USD flows: USD dips slightly on weaker CPI

USD softer after weaker CPI, but impact modest

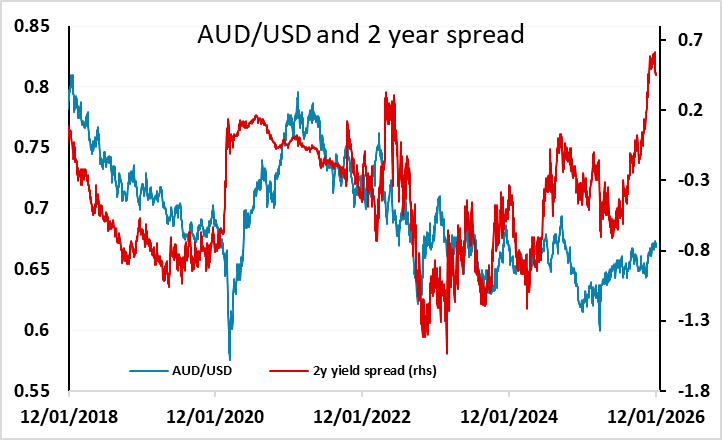

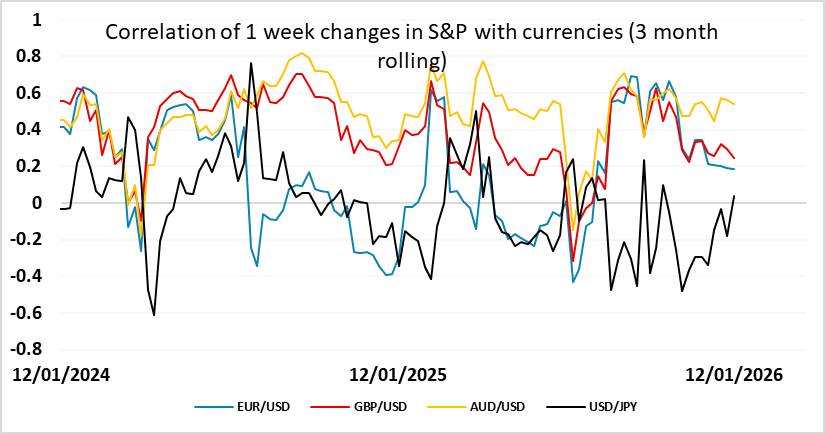

Softer than expected US CPI has triggered a modest USD decline, reversing some small USD gains seen in the last hour against the EUR, and taking USD/JPY to its lows of the European day, although still well above the levels seen at the start of the Asian session. CPI headline was in line with consensus at 0.3% m/m, 2.7% y/y, but the core was 0.2% m/m, 2.6% y/y, 0.1 below consensus. The market is still priced for a Fed ease in June, but there is now seen to be a 50% chance of a cut by April. While the data does suggest we are seeing generally weaker inflation pressure, it doesn’t make much difference to the big picture USD story. The positive equity market reaction has taken S&P futures to a new all time high, suggesting upside risks for the riskier currencies, with the AUD and NOK representing the best value.