FX Daily Strategy: N America, February 14th

GBP moderates on CPI

Declining risk premia also supporting GBP and other risky currencies…

…but are at levels which suggest danger of an equity correction is rising

JPY preferred to CHF as safe haven if risk premia rise

GBP moderates on CPI

Declining risk premia also supporting GBP and other risky currencies…

…but are at levels which suggest danger of an equity correction is rising

JPY preferred to CHF as safe haven if risk premia rise

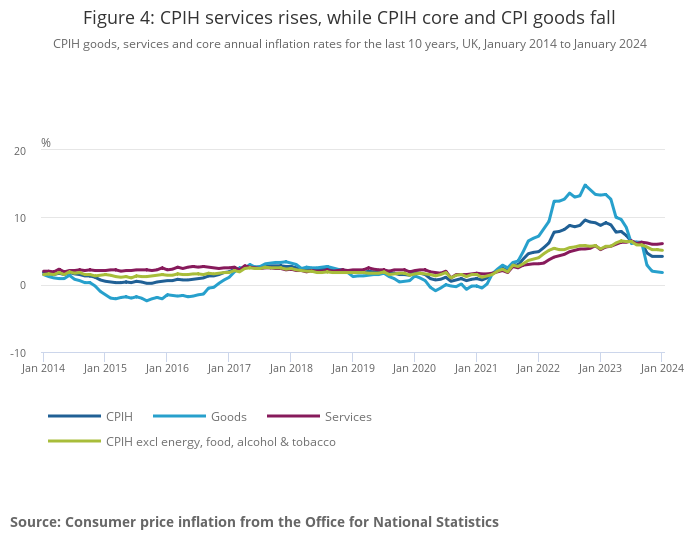

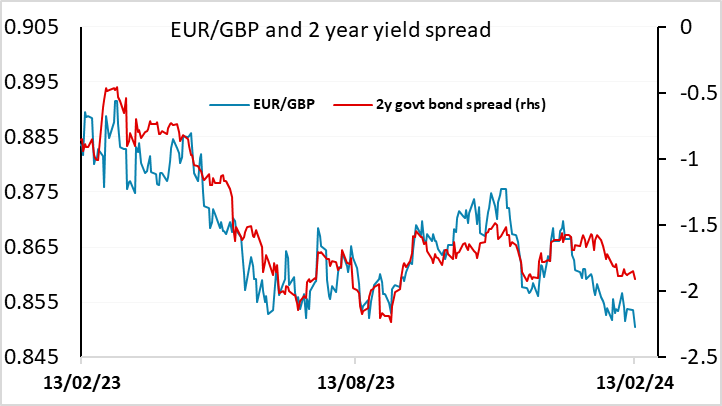

UK CPI has come in weaker than expected, albeit only modestly, with both headline and core CPI unchanged on a y/y basis in January from December at 4.0% and 5.1% respectively. EUR/GBP has gained around 20 pips on the news, bouncing up to 0.8525. But in practice, this isn’t going to have a major impact on BoE thinking, especially since services inflation was actually slightly higher, and the hawks on the MPC see services inflation as key, as it is more likely to reflect the strong rise in wages. The CPIH all services index rose by 6.1% in the 12 months to January 2024, up from 6.0% in December 2023. However, the largest upward contribution to the change came from housing services, which is less obviously wage related.

UK CPI has come in weaker than expected, albeit only modestly, with both headline and core CPI unchanged on a y/y basis in January from December at 4.0% and 5.1% respectively. EUR/GBP has gained around 20 pips on the news, bouncing up to 0.8525. But in practice, this isn’t going to have a major impact on BoE thinking, especially since services inflation was actually slightly higher, and the hawks on the MPC see services inflation as key, as it is more likely to reflect the strong rise in wages. The CPIH all services index rose by 6.1% in the 12 months to January 2024, up from 6.0% in December 2023. However, the largest upward contribution to the change came from housing services, which is less obviously wage related.

All in all, the numbers don’t provide any real rationale for a change in market expectations of the UK rate path. GBP remains a little strong against the EUR relative to the recent yield spread correlation, so today’s numbers should be enough to prevent a break below 0.85 and may see a correction back to 0.8550, but no major move seems likely.

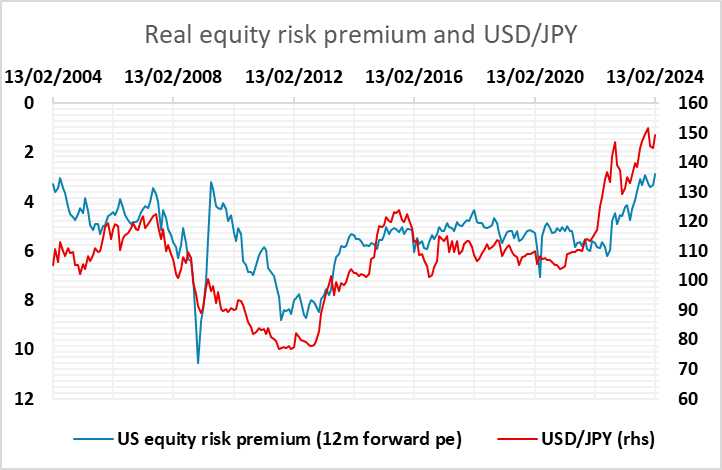

The picture for GBP and the other risky currencies will also to some extent be determined by general risk appetite. GBP/JPY hit its highest since August 2015 on Tuesday, and as with many other JPY crosses, continues to hold a strong correlation with the US equity risk premium. While equity indices fell back on Tuesday after the US CPI data, the equity risk premium actually fell slightly further because the decline in equities didn’t fully offset the rise in US yields. As long as equity markets are resilient to rising yields, risky currencies will remain well supported. But risk premia are now very,very low, below the levels seen before the GFC, and this remains hard to justify given growth prospects are moderate at best starting from a level close to full employment. So we are becoming wary that as the market reduces rate cut expectations, equities will start to suffer more.

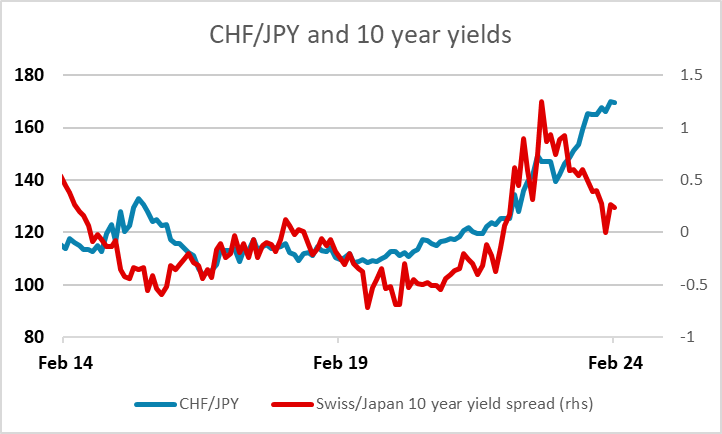

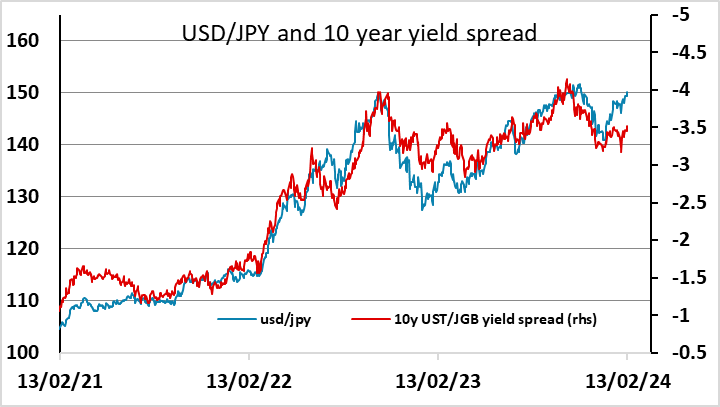

This suggests that JPY weakness is also likely to be on its last legs, especially given the prospect of a BoJ exit from ultraeasy policy in the spring. Yield spreads already suggest USD/JPY is overdone above 150, and it looks to be primarily the strength of the equity market and the decline in risk premia that is keeping the JPY bear trade afloat. The CHF also suffered on Tuesday, with weak Swiss CPI contrasting with the strength in the US, but there is a much stronger case for CHF weakness than JPY weakness given the strong CHF starting levels and the probability that SNB and BoJ policy will be moving in opposite directions, from the spring, favouring the JPY.