FX Daily Strategy: APAC, January 21st

UK CPI expected to show a small rise in December

GBP to remain under some pressure due to risk negative tone

USD unlikely to recover unless some progress is seen on Greenland

JPY weakness is illogical but needs BoJ intervention if it is to reverse

UK CPI expected to show a small rise in December

GBP to remain under some pressure due to risk negative tone

USD unlikely to recover unless some progress is seen on Greenland

JPY weakness is illogical but needs BoJ intervention if it is to reverse

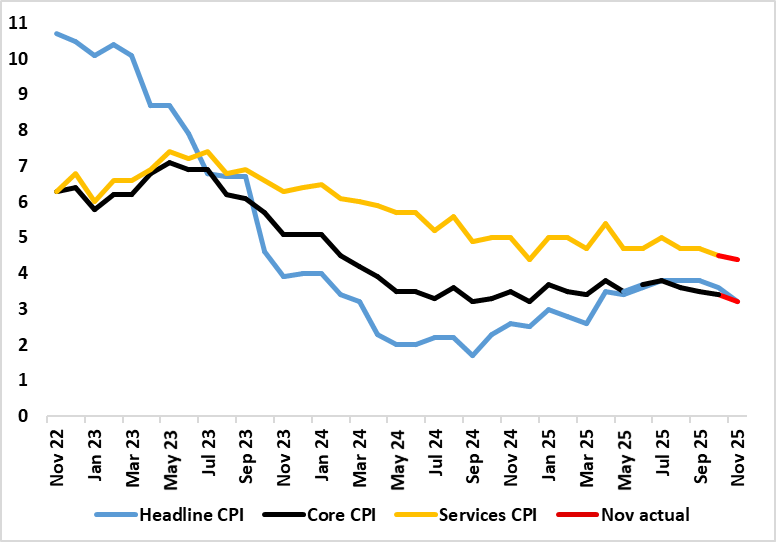

Headline and Core CPI Eased Further in November

Source: ONS, Continuum Economics

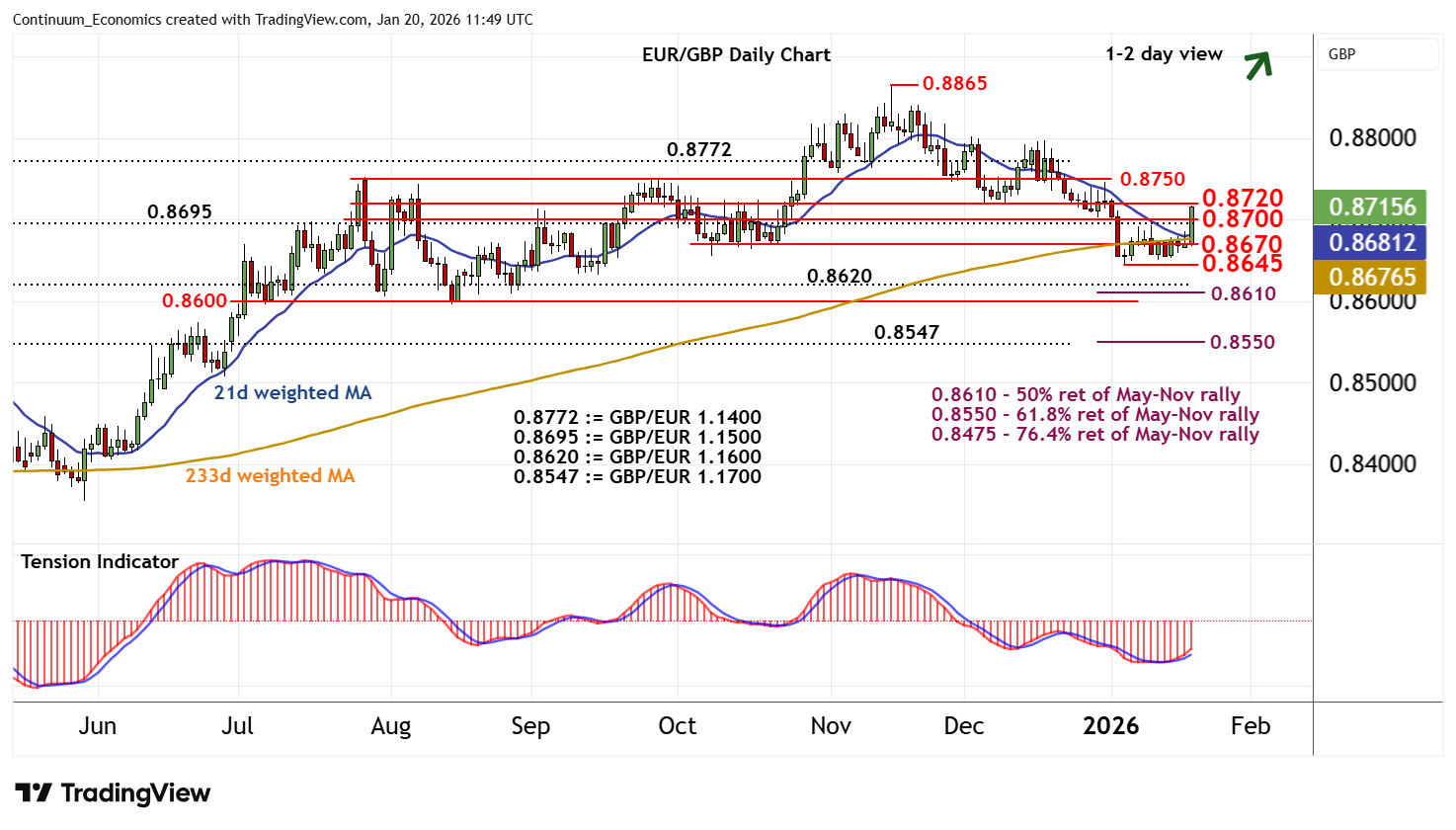

UK CPI is the main data due on Wednesday. Broadly neutral UK labour market data on Tuesday initially saw GBP firm slightly, but by the end of the day EUR/GBP was higher, breaking above 0.87 due to the generally risk negative market tone. The market consensus is for CPI to rise slightly to 3.3% y/y in December from 3.2% in November on both a headline and core basis. Such numbers would be unlikely to increase expectations of BoE easing, which remain mainly focused on the April 30 meeting, which is priced as an 80% chance, although there is a 40% probability ascribed to a cut in March.

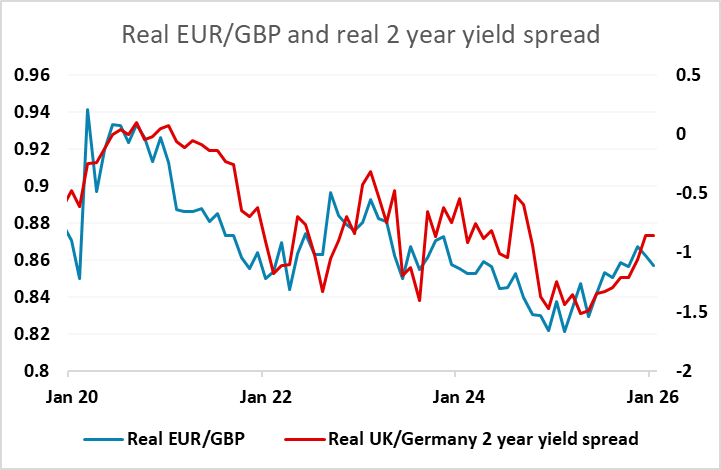

Nevertheless, we still see scope for GBP to soften a little further. Real short term yield spreads still point a little higher, and a deteriorating risk picture suggests GBP downside risks against the EUR, especially in a more USD negative environment. We also see the risks for CPI to be slightly on the downside relative to the market consensus. Even so, the highs of last year at 0.8865 are some way away, and are unlikely to come under real threat unless the risk position deteriorates more significantly.

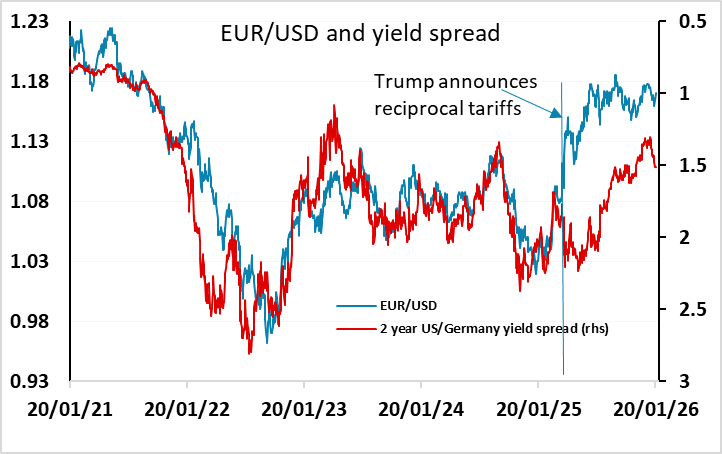

The general market tone will depend on any developments in the Greenland saga. The USD was under general pressure on Tuesday, reprising the behaviour seen when Trump announced reciprocal tariffs in April last year. Then, EUR/USD gained 7 figures in three weeks despite rising US yields and widening yield spreads in the USD’s favour. Since then, spreads have moved back in favour of the EUR, and the outperformance of the historic yield spread relationship is now quite modest. The reaction to the Greenland tariff threat has so far been more modest, in part because many doubt that the tariffs will be imposed, in part because equity declines have been milder. However, unless some solution emerges it is hard to see equities recovering before the tariffs are imposed on February 1, and the USD can be expected to remain under pressure.

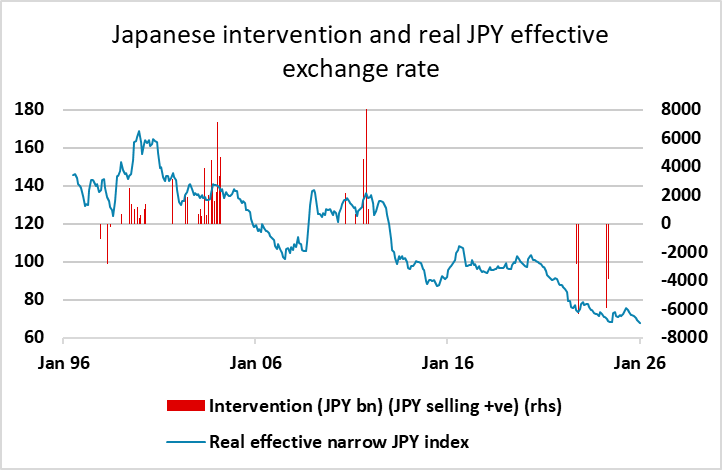

The JPY underperformed on Tuesday, with the announcement of the new Japanese election on February 8 and the expectation that a Takaichi win will mean easier fiscal policy combining to extend JPY weakness on the “Takiachi trade”. We continue to see JPY weakness on this basis as illogical, as the Japanese fiscal position is relatively solid despite a large gross government debt burden, and expansionary fiscal policy would normally mean a stronger currency due to the likely BoJ response of tighter monetary policy. However, the JPY is in its own momentum driven world of weakness when almost any news is now regarded as JPY negative. Fighting JPY weakness is not advisable unless the BoJ comes in to help with physical FX intervention. This is already overdue in our view, with the JPY trading record real trade-weighted lows, and despite recent threats, there is doubt that the Japanese authorities are prepared to intervene in the run-up to the election. But if they don’t, it’s hard to see a turn in the JPY downtrend.