FX Daily Strategy: APAC, January 24th

NZ CPI could impact NZD given distance between RBNZ and market projections

EUR/GBP may rise if gap between UK and EUR PMIs closes

CAD still has scope to fall modestly on neutral BoC meeting

NZ CPI could impact NZD given distance between RBNZ and market projections

EUR/GBP may rise if gap between UK and EUR PMIs closes

CAD still has scope to fall modestly on neutral BoC meeting

NZ CPI, S&P PMIs, and the BoC monetary policy decision are the main events on Wednesday’s calendar.

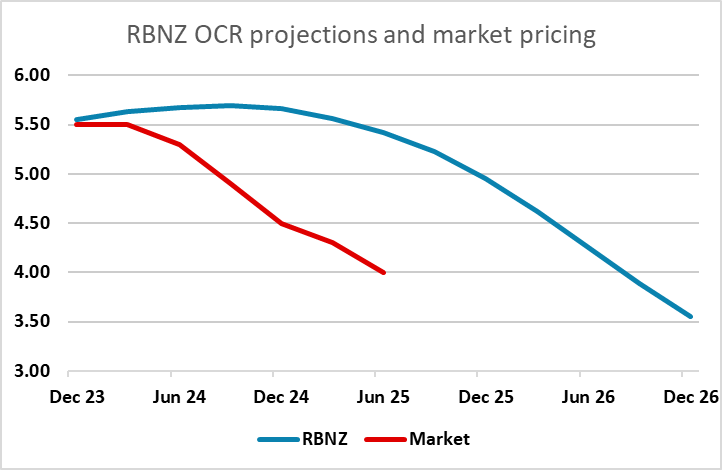

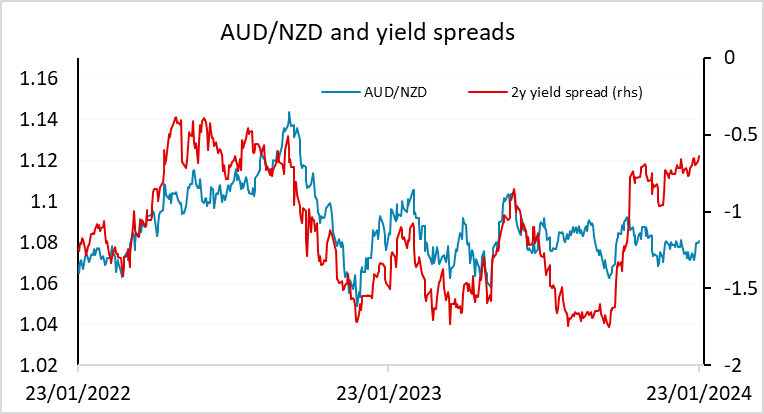

NZ CPI could be important for RBNZ policy. The market consensus is for a drop in the y/y rate to 4.7% in Q4 from 5.5% in Q3, based in part on weaker data in the new monthly selected price index. But the market is already pricing a much easier path for policy than projected by the RBNZ, so there isn’t a lot of scope for there to be a reaction to soft data. The risk seems greater than rate cut expectations are reduced on stronger than expected data. However, from an FX perspective, the NZD has outperformed its usual yield spread relationship with the AUD in the last few months, in part because the AUD has been undermined by concerns around China. Nevertheless, there doesn’t look to be a lot of NZD upside against the AUD, so while there may be more scope for NZ yields to rise than fall, the FX impact would be greater from lower yields. So there is likely to be more FX sensitivity to weaker than expected data, even if it doesn’t have a lot of impact on yields.

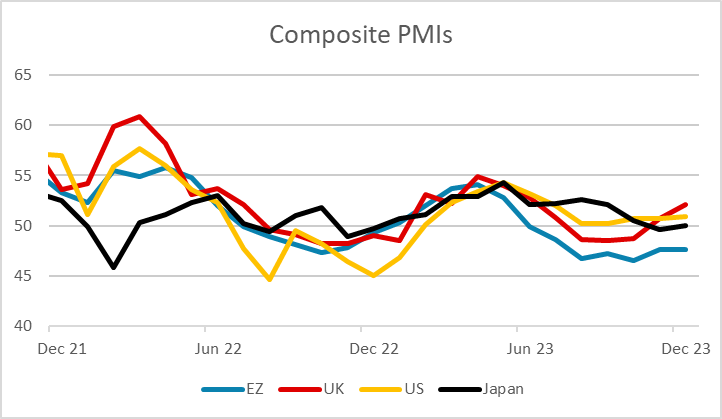

In Europe, the PMIs will be the primary focus ahead of the ECB meeting on Thursday. Eurozone PMIs remain at low levels, and while there is some evidence of stabilisation in recent months, they continue to look weak relative to the other major currency areas. There is a market expectation of a modest recovery in January, and this looks likely to be required to prevent EUR losses. EUR/GBP may be the most sensitive pair to the PMIs, as the UK PMIs have improved significantly in recent months. We are a little sceptical of this UK outperformance, and wouldn’t be surprised to see some narrowing of the gap between the UK and Eurozone numbers this month. As it stands, EUR/GBP looks to be pricing in UK outperformance, as it has traded below the level suggested by yield spreads in recent weeks. There should be some vulnerability to a relative EUR improvement.

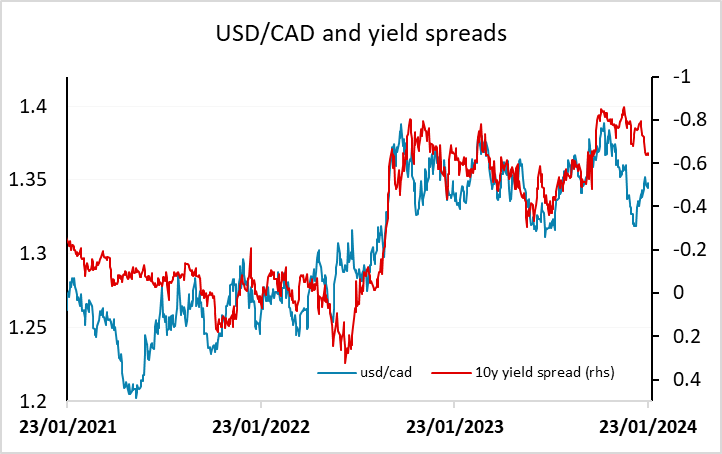

The Bank of Canada meeting seems unlikely to have much impact. With data showing subdued activity but stubbornly high inflation, rates look highly likely to remain unchanged at 5.0%. The statement is likely to see a similar tone to that on December 6 which no longer saw the economy as in excess demand but remained willing to raise the policy rate further if needed. USD/CAD was trading strong relative to yield spreads at the beginning of the year, but has gradually moved back in line. There may be a little further to go, especially if the BoC sounds any less likely to raise rates again. However, the market isn’t pricing any risk of a rate hike, so may be more vulnerable to hawkish comments which would be CAD positive.