JPY, CHF, NOK flows: Some reversal of Tuesday's risk off moves

JPY falls back ahea dof US data but still has potential for bigger picture gains. Scope for some general reversal of Tuesday's risk off trades

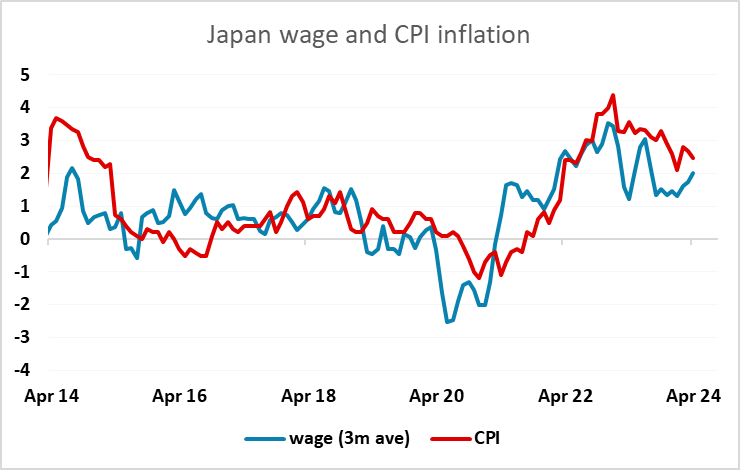

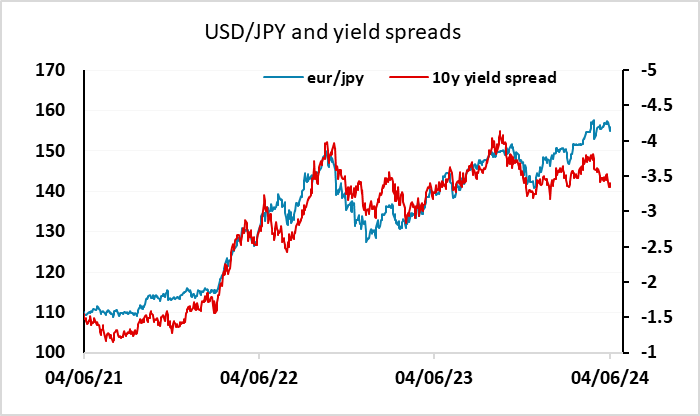

A fairly quiet start in Europe with most of the focus today on the US ISM services PMI released this afternoon. Overnight the JPY reversed some of yesterday’s gains helped by 10 year JGB yields dropping back below 1%. But the Japanese labour cash earnings data showed a larger than expected rise to 2.1% y/y, and this underpins expectations of a rise in inflation over the year as earnings growth is likely to rise further after higher wage agreements were made for this year in March, with large companies agreeing to 5.25% wage increases. Yield spreads already point to a stronger JPY, but JPY bulls may be reticent ahead of today’s ISM, which is expected to rebound from the weak April reading, and the employment report on Friday. The ADP report later will be watched as a potential leader for the payroll number, but in practice rarely provides a good guide.

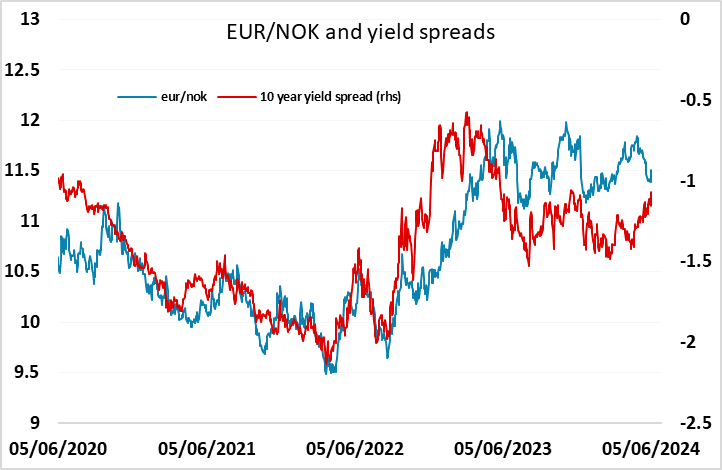

The generally better risk tone this morning should allow some reversal of a lot of the risk negative trades seen on Tuesday. In the European currencies the most pronounced move was the rise in CHF/NOK, suggesting an unwinding of carry trades, but there should be scope for EUR/NOK to fall back from here, while downside now looks much more limited for EUR/CHF.