FX Weekly Strategy: Europe, June 30th - July 4th

US employment report the prime focus

Some risk of weaker numbers after higher claims figures from mid-May

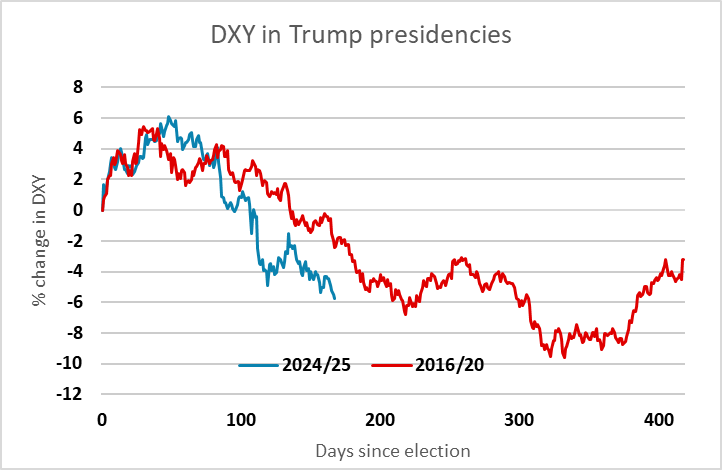

General USD weakness remains hard to oppose

JPY could recover some ground on the crosses on weaker US data

Strategy for the week ahead

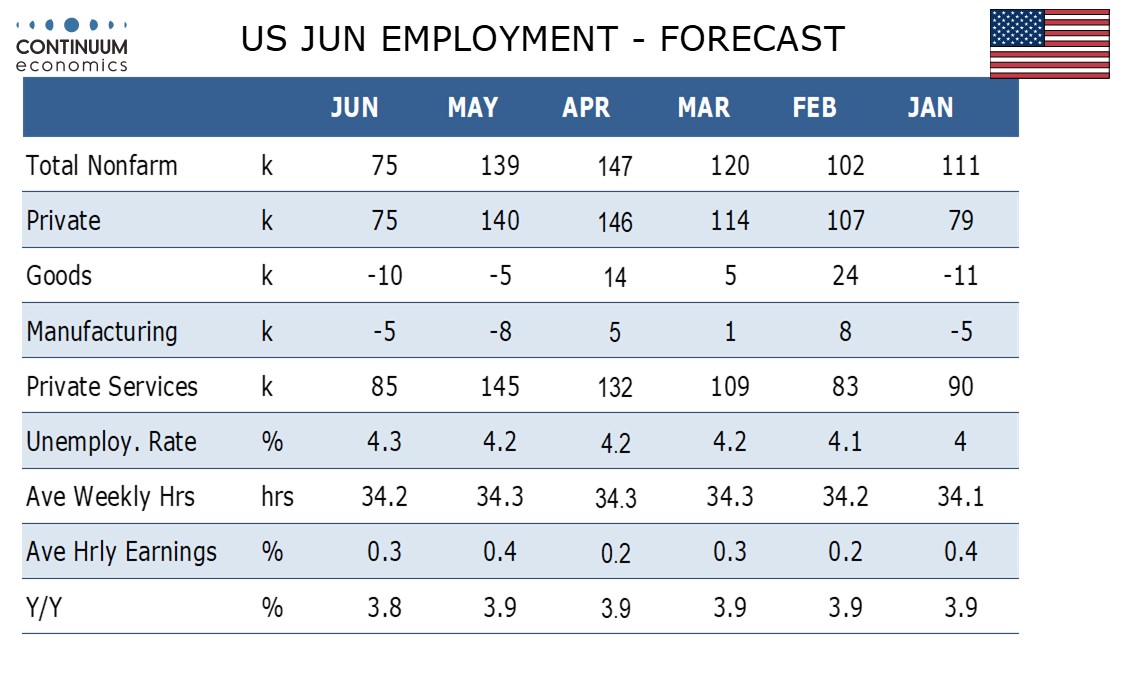

The US employment report will be the prime focus this week, with a bigger risk of a significantly lower payrolls number this month after the rise in initial claims seen since mid-May. Our forecast of a 75k rise is significantly below the market consensus of a 129k increase, and could be expected to increase expectations of Fed easing and create some concern about the US slowdown.

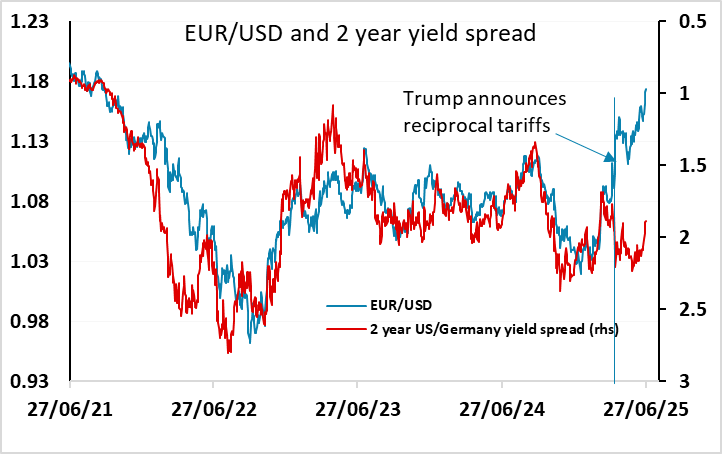

What would this mean for the FX market? The USD has already been under pressure for the last two months, particularly against European currencies, with the weakness only partially related to concerns about US slowdown. Asset managers have reported a structural shift of investors away from the USD due partly to concerns about the sustainability of superior US growth under Trump’s tariff policies, partly to already overweight positioning and uncertainty. Evidence of weakening in the US labor market would be seen as another reason to reduce USD positioning, and could be expected to lead the more USD losses across the board.

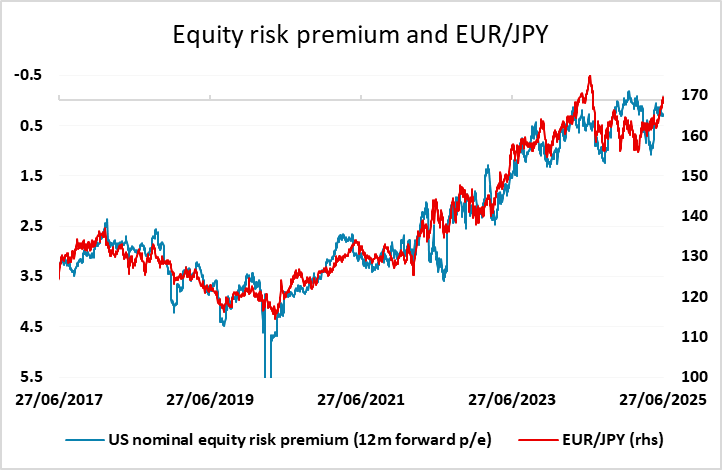

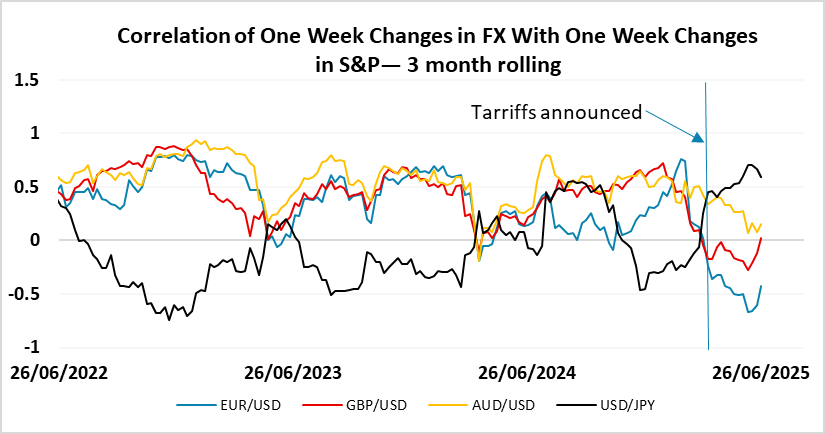

However, which currencies will benefit would depend on how the equity market reacted to any evidence of weaker data. We certainly see the equity market as vulnerable at current levels, with the S&P 500 having hit new highs last week without a great deal of support from economic data, based on a combination of increasing expectations of Fed easing and some improved geopolitical sentiment. It remains hard to justify the current high level of the equity market/low level of equity risk premia given the risk of a slowdown due to tariffs and the starting position close to full employment which makes it difficult to achieve above trend growth without inflationary pressures. But sentiment is nevertheless very resilient, and if US yields fall in response to weaker US data, equity prices may hold near the highs. This would still suggests to us that the JPY ought to benefit the most from any weaker data, as lower yields would imply higher equity risk premia, and the JPY continues to show a strong medium term positive correlation with equity risk premia, particularly on the crosses. The JPY has been very weak on the crosses in recent weeks as the equity market has moved to new highs, and is likely to continue weak unless we see some reversal, but remains extremely undervalued and the risks of a sharp reversal on a turn lower in risk sentiment are rising.

We also have HICP data from the Eurozone, with the French and Spanish data already released suggesting the risks are on the upside. This helped provide some support for the European currencies in the last week, with front end yield spreads moving in the EUR’s favour, although most of this was down to lower US yields rather than higher yields in Europe. Even if we see higher Eurozone CPI data, the impact on the EUR is likely to be modest with US and geopolitical events still likely to create the most volatility.

There is also some potential for the tariff issue to return to the headlines, as July 9th is supposed to be a significant deadline. Of course, Trump could choose to extend the deadlines further, but if geopolitical concerns start to fade tariffs are likely to come back to the fore.

Data and events for the week ahead

USA

The highlight of the US calendar in June’s non-farm payroll, due on Thursday due to the 4 July holiday on Friday. We expect a slower 75k increase both overall and in the private sector, with a 0.3% rise in average hourly earnings and a rise in unemployment to 4.3% from 4.2%. Other labor market signals will come from May’s JOLTS report on labor market turnover on Tuesday, and Wednesday’s ADP report on private sector employment, which we expect to underperform the non-farm payroll with a rise of 50k. Weekly initial claims on Thursday will give some clues on whether any slowing in June payrolls will extend into July.

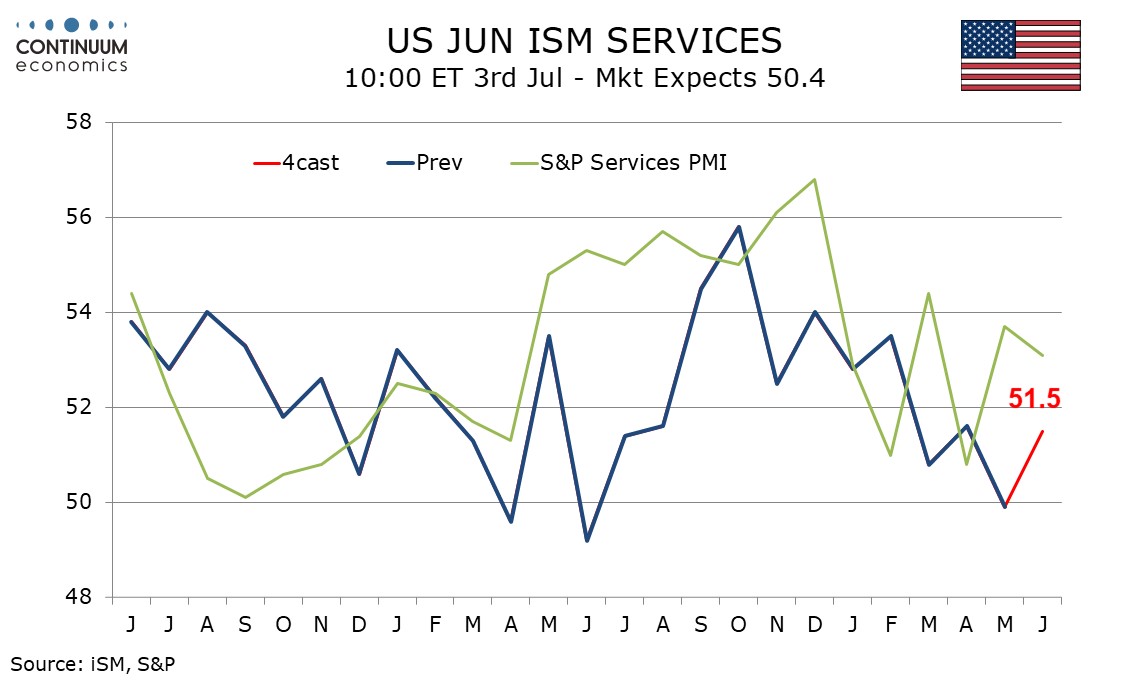

June ISM surveys are due. We expect the manufacturing index on Tuesday to rise to 49.0 from 48.5 and the services index on Thursday to rise to 51.5 from 49.9. Other releases due are May construction spending on Tuesday, and on Thursday, May’s trade balance, where we expect the deficit to rise to $71.7bn from $61.6bn, as well as May factory orders. Fed speakers scheduled are Bostic and Goolsbee on Monday, Powell on Tuesday and Bostic again on Thursday.

Canada

Canada sees June S and P PMI data, manufacturing on Wednesday and services on Friday. May’s trade balance is due on Thursday.

UK

The week starts with final Q1 GDP data and the first stab at the Q1 current account. No revision is seen for the former and for the latter, after a deficit of 2.9% of GDP in Q4 2024, we see a narrowing having occurred last quarter.

Individual MPC updates are due from Taylor (Tue and Fri) and firstly Governor Bailey (Tue) at the ECB conference (se below). The BoE will also be offering information from its latest Decision Makers Survey (Thu), this adding to insights from final PMI numbers (Tue/Thu) as well as the Construction PMI (Fri). The BoE also publishes it quarterly Credit Condition Survey (Thu). But the main hard data interest will be the BoE money and credit data (Mon) where housing market volatility and distortions may again be the order of the day.

Eurozone

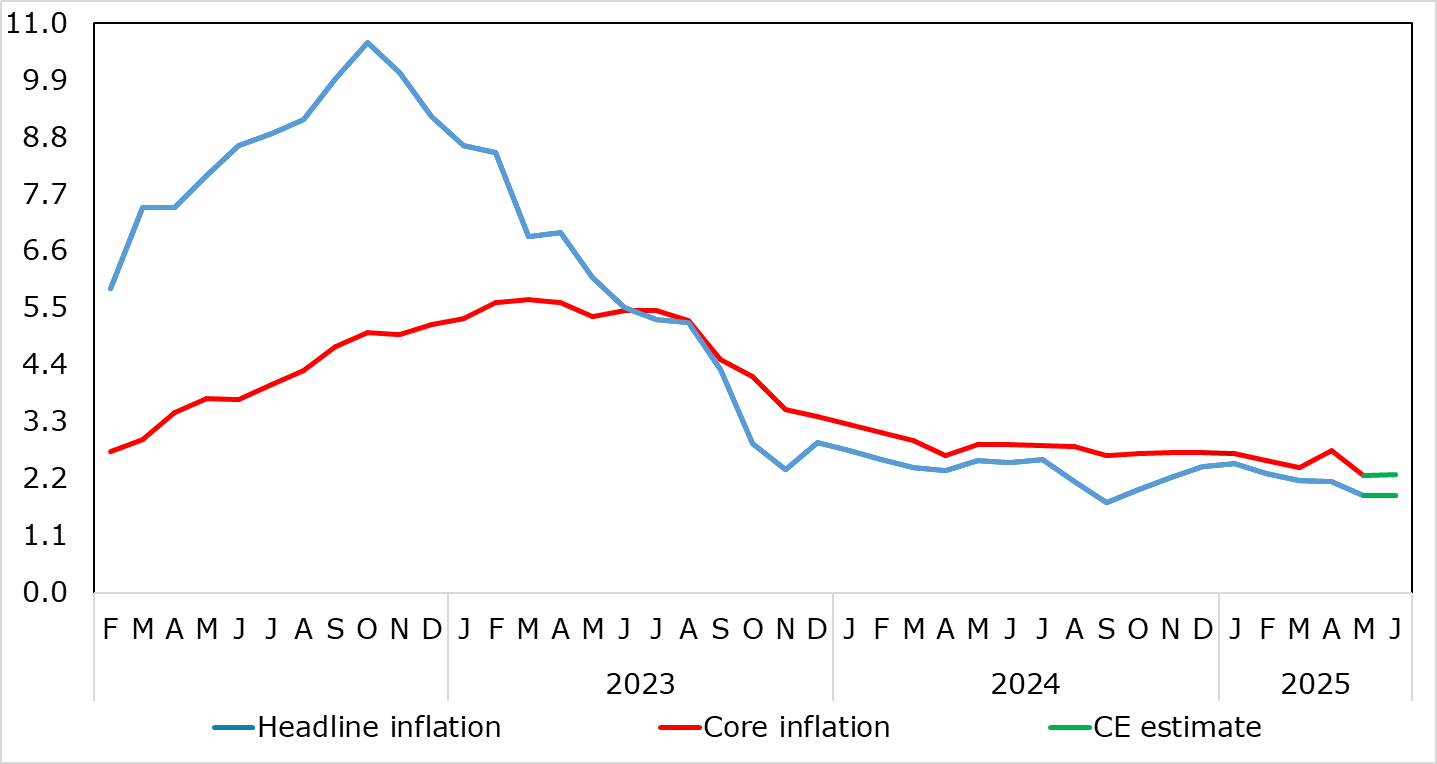

Several important updates are due this week. The main one on Tuesday with the flash HICP for June. We see the flash staying at May’s below-consensus, eight-month low and below-target 1.9%. More notably, having jumped 0.5 ppt to 4.0% in April, very probably due to the impact of the timing of Easter affecting airfares and holiday costs, services inflation fell back to a 27-mth low of 3.2%, mirroring a similar Easter effect in 2019, Indeed, as a result, the core rate dropped to 2.3%, the lowest since Oct 2021. However, adverse energy basis effects and a further calendar distortion may pull services and core back up in June (again temporarily). German CPI/HICP numbers arrive on Monday. The unchanged 2.1% June HICP we see, comes with ‘only’ a 0.1 ppt drop in the core to 2.6%, although preliminary data will not provide a breakdown to reveal the latter. Wednesday sees labor market figure where we see a rise in unemployment. Regardless, the still low jobless rate comes alongside a continued and above-trend increase in the workforce, this possibly being a major factor in the manner in EZ wage inflation has been falling. PPI numbers are due Friday and German orders are due the same day and probably due a correction

Headline HICP Back Below Target as Services Rise Reverses

Source: Eurostat, CE, ECB

There is also ECB money/credit on Monday, numbers that have improved but are still historically weak. Tuesday sees the ECB consumer expectations survey update. But the main event is the ECB Forum on Central Banking 2025 in Sintra and lasting Mon-Wed with topics based around ‘Adapting to change: macroeconomic shifts and policy responses’.

Rest of Western Europe

There are no key events in Sweden. Otherwise, in Switzerland, Tuesday sees CPI data which may stay slightly negative in y/y terms; if so, this be weaker than recent SNB projections. Monday sees KOF survey numbers.

Japan

Overall household spending on Friday is the most important economic release for Japan next week. Household spending has been lagging as real wage remain negative. Private consumption need to see more recovery for a stronger Japanese economy. Else, we have industrial production on Monday and manufacturing data on Tuesday. But the most critical headline is any trade progress between Japan and U.S.

Australia

Trade balance on Friday and Retail sales on Thursday would capture some eyeballs but unlikely to be market moving as RBA have their sight locked into inflation figure. Private inflation data on Monday and PMIs scatter throughout the week are likely tier two.

NZ

Business outlook and confidence in the beginning of the week are the only important data for NZ next week.