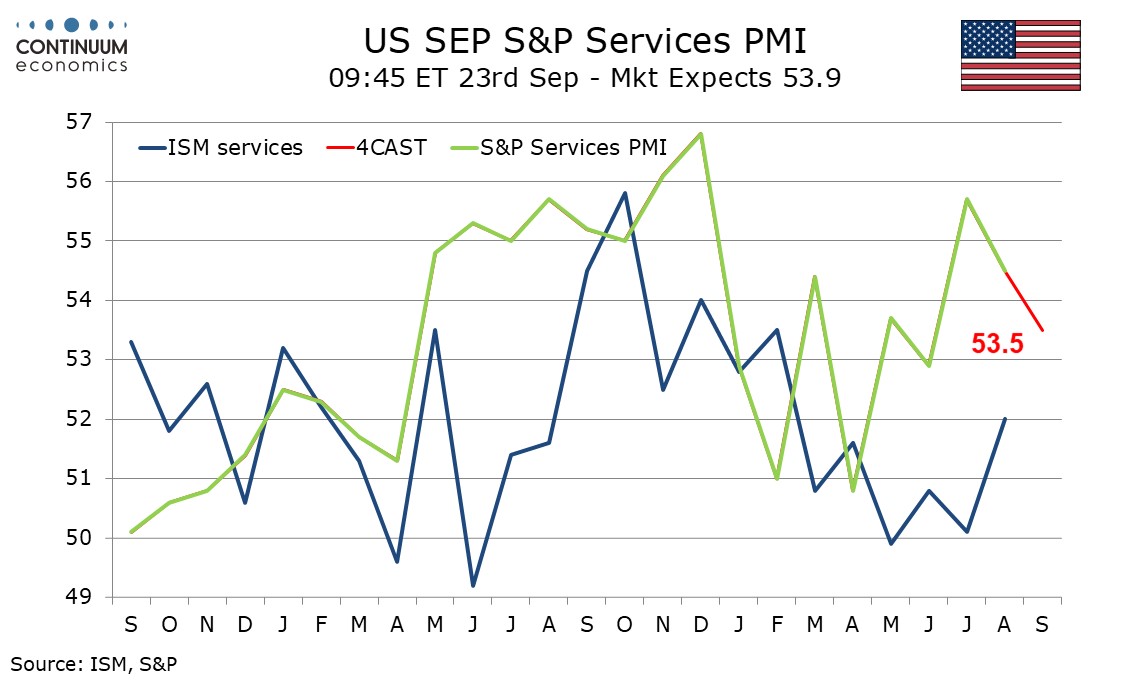

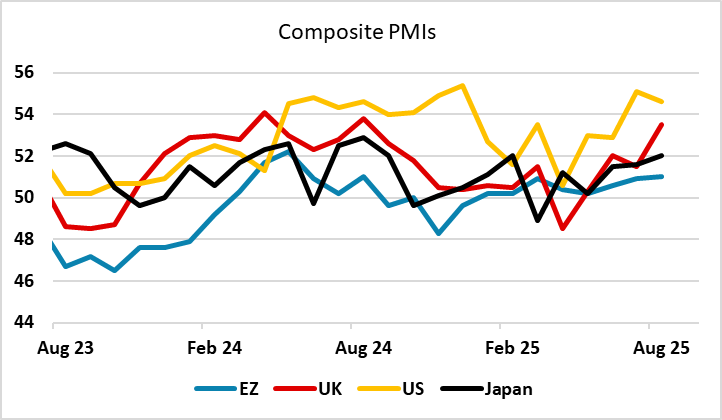

PMI data will be the main focus for Tuesday. The European numbers have been broadly steady in recent months, while the US (and UK) numbers have show significant gains. There is usually less focus on the US and UK data, largely because they are less strongly correlated with official measures of activity than the Eurozone data. Indeed, the UK manufacturing PMI has barely any correlation with the official manufacturing output data. In the US case, the ISM data has shown a much weaker picture than the S&P PMIs, so the S&P data has limited impact. We do expect to see some decline in the US and UK PMIs this month, and this may be mildly USD negative, but the impact is unlikely to be large.

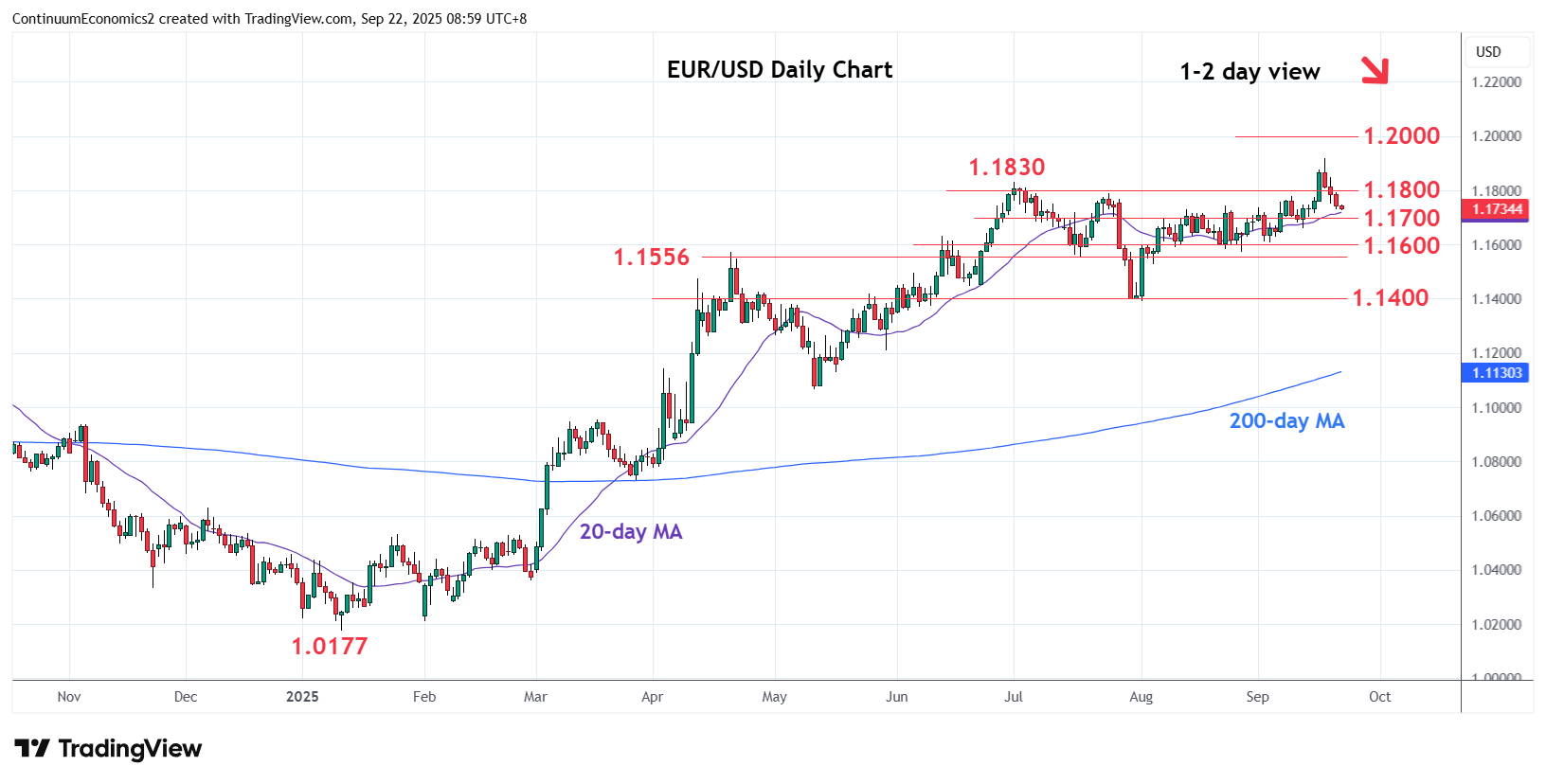

There is more scope for a reaction to the Eurozone PMIs, which do have a better correlation with official activity data, and in the German case the PMIs also map fairly well onto the IFO survey. While we don’t expect much change in the Eurozone PMIs, there is potential for a EUR reaction if we see a miss of a point in either direction. Still, after the rise in US yields at the end of last week, it’s likely that we will see fairly stable trading in the 1.17-1.18 range until we get a trigger for a more significant move in yields on either side of the Atlantic.

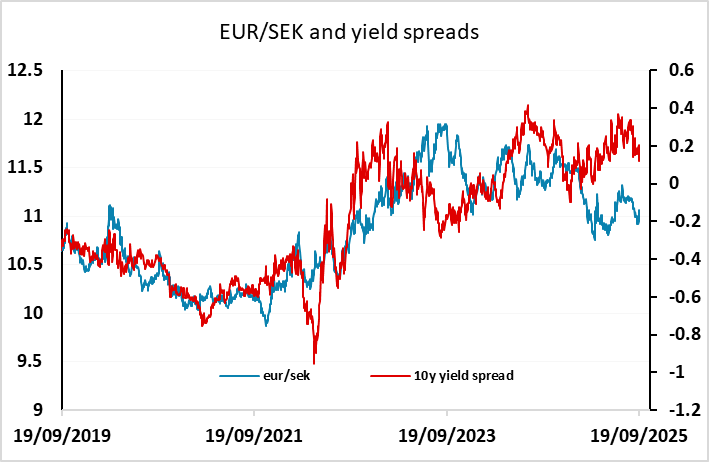

We also have the Riksbank meeting in the European morning, with then market now only pricing just over a 30% chance of a 25bp rate hike. The probability of a rate hike is seen to have declined due to the very expansionary Swedish budget, the detail of which were released over the weekend. The market is still priced for a rate cut by year end, but the expansionary budget should mean the Riksbank hold off this time, and this should provide some support for the SEK. While upside for the SEK still looks quite restricted as it has outperformed relative to yield spread moves against the EUR this year, there should still be scope for a modest EUR/SEK dip if there is no cut, although there would likely be a larger rise if the Riksbank surprised the market by going ahead and cutting rates this time around. There will also be interest in any commentary, with scope for SEK gains if the Riksbank plays down the chances of another cut this year.

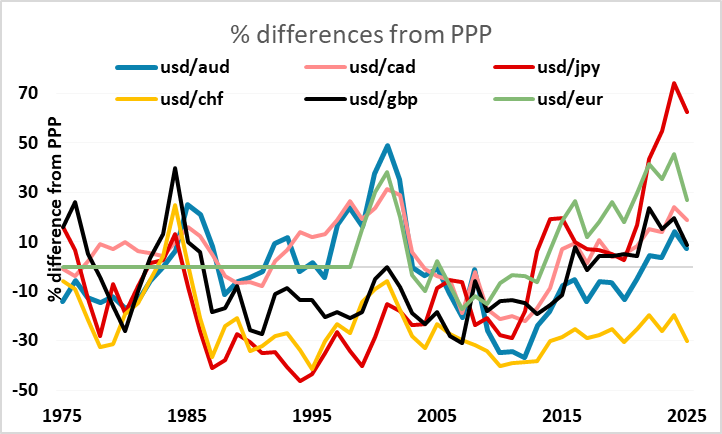

The general market tone remains quite sleepy, with a relatively quiet week for news. FX markets look quite stable, but we would continue to emphasise that this stability is coming at some extreme levels, particularly for the JPY, which made a new all time low against the CHF on Friday, and remains at extremely undervalued levels relative to all the majors. This is primarily a consequence of the low level of volatility and risk premia and the high level of the equity market. Quiet markets serve to sustain the status quo, but any pick up in volatility would increase the risk of a sharp JPY recovery.