FX Daily Strategy: APAC, May 23rd

JPY to stay well supported by rising CPI

CHF/JPY remains the clearest value trade

GBP may gain on retail sales but hard to see sustained break lower in EUR/GBP

USD likely to be resilient on home sales data

JPY to stay well supported by rising CPI

CHF/JPY remains the clearest value trade

GBP may gain on retail sales but hard to see sustained break lower in EUR/GBP

USD likely to be resilient on home sales data

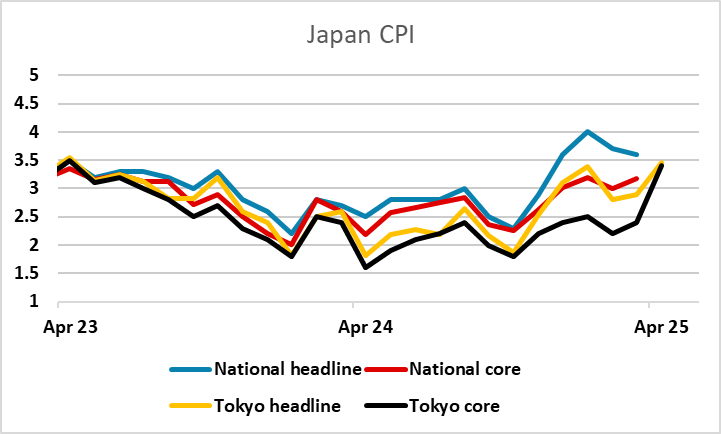

Friday sees US new home sales, CPI in Japan, and retail sales from the UK and Canada. The Japanese CPI data does have some potential to influence BoJ policy, but the national CPI data is usually well forecast by the Tokyo CPI data already released, which effectively acts like preliminary CPI data, so it is rare for the national numbers to provide any surprise. This time around, the FX market is in any case less focused on current data, with more attention on the likely impact of tariffs later on in the summer. The BoJ will similarly be less focused on the current inflation numbers. However, core CPI is expected to accelerate to 3.6% y/y after the sharp rise in the Tokyo core to 3.5% y/y and if anything, the risk is on the high side. While no BoJ action is likely while the uncertainty of the tariff impact is hanging over the market, the acceleration in inflation means that any news of a trade deal or a tariff reduction, or evidence of solid post-tariff growth in the US, would likely be enough to trigger expectations of a BoJ hike at the next meeting.

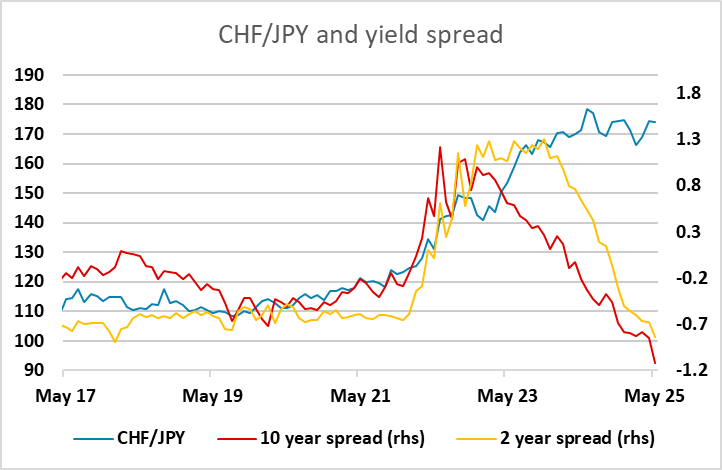

As it stands, the market is only pricing 15bps of BoJ tightening this year, but this could rise quickly if the US or world economy shows post-tariff resilience. To some extent, this means the JPY is in a win/win situation. A weak US/global economy would undermine risk sentiment and tend to favour the JPY, but any strength in the global economy would likely trigger a BoJ rate hike, while other majors continue to cut rates. Japanese longer term yields have already risen substantially and the JPY looks attractive across the board, but from a yield spread perspective, CHF/JPY remains the clearest value play, especially since the CHF has similar risk characteristics to the JPY.

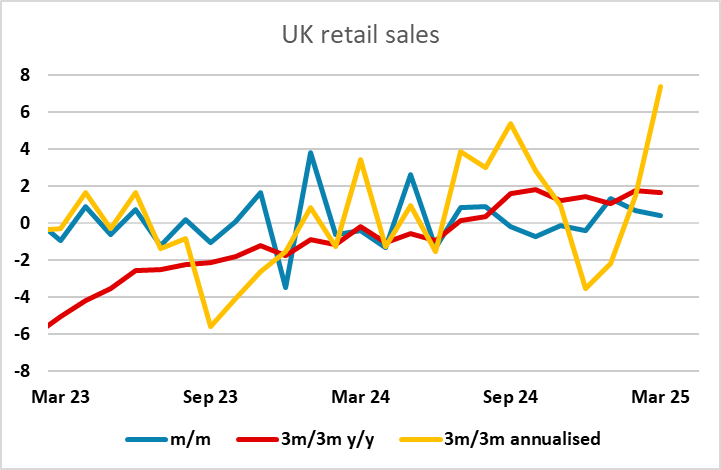

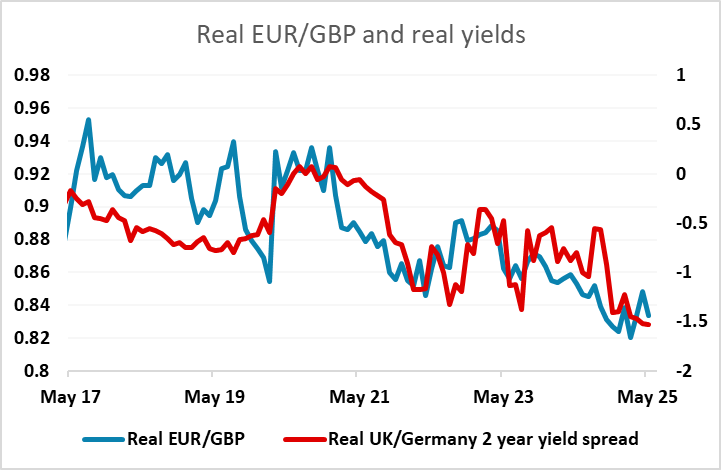

UK retail sales will attract more interest than usual after an exceptionally strong Q1 performance. The consensus is for another solid gain, in part due to mild weather, and this should help support GBP against the EUR after some gains on Thursday helped by relatively strong UK PMIs. Even so, any break below the 0.84 level will be difficult to sustain, as this still represents a high level of the pound from a longer term value perspective, and the pound remains vulnerable to any risk turn lower.

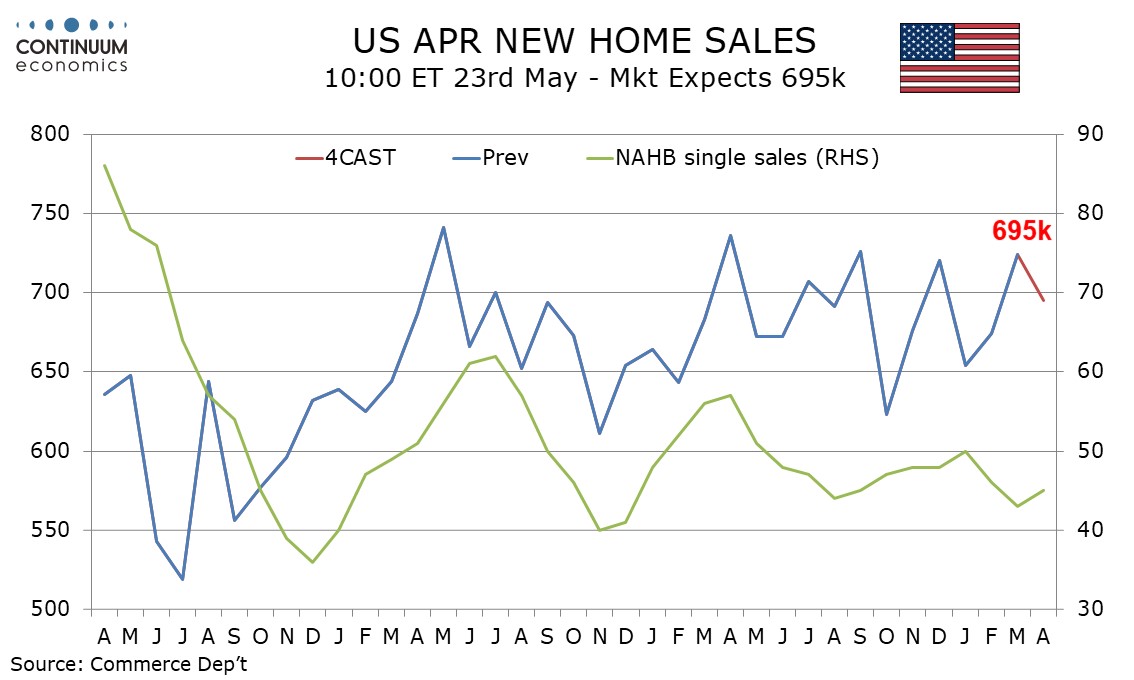

In the US, we expect an April new home sales level of 695k, which would be a 4.0% decline if March’s surprisingly strong 7.4% increase to 724k is unrevised. March’s level was near the tip of the recent range but underlying trend continues to have little direction, suggesting a dip in April is likely. Some housing sector surveys, such as the NAHB’s and MBA’s, showed modest improvements in April, but the NAHB index slipped in May and April existing home sales unexpectedly fell. We doubt the FX market will take a great deal of interest in these numbers, as the trend is choppy, but the housing sector will be important to watch in the coming months as the rise in longer term US yields could be damaging.