USD, JPY flows: USD gains, JPY soft after Powell, Mimura comments

USD generally firm as Powell sounds less dovish. JPY stays weak as market remains sceptical of BoJ tightening despite more JPY positive comments from new head currency diplomat Mimura.

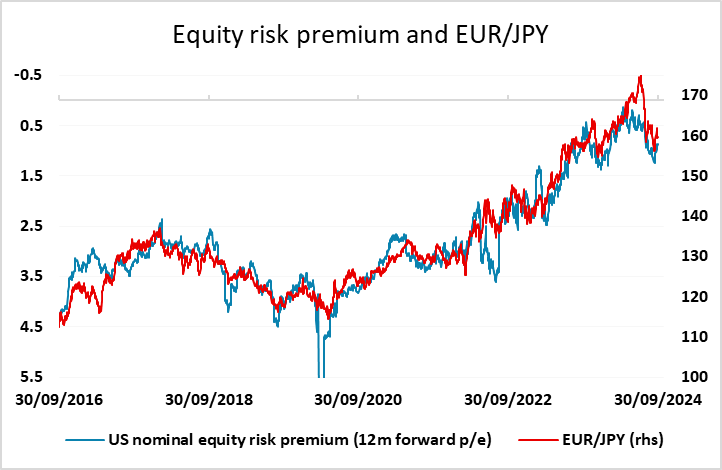

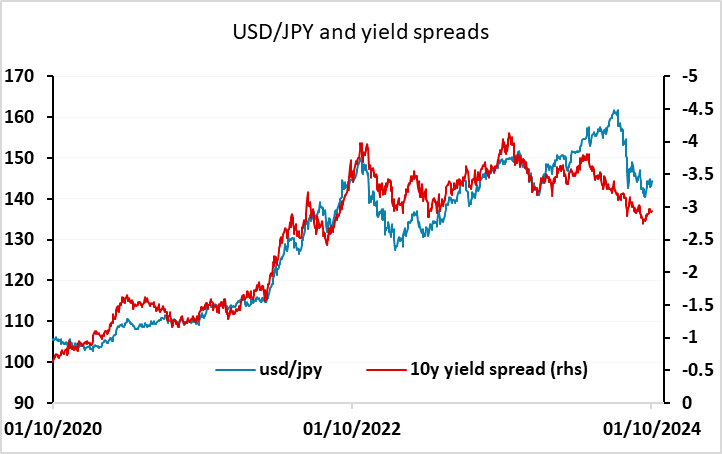

Somewhat less dovish comments from Fed Chair Powell overnight, indicating the Fed was not in a hurry to cut rates quickly, helped the USD gain across the board, with the JPY once again seeing the biggest move. There were also some comments from Japan’s new top currency diplomat Mimura overnight, who said that he hoped that foreign exchange rates will move in line with economic fundamentals as Japan’s economy is entering a different phase with monetary policy normalisation. He also said that one big factor behind the yen's weakness was that Japan was in deflation for 30 years, but said that was changing now as the economy is being normalised, including monetary policy. While he also said yen short positions have been mostly unwound, his comments suggested that the Japanese authorities are looking for the JPY to rise further as monetary policy is tightened and there is evidence that Japan is moving out of deflation. But his comments didn’t help the JPY, which fell back both against the USD and on the crosses. For now, the market is sceptical about the prospects for further BoJ tightening, with only 7bps of tightening priced from the BoJ this year, and only 25bps priced by the end of 2025. As long as this is the case, USD/JPY looks unlikely to break back below 140, and a 140-145 range should hold. As we are approaching the top of this range, the risks are to the downside, but a major move looks unlikely until or unless there is news that increases expectations of BoJ tightening.