Preview: Due January 14 - U.S. December PPI - Yr/yr growth accelerating

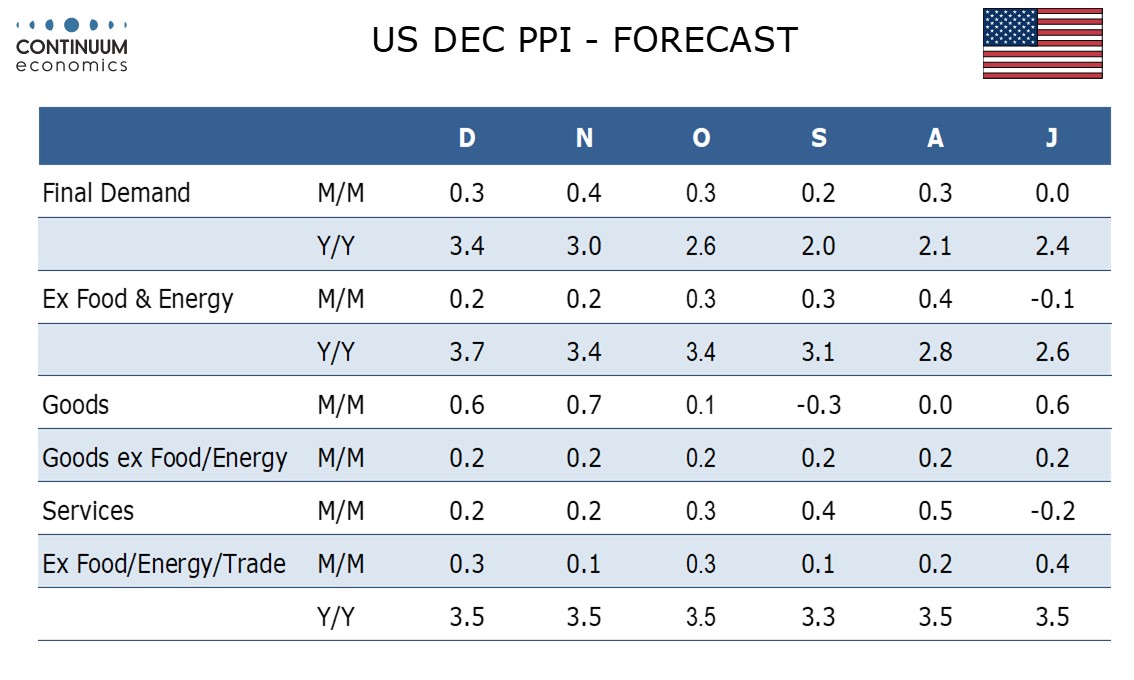

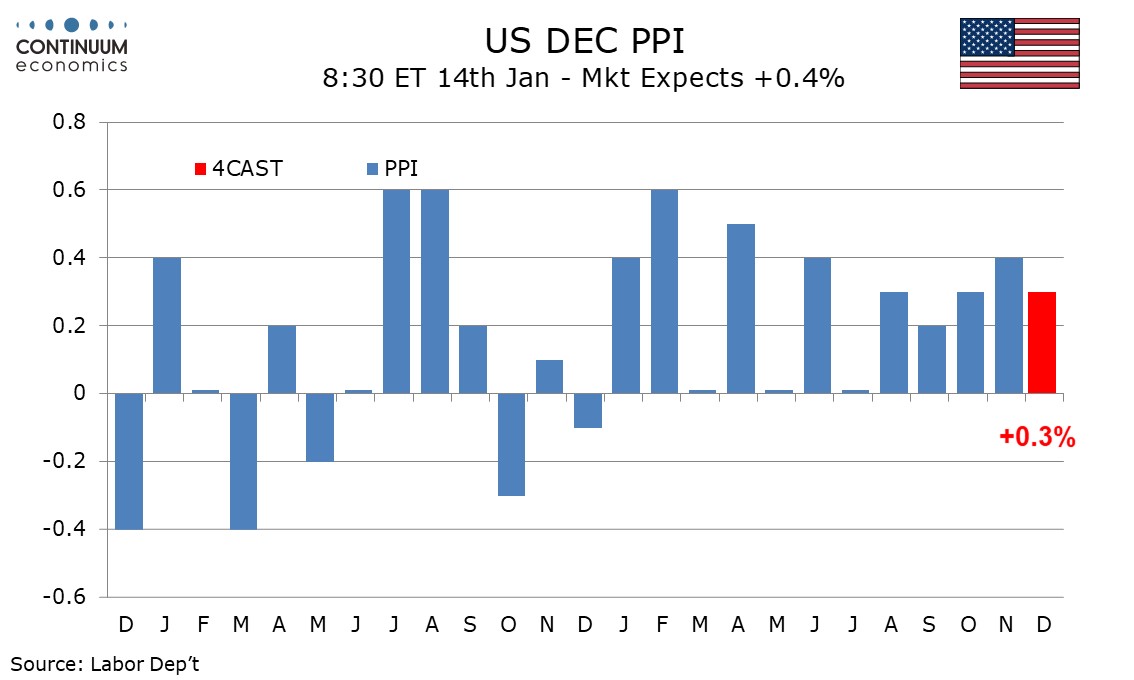

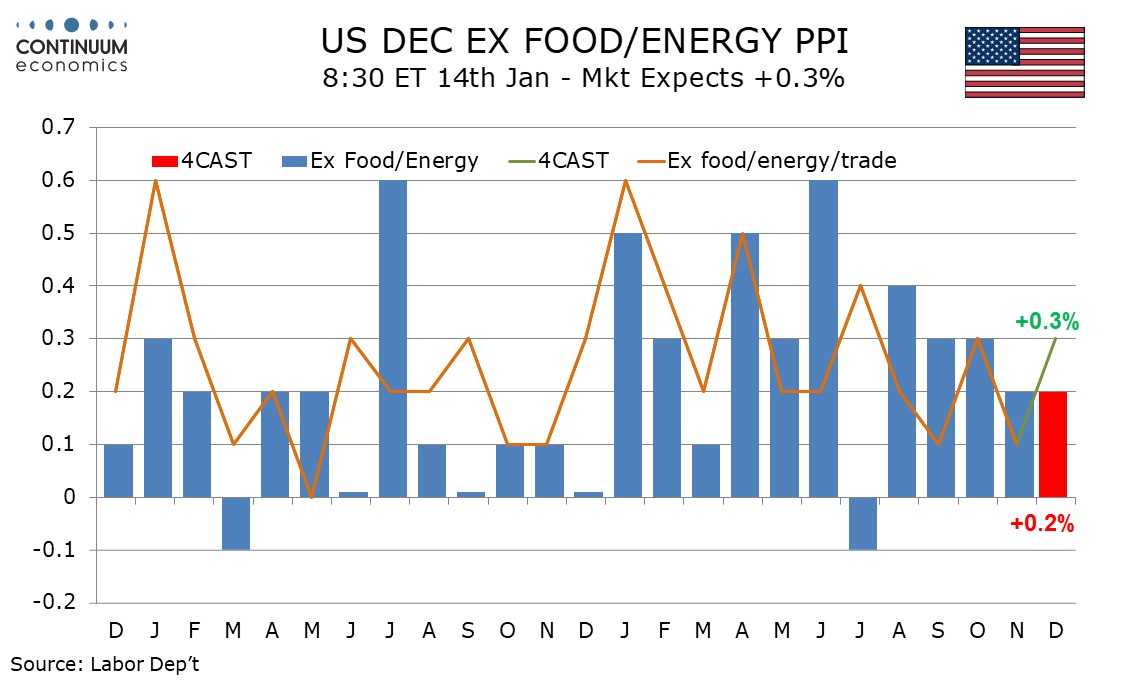

We expect December PPI to rise by 0.3% overall and ex food, energy and trade, though ex food and energy we expect a slightly slower rise of 0.2%, though trend appears to have regained momentum.

Energy prices are likely to be lifted by gains in gasoline, at least after seasonal adjustments, though food prices may partially correct a very sharp gain in November that was led by surging prices of eggs.

We expect goods ex food and energy to see a sixth straight increase of 0.2% and services to also increase by 0.2% for a second straight month restrained by a correction lower in trade prices. However excluding trade we expect services to produce stronger outcomes than below trend data seen in November.

Yr/yr growth would then rise to 3.4% overall from 3.0%, and to 3.7% from 3.4% ex food and energy, both reaching their highest levels since February 2023. Ex food, energy and trade we expect an unchanged yr/yr pace of 3.5%, which would also match the pace seen in four of the last five months.