FX Daily Strategy: APAC, February 20th

Little impact likely from Australian employment data…

…but AUD still has upside potential

JPY continues to edge higher with CHF/JPY looking particularly vulnerable

GBP strength bolstered by data short term, but little further upside scope

Little impact likely from Australian employment data…

…but AUD still has upside potential

JPY continues to edge higher with CHF/JPY looking particularly vulnerable

GBP strength bolstered by data short term, but little further upside scope

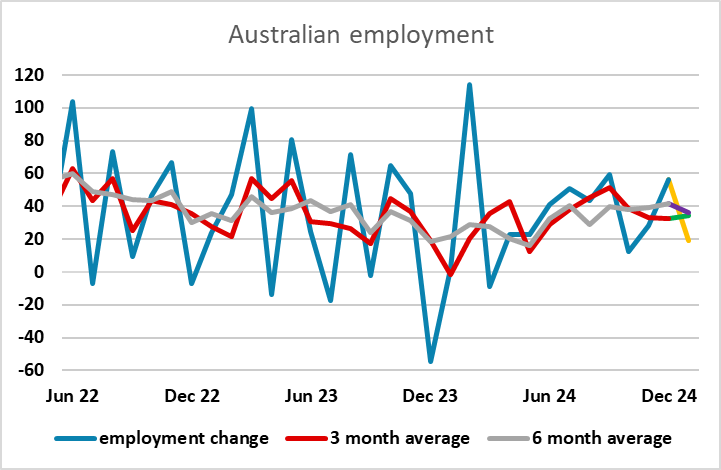

Thursday sees Australian employment data but little else of major interest, with just the regular jobless claims data and the Philadelphia Fed survey from the US. The Australian employment situation is important for policy, but it is unlikely that these numbers will have much impact. The employment data has been choppy over the past few years, but the underlying trend has been steady, with the unemployment rate oscillating around 4.0% and the average employment gain hovering around 40k per month for the last 6 months. The consensus forecast of a 19k rise in employment on the month would make no significant difference to the underlying trend.

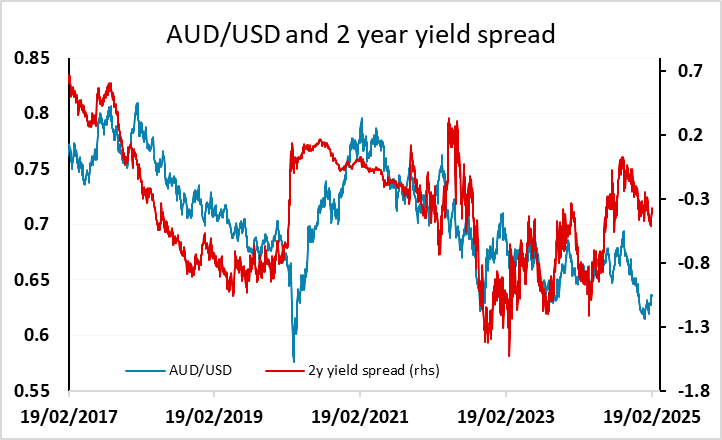

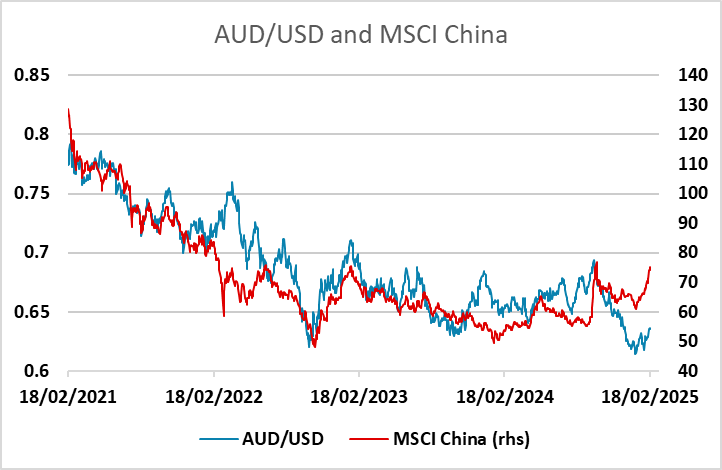

AUD/USD has edged a little lower after breaking to new highs for the year on Monday, but continues to look attractive as long as risk sentiment hold up. Yield spreads still point to a higher AUD, and the strength of equities in general and Chinese equities in particular also suggests scope for AUD gains. While there is still uncertainty surrounding US tariffs and the impact on global growth and risk sentiment, and AUD/USD could suffer if risk sentiment turns lower, Australia is under less threat than most countries, and AUD/CAD should perform well even in a tariff induced negative risk scenario. AUD/USD faces a significant resistance area around 0.64, but we see a good chance of a break above here if the global picture remains stable.

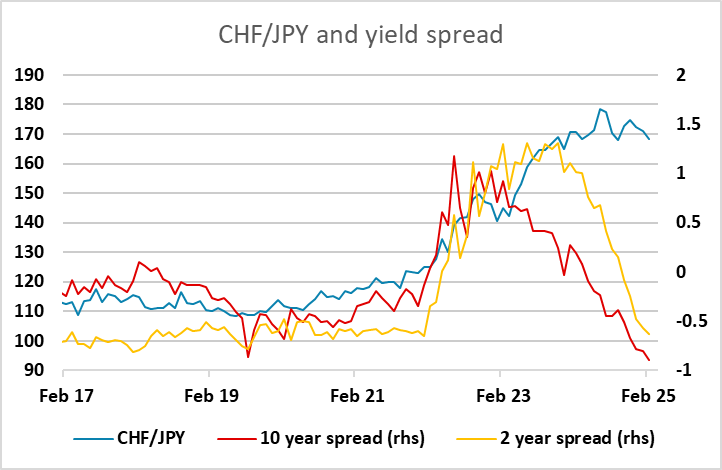

Otherwise, there wasn’t a lot of activity on Wednesday, but the JPY continues to edge higher and is getting close to breaking some key levels. USD/JPY still looks to have scope to break below 150 based on the correlation with yield spreads, while we continue to see CHF/JPY as the best value trade, This dampens any impact from risk fluctuations, as the CHF also tends to suffer in risk positive conditions, and from a value perspective it is hard to justify the 50% rise in CHF/JPY seen in the last few years now that yield spreads have moved back in the JPY’s favour.

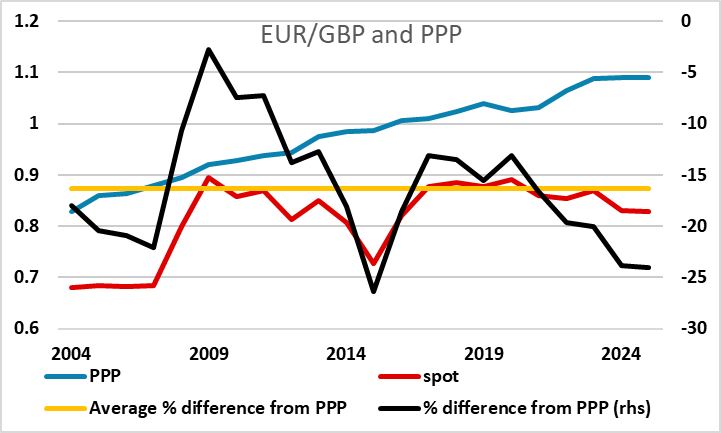

On the back of the stronger than expected UK CPI on Wednesday and the better than expected UK employment data released on Tuesday, GBP has made some modest gains against the EUR this week, making fresh 2025 lows, but gains are becoming increasingly hard to extend at these levels. Despite the stronger UK data there has been minimal movement in yield spreads in GBP’s favour, and we are now at levels in EUR/GBP that are approaching the highest in real terms seen since 2015 – before the Brexit vote. The data may discourage the BoE MPC hawks from any further early easing, but we still expect rates to fall more than the market is pricing in this year as weak demand starts to take its toll on UK employment and wages, suggesting the big picture risks for EUR/GBP are still on the upside.