USD, EUR, AUD, NZD flows: NZD decline leads USD rise

A lower NZD after the RBNZ left rates unchanged was followed by a generally firmer USD as equities softened

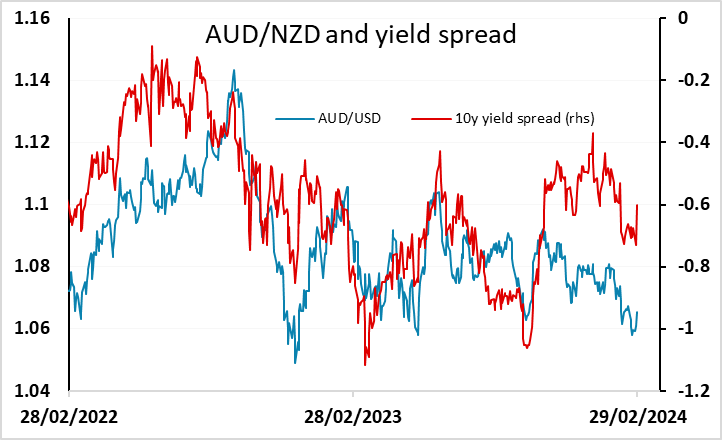

The USD is generally firmer overnight, with some declines in regional equities looking to be the main driver, although these declines are quite modest and seem unlikely to be enough to sustain USD gains. The decline of the NZD made sense after the RBNZ sounded more dovish than expected in leaving rates unchanged, and this may also have spread to other USD pairs. Yield spreads suggest there is still scope for AUD/NZD to rise further, but for today the AUD may be held back be negative regional equity sentiment.

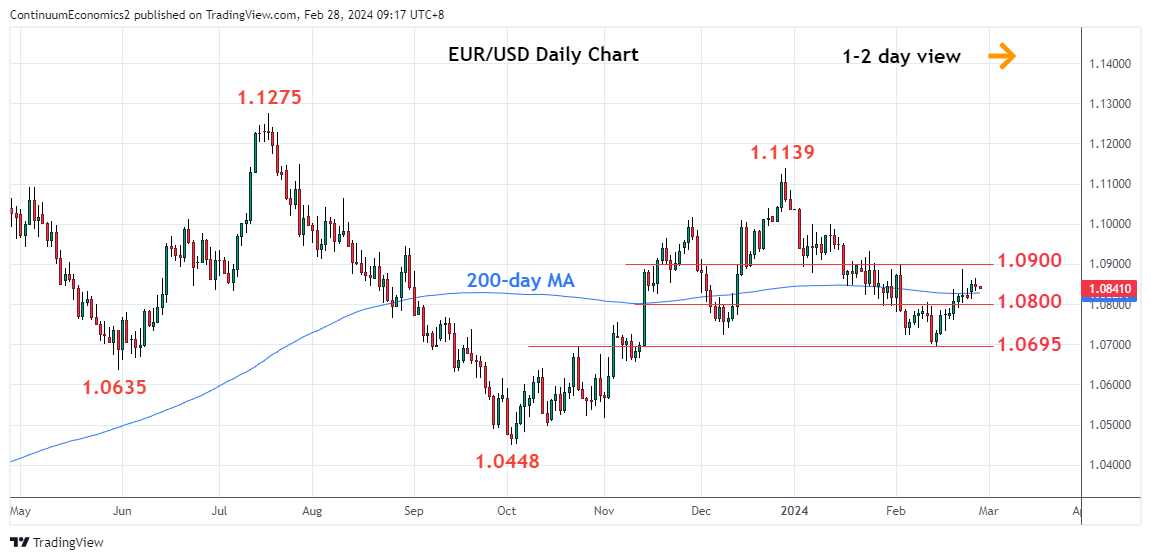

This morning sees some Swedish and Eurozone confidence data, which may determine the near term trend, although we don’t see real scope for EUR/USD to trade sub 1.08 ahead of the inflation numbers tomorrow and Friday.