FX Daily Strategy: APAC, August 20th

NZD may slip lower on RBNZ

SEK downside risks on Riksbank

EUR/GBP biased higher on UK CPI

Rangebound market needs evidence of US labor market weakness to break ranges

NZD may slip lower on RBNZ

SEK downside risks on Riksbank

EUR/GBP biased higher on UK CPI

Rangebound market needs evidence of US labor market weakness to break ranges

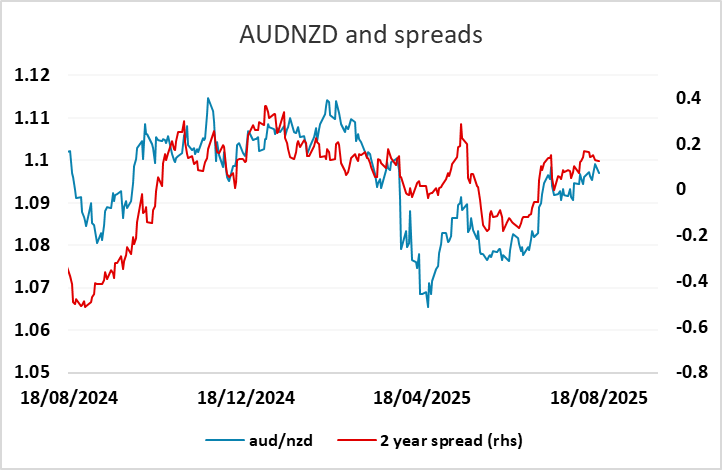

Wednesday sees policy meetings from the RBNZ and Riksbank as well as UK CPI data. The RBNZ meeting is first up, and is expected to deliver a 25bp cut in the policy rate. This is more than 90% priced int the market, so the focus is likely to be more on what the RBNZ signal about the potential for a further rate cut this year. As it stands, the market is pricing around a 60% chance of another rate cut before year end (assuming we get a cut this month), so there is two way potential for a NZD reaction depending on the signals coming out of the meeting. At this stage we slightly favour the RBNZ taking a dovish view, and see potential for gains in AUD/NZD in response.

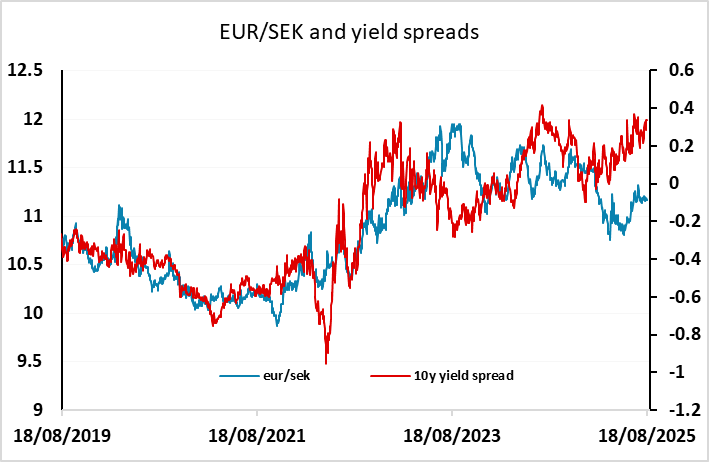

The Riksbank, in contrast, are priced as unlikely to cut rates with a cut priced as less than a 20% chance. However, we see a cut as much more likely than this, after hints after the last meeting of a further possible move. With both real activity and CPI data having delivered downside news and surprises, the rationale as well as scope is there for what we think will be flagged as a final move. There is one more cut priced in by the end of the year, so if this was flagged as a final move the impact on the SEK may not be huge, but it would be negative, while if the Riksbank leave rates unchanged but still suggest further easing is possible there is unlikely to be much SEK impact. The SEK till looks expensive relative to yield spreads against both the EUR and NOK, so we see clear SEK downside risks on the meeting.

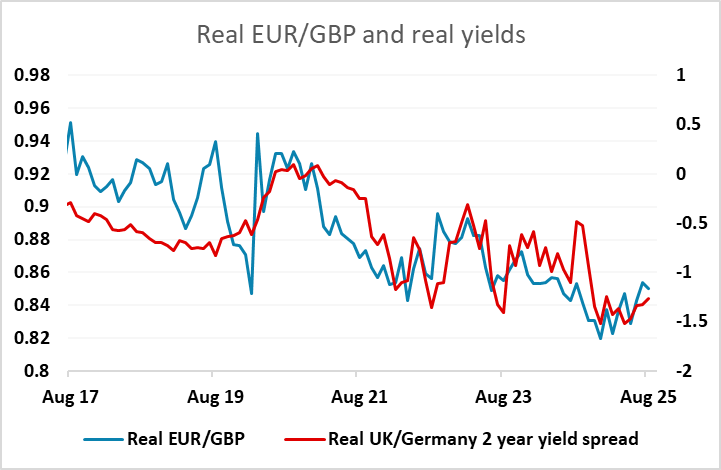

We see UK CPI inflation steady at 3.6% in July, 0.2 ppt below BoE thinking and also slightly below market consensus. Our relatively lower estimate factors in lower services inflation and a fall back in that for food, the former allowing the core rate to unwind the increase to 3.7% see last time around. EUR/GBP has tested the 0.86 level since the release of stronger than expected UK Q2 GDP data, but has failed to sustain a break below, and with another rate cut not fully priced in until March next year, the risks now should be on the GBP downside, with any softness in inflation likely to increase market expectations of near term easing. In ral terms, EUR/GBP still looks low and should edge higher if we see convergence between real rates in the UK and Eurozone, as seems liekly given the similar growth profiles.

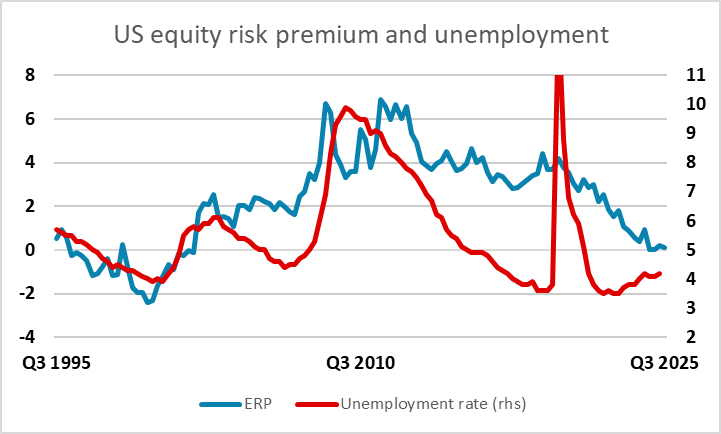

In general, FX markets remain largely rangebound, and it’s hard to see a breakout in either EUR/USD or USD/JPY without some clear economic news out of the US, or a surprise statement from Fed Chair Powell at Jackson Hole on Friday. Bigger picture we still see the high level of the US equity market as unsustainable, but evidence of weakness in the US labour market looks necessary to trigger a significant correction. If this were to come, the JPY would be the main beneficiary, with the USD possibly even holding its own against the riskier currencies. The US jobless claims data on Thursday relates to the employment report survey week, so has potential to have some impact.