EUR, JPY flows: USD firmer early after EUR rally on Monday

EUR gained as tariff threat delayed, but slipping after weak French CPI. JPY under presure

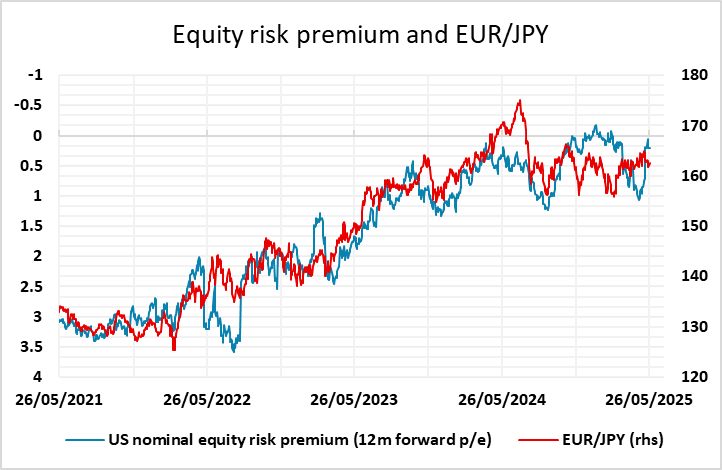

The riskier currencies have generally performed better over the long weekend in the US and UK, helped by Trump announcing a delay to the 50% tariff on the EU from June 1 to July 9. While the threat wasn’t generally seen to be credible anyway after the deal with China, this has reversed the dip in the EUR and the other riskier currencies seen when the original threat was announced on Friday. However, the EUR has slipped a little lower in early trade after a weaker than expected French preliminary May CPI release, which showed a drop to 0.6% from 0.9% y/y. The USD has also strengthened against the JPY in late Asia/early Europe trading, with USD/JPY rising a figure. The proximate cause of this is unclear, but JPY weakness may be cross related, with risk premia still at levels which suggest EUR/JPY will hold at high levels.

There isn’t much on the calendar for the rest of the day, but we may see risk positive trading extend in the US in response to the delay to the EU tariff, suggesting the JPY could remain under pressure on the crosses.