FX Daily Strategy: APAC, January 20th

Data may take a back seat

Equity correction needed to extend JPY recovery

AUD favoured over EUR if markets stay risk positive

GBP could suffer on UK labour market data

UK labour market data may indicate potential for more BoE easing

Scope for GBP to decline against the EUR even on current yield spreads

Greenland uncertainty may favour the JPY

Supreme Court decision on tariffs becomes more important

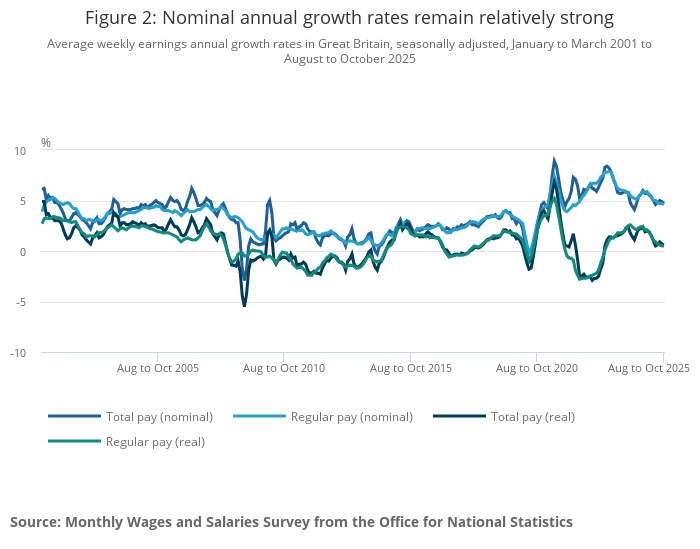

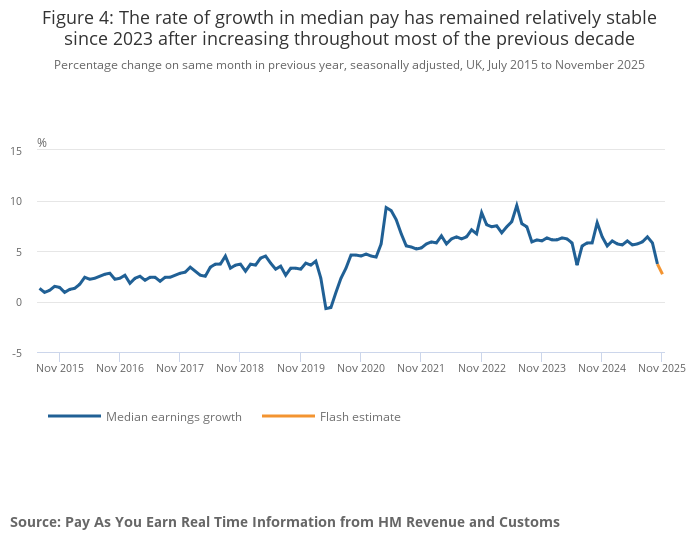

UK labour market data is the main calendar item on Tuesday. As it stands, the market is pricing a rate cut in April as an 80% chance, with March a 40% chance, while February is rated as effectively no chance. The Monetary Policy report in February may give some further guidance, but whether there is a prospect for a near term cut will depend in large part on whether the labour market data continues to show weakness. The continued strength of earnings growth has been a major bugbear for the BoE hawks when voting against more aggressive rate cuts in the last year or two, but the latest data (November for the HMRC data, October for the ONS data) does show some clear evidence of weakening in earnings growth.

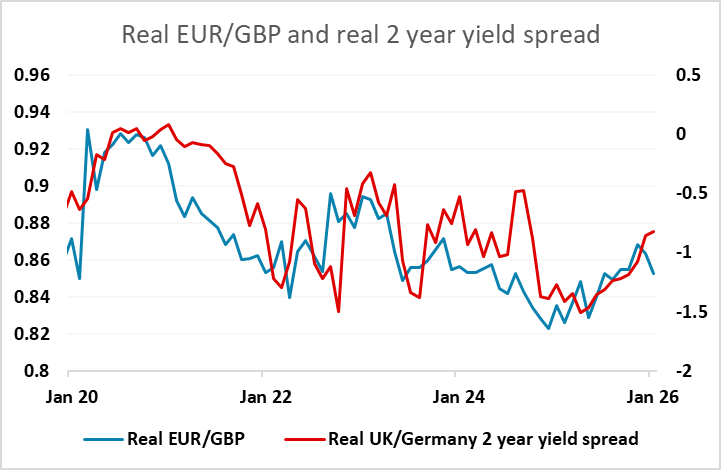

Given the sharp drop in earnings growth evident in the HMRC November data, another number in line with the November data in December might be enough to increase the pressure on the BoE to ease further if the ONS data for November backs up the decline in the HMRC data. We continue to see scope for more BoE rate cuts than the market is pricing in – 3 rather than 2 in 2026 – and if this starts to get priced into the curve, EURGBP has potential to move back above 0.87 and press towards the highs seen in 2025 at 0.8865. The market consensus is for a fairly modest decline in the November ONS earnings data to 4.6% y/y total, 4.5% ex-bonuses, but the HMRC data suggests potential for a more substantial fall (although the ONS data is a 3 month average September-November, reducing the volatility). In any case, we see EUR/GBP as somewhat below the levels consistent with the current real yield spreads, and weakening risk appetite will also tend to be GBP negative, so we favour the EUR/GBP upside.

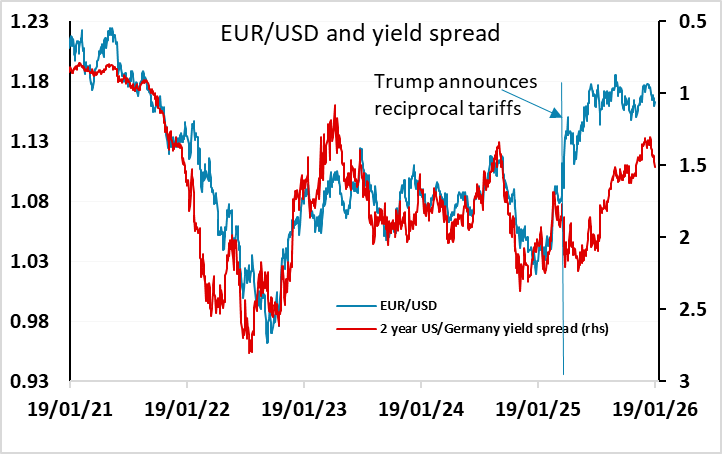

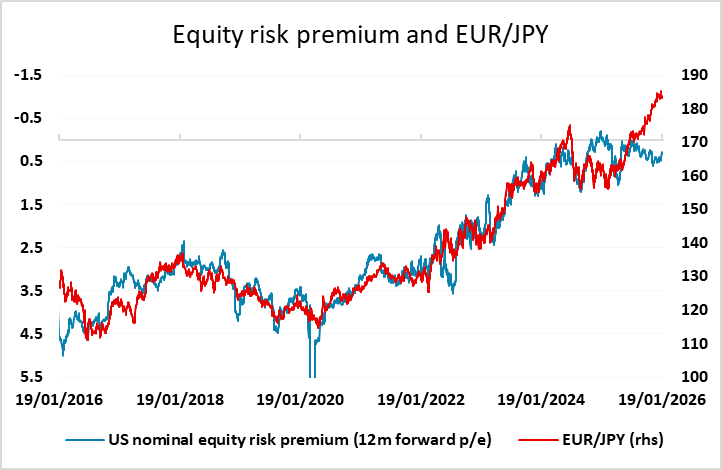

The market focus may, however, continue to be more on the Greenland situation than on data. European opposition to the US claiming the territory is clear, and the threat of tariffs isn’t going to change their minds. If tariffs are imposed in an attempt to pressure Europe, we are likely to see some extension of the equity market weakness we saw on Monday, which ought to lead to some more risk negative trading. However, the FX market reaction has so far been more USD negative than risk negative, with the JPY actually losing ground on the crosses on Monday. This may reflect the fact that the USD lost ground after the reciprocal tariffs were announced in April, with the JPY also underperforming from June as equities recovered from the initial losses. Indeed, the JPY failed to gain on the crosses despite the initial decline in equities. However, we expect it will be different this time around, as the focus is completely on Europe this time, and we are starting at much higher levels of equities and of EUR/JPY. We consequently see more scope for JPY gains.

One other factor to consider is whether the Supreme Court rule the Trump reciprocal tariffs as illegal. This becomes more important now, both because of the new tariff threat, and because the trade deal with the EU might well not be ratified if the Greenland problems persist. This would make the original reciprocal tariffs relevant, which they wouldn’t be if the US trade deal with the EU was in place. The Supreme Court could rule as early as Tuesday, and the market odds suggest around a 70% chance that they rule the tariffs illegal (if they do rule). A ruling that the tariffs were illegal would undermine Trump’s position, but the FX impact is unclear. Trump would be unlikely to accept any such ruling without a fight, so we expect the reaction would be USD negative, and potentially risk negative.