FX Daily Strategy: Asia, February 9th

CAD to focus on employment data

Risk to CAD downside given more modest BoC easing expectations

NOK has upside potential, but needs higher than expected CPI to trigger a move

JPY weakness looks untrustworthy

CAD to focus on employment data

Risk to CAD downside given more modest BoC easing expectations

NOK has upside potential, but needs higher than expected CPI to trigger a move

JPY weakness looks untrustworthy

Another quiet day for data in what has been a quiet week, with the Canadian employment numbers and the Norwegian CPI data the only potentially market moving releases.

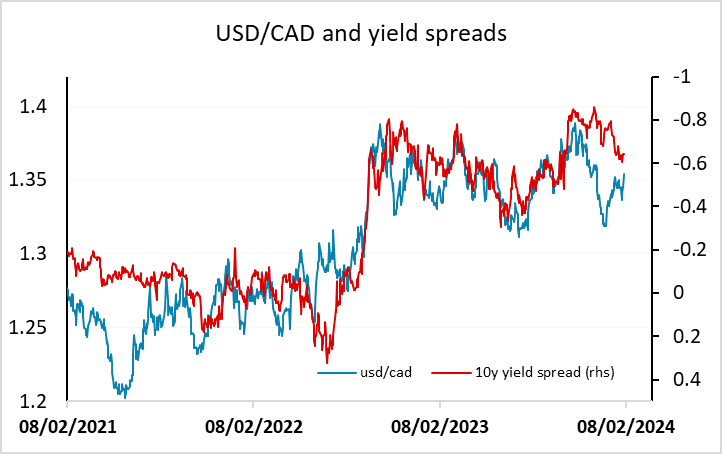

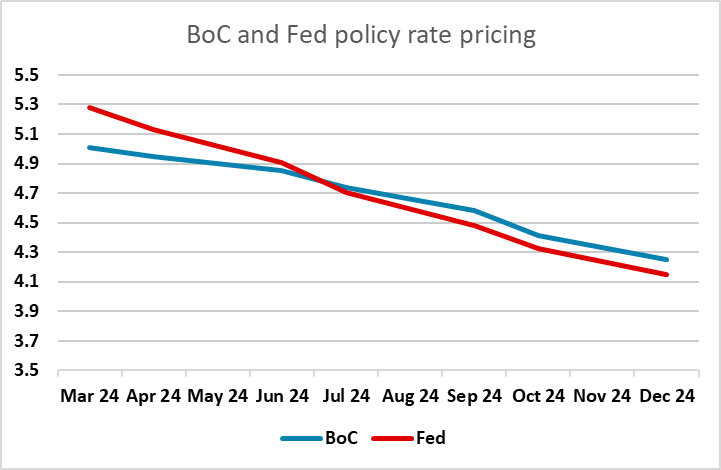

After the exceptionally strong US employment data last week, the Canadian numbers will need to show similar strength if the CAD is to regain the ground lost to the USD over the last week. The CAD had outperformed yield spreads at the end of last year, and has been correcting those gains this year, as spreads have moved in the CAD’s favour. However, it is hard to make a case for short end yields to move further in favour of the CAD given the current pricing of more substantial cuts form the Fed than the BoC. At the same time, USD/CAD still looks a little low relative to the current yield spread levels. So if the Canadian employment data fails to match the sort of strength seen in the US, the risks are weighted to the CAD downside. The market consensus of a 15k rise in employment and a rise in the unemployment rate to 5.9% from 5.8% doesn’t seem sufficient to support the view that the BoC will ease less sharply than the Fed, nor the CAD’s outperformance of yields spreads this year. So USD/CAD risks should be to the upside.

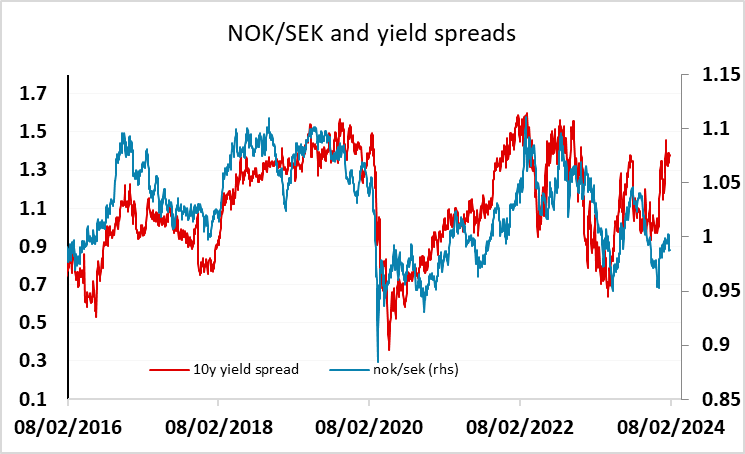

The NOK is in the opposite situation. The position is clearest against the SEK, with NOK/SEK having a historically strong correlation with Norway/Sweden yield spreads. However, even though spreads have moved significantly in the NOK’S favour in the last month, the NOK has underperformed. We favour a recovery in NOK/SEK, but some sort of trigger looks necessary, as EUR/NOK has been edging up in recent days in spite of the attractive spreads and risk positive markets which are normally NOK positive. While it would take a lot to shift Norges Bank back towards further tightening, a CPI number that fails to match the market consensus of a decline to 5.2% y/y in the core could be enough to trigger some NOK strength.

In recent years it would have been unthinkable to talk about the CAD and NOK without a mention of the oil price, but the oil price correlations that these currencies used to show broke down around the time of the pandemic and haven’t reappeared. The oil price in any case remains reasonably stable, and is unlikely to impact either currency unless there is an unexpected announcement of a ceasefire in Gaza. Even then, the likely negative oil price implications might well be offset by the benefits to risky assets.

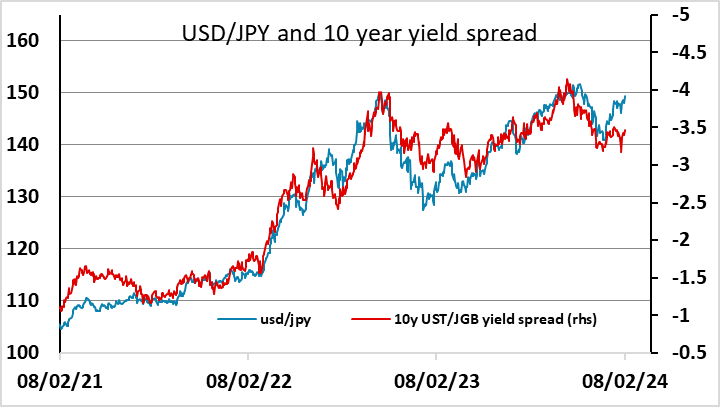

JPY weakness was the theme on Thursday, with the JPY seemingly suffering from the strength of the US equity market and the low level of vol, which is encouraging carry traders. For the last few years, USD/JPY has been driven by moves in yield spreads rather than the level of spreads, and it is rare for these carry trades to cause a prolonged break in the correlation between the currency and the yield spread movement. We would therefore be wary of assuming that the JPY weakness will extend, with 150 looking likely to be a bridge too far.