RBI’s Balanced Act: Steady Rates and a Promising FY25 Outlook

The Reserve Bank of India's Monetary Policy Committee, led by Governor Shaktikanta Das, chose to keep the repo rate unchanged at 6.5% for the seventh consecutive time, aiming to ensure that the disinflationary process sustained. Growth is expected to be robust in FY25, while inflation risks are elevated. The increasingly diverging views among the MPC suggest that a rate cut is likely in 2024.

In its latest monetary policy decision, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) has opted to maintain the policy repo rate at 6.5%, with a majority vote of 4 to 2. This decision also leaves the standing deposit facility (SDF) rate unchanged at 6.25%, and both the marginal standing facility (MSF) rate and the Bank Rate at 6.75%. Alongside this rate decision, the MPC reaffirmed its commitment to withdrawing accommodation, aiming to achieve inflation convergence to the target while supporting economic growth.

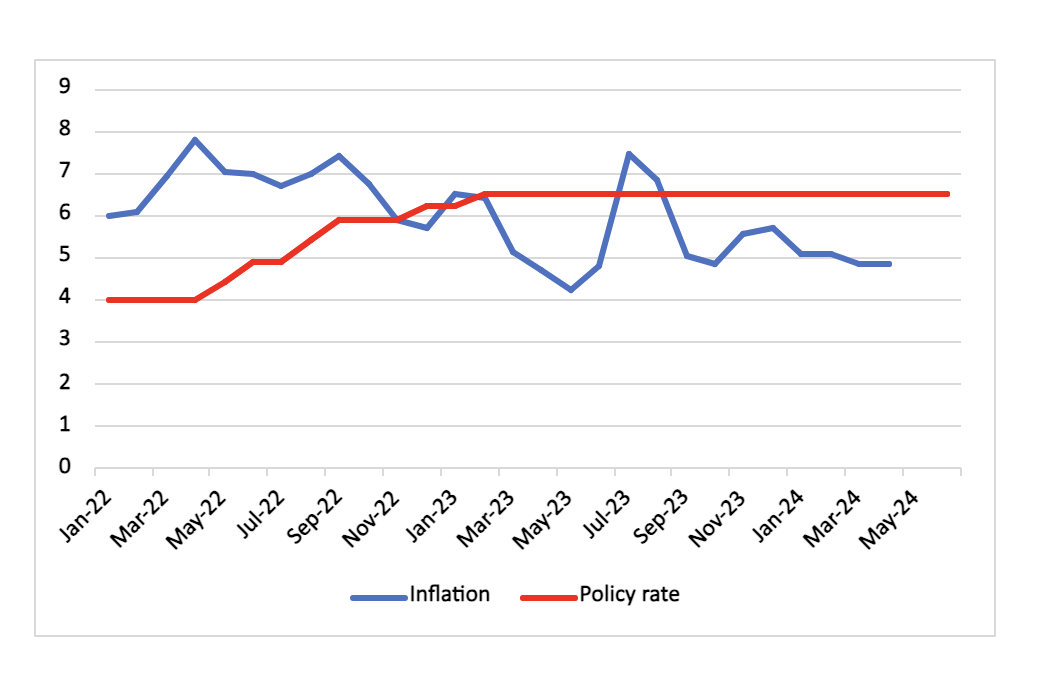

Figure 1: India Inflation and Policy Rate (%)

Source: Continuum Economics

RBI Governor Shaktikanta Das, in his address this morning, laid out an optimistic outlook for India's growth and inflation prospects. The central bank has pegged India's growth for the fiscal year 2025 (FY25) at a robust 7.2% year-on-year. This growth projection is underpinned by a resilient external sector, increased urban private spending, and a pickup in investment. According to Das, the risks to this growth forecast are evenly balanced, with the economy positioned at an inflection point. On the inflation front, Governor Das emphasised the RBI's vigilance in monitoring external risks. The inflation forecast for FY25 stands at 4.5% year-on-year. Inflation is expected to moderate in the second quarter of FY25 due to low base effects but is projected to trend upwards in the third quarter. While lower fuel costs have contributed to easing headline inflation, this has been counterbalanced by high food inflation, particularly in the pulses and vegetable categories. The arrival of the monsoon season is anticipated to ease food inflation, but the situation requires close monitoring.

The governor also provided insights into India's external sector, highlighting that the country's foreign exchange reserves reached a historic high of USD 651.5 billion at the end of May 2024. Additionally, the current account deficit is expected to have moderated over the fourth quarter of FY24. This strong external position indicates that India is well-prepared to meet all its external sector obligations.

A noteworthy point though from Das' statement was around factors influencing India's policy decision. Das noted that while the RBI monitors the monetary policies of advanced economies, particularly the U.S. Federal Reserve, these external factors are not the primary determinants of India's monetary policy decisions. Instead, India's policy focus remains firmly on domestic factors and the prevailing economic conditions within the country. Given this stance, a rate cut is not anticipated in the near term. Any potential rate reduction is likely to be considered in the fourth quarter, provided inflation follows a sustained disinflationary path.

The decision to maintain the current rates comes amid a complex global and domestic economic landscape. The global economy has been grappling with uncertainties, including geopolitical tensions, fluctuating commodity prices, and the economic policies of major economies. Domestically, while the Indian economy shows resilience and growth potential, it also faces challenges such as inflationary pressures and sector-specific issues.

In terms of outlook, it appears that a rate cut in the near term is unlikely. The RBI has sufficient room to hold rate given manageable inflation, strong growth momentum and robust private credit growth (19.1% yr/yr in April). However, given the increasing divergence among the RBI members, a rate cut cannot be ruled out entirely. The 4:2 vote to hold rate suggests that a rate cut although not likely in Q3, cannot be ruled out in Q4. Our expectation is that the RBI will cut its policy rate by 25bps in Q4 2024, primarily to support private investment.