FX Daily Strategy: Europe, January 9th

Tokyo CPI a focus for JGB yields

JGB yield rise likely necessary to trigger a general JPY rally near term

EUR upside limited despite apparently attractive yield spreads

CHF FX reserve data may help CHF top out

Tokyo CPI a focus for JGB yields

JGB yield rise likely necessary to trigger a general JPY rally near term

EUR upside limited despite apparently attractive yield spreads

CHF FX reserve data may help CHF top out

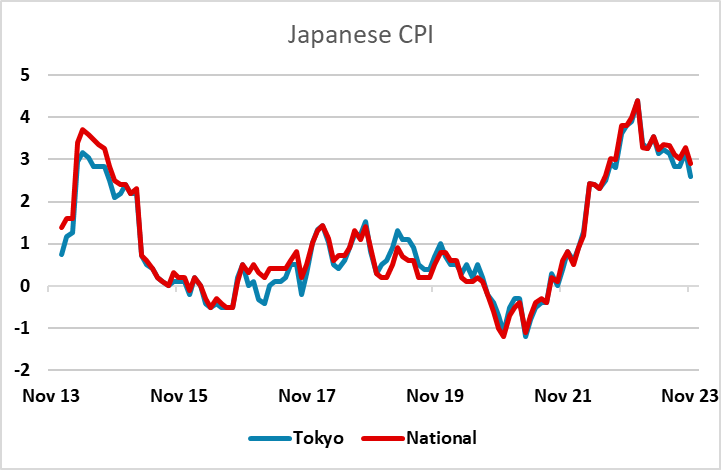

Tokyo CPI is an important release at the beginning of the Asian session on Tuesday. Tokyo CPI is highly correlated with the national CPI data, so is effectively the preliminary CPI release for Japan. Market consensus is expecting a decline in the core Tokyo CPI to 2.1% from 2.3%, and this sort of decline in core inflation would support the soft tone to JGB yields seen since the December BoJ. However, Tokyo CPI has fallen a little more than the national numbers in the last few months, so declines may start to slow. Either way, it seems likely that it will require either a rise in JGB yields or generally weak data in the US and Europe to trigger a general JPY recovery at this stage. We do see a major JPY recovery over the year, but in the short run higher JGB yields look like being required as a trigger, with the data elsewhere not showing any clear-cut downturn.

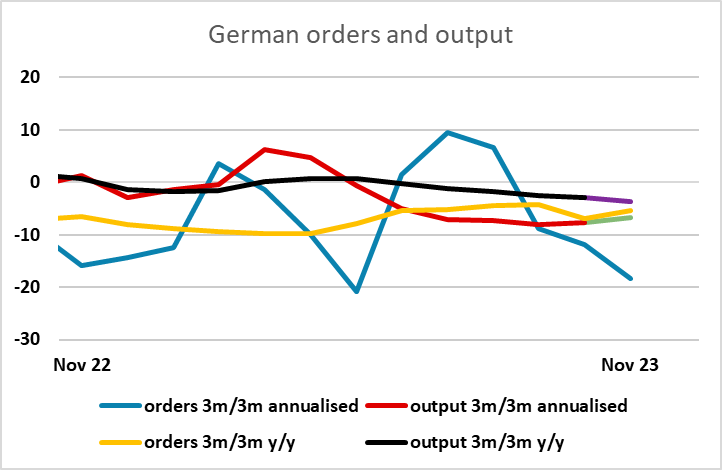

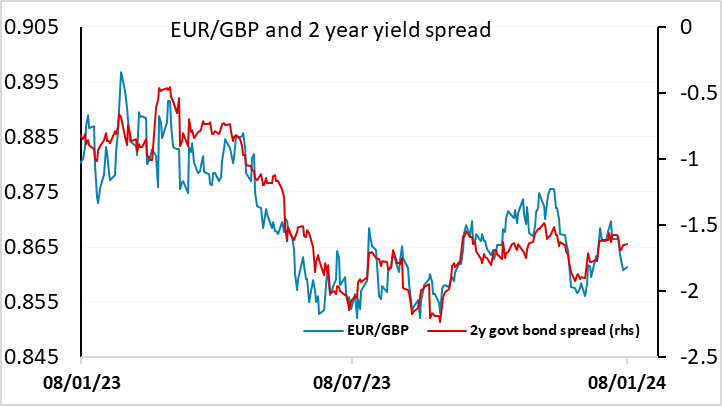

There isn’t a great deal else on Tuesday’s calendar. German industrial production data might attract some attention, but whatever the data, the soft German orders data on Monday doesn’t suggest any reason for significant optimism. Even so, it was notable on Monday that EUR yields were once again firmer, and at current levels are suggesting some upside scope against the USD and GBP. But given the still generally soft Eurozone data (the upward revision to PMIs in December notwithstanding) we are wary of seeing this as a reason for EUR bullishness. Soft industrial production data could bring yields down to levels more consistent with the current level of the EUR.

Monday was generally a fairly quiet day for FX, with the Zhongzhi bankruptcy in China lending a mildly risk negative tone to early trading, but this didn’t really extend through the day, although te AUD continued to trade on the soft side. In practice, the bankruptcy should probably not be treated as new negative news, as the financial problems have been in the public domain for some months, and the decision to implement bankruptcy rather than some sort of bail out might be seen as a cleaner decision. Nevertheless, it is still a reminder of the problems in the Chinese property sector which may hold back global growth in the next year or two, and seems likely to dampen risk sentiment for the rest of this week, or at least up to Thursday’s US CPI data.

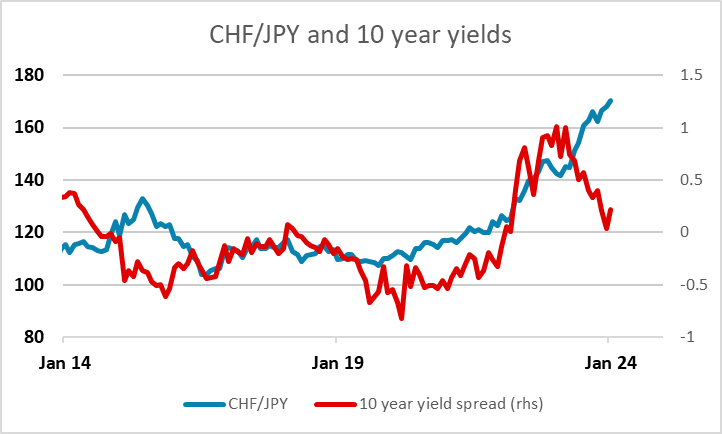

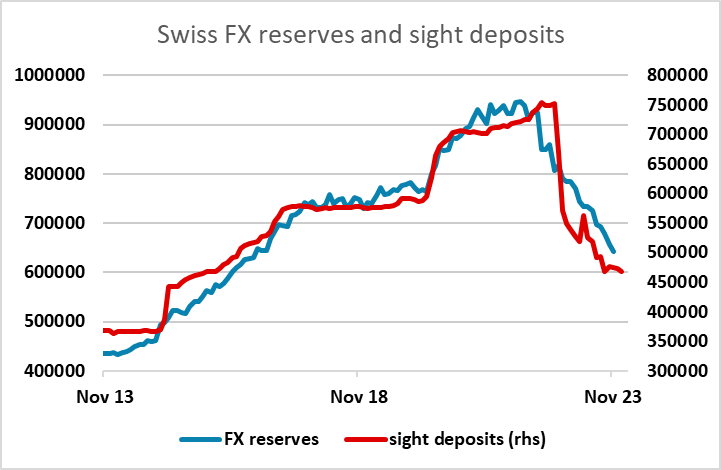

The CHF showed some early strength on the back of higher than expected December CPI on Monday, but this was all energy related and the gains didn’t last. Nevertheless, the CHF remains at very high levels, having gained strongly at the end of December. This came in spite of a more dovish SNB stance at the December meeting, and an indication that they would halt their selling of FX reserves, relieving upward pressure on the CHF. The December FX reserve data is due on Tuesday, and should show little change, as sight deposits data is normally a reasonable guide. If so this should be another reason to expect the CHF to top out near current levels. We continue to see CHF/JPY as the most obvious value trade on a reversal of CHF strength.