FX Daily Strategy: APAC, March 7th

US employment report the focus

Scope for some USD recovery on a stronger than expected number

Underlying picture still not USD supportive

CAD may have short term upside scope on employment data but hard to be positive longer term

EUR gains based on strength of European equities may not persist

US employment report the focus

Scope for some USD recovery on a stronger than expected number

Underlying picture still not USD supportive

CAD may have short term upside scope on employment data but hard to be positive longer term

EUR gains based on strength of European equities may not persist

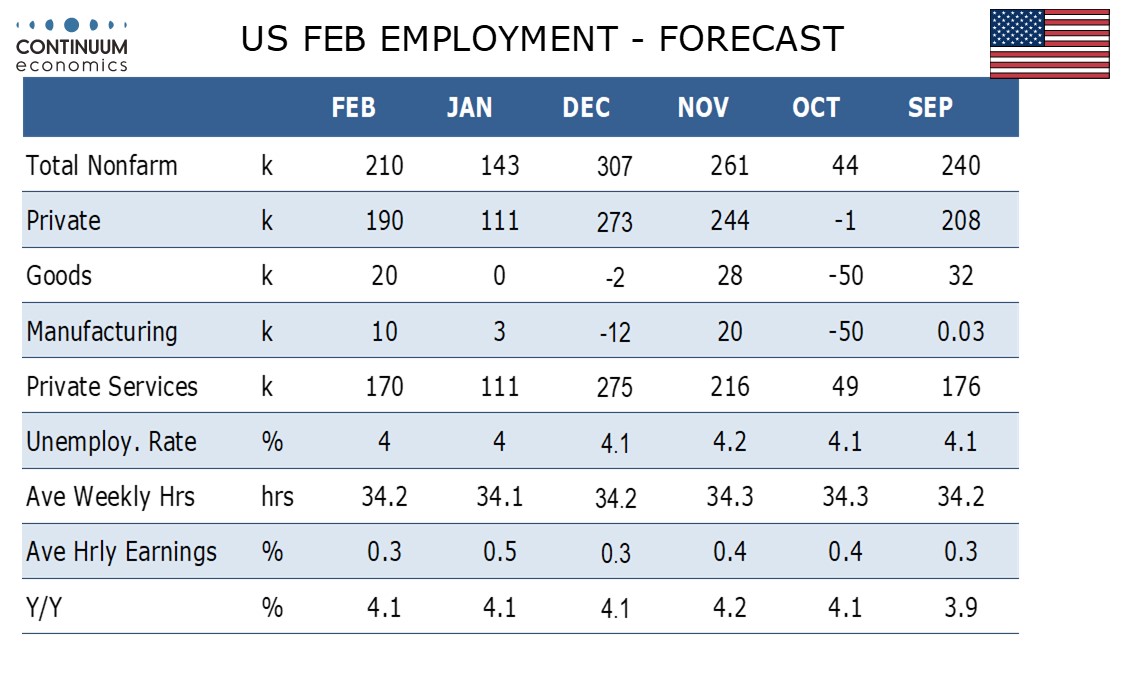

Friday’s focus will be on the US employment report. We expect a 210k increase in February’s non-farm payroll, with 190k in the private sector, slightly stronger than in January but slower than in November and December. We expect unemployment to remain at 4.0% and a 0.3% rise in average hourly earnings, following an above trend 0.5% in January. Our payroll forecast is above the market consensus of 159k, but the average earnings and unemployment rate forecasts are in line with the consensus. 50k on payrolls isn’t really a very big deal, but after a week of USD weakness it’s probably enough to trigger a fairly sharp initial USD recovery. Bigger picture it doesn’t mean very much, as the focus is on the current policy changes and their likely impact down the road. The February employment report is essentially old news. If Trump’s tariff increases are sustained the market is likely to continue to anticipate a weakening of both the global and the US economy going forward.

Thus far, the tariff concerns have actually proved USD negative in contrast to the general expectation that tariff increases would be USD supportive. Even USD/CAD is slipping lower, despite forecasts from the BoC that a 25% tariff could well mean recession in Canada. Partly this reflects the fact that the BoC may not ease more than the Fed as retaliatory tariffs will lead to higher Canadian prices. Partly it reflects the more positive EUR picture in response to the expectation of increased European defence and infrastructure spending, which has led to more general USD weakness. Partly it is also a consequence of the high US equity market valuation and greater US sensitivity to equity market moves, which means any weakness in global growth may well have a disproportionate second round impact on the US. For all these reasons we doubt that any USD rally on the employment data will last very long if the Trump policy agenda is sustained. Nevertheless, a 1% recovery is quite possible on a stronger than expected employment report.

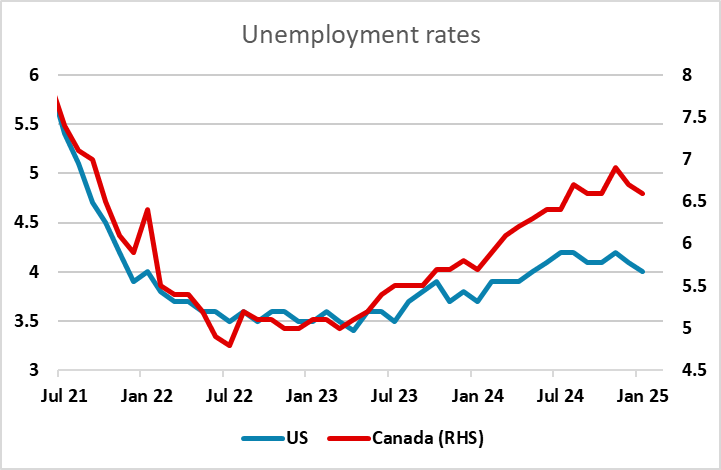

We also have the Canadian employment report, which surprised on the upside last time around and is expected to see some correction this time as a result, with the unemployment rate expected to rise to 6.7%. The risks may be on the CAD upside given the market assumption of a weaker report, with this data unlikely to reflect any decisions being made on the basis of US tariff increases. But the picture is likely to be gloomier going forward unless Trump relents on his tariff decisions, so it’s hard to be positive on the CAD despite its recent resilience.

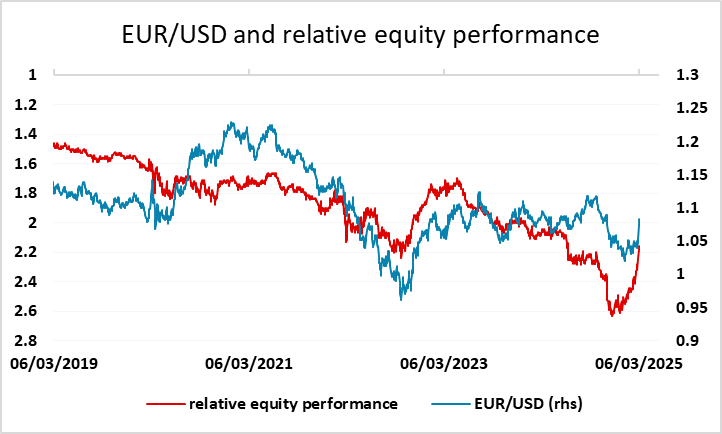

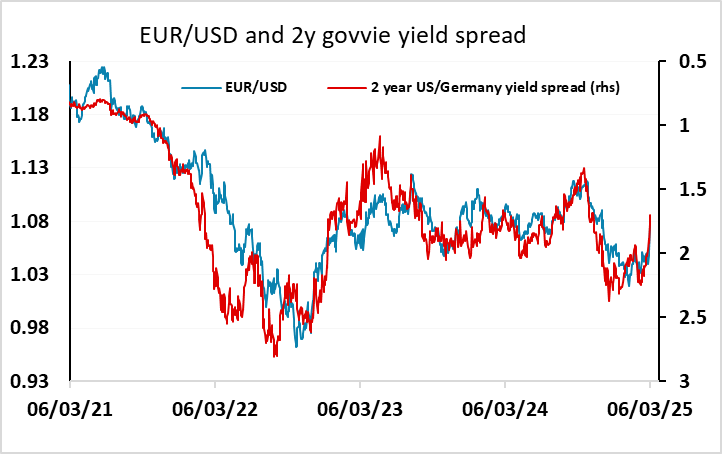

While EUR/USD gains have been largely driven by narrowing US/Europe yield spreads in the last week, there is also a part being played by the relative strength of the European equity market. This partly relates to the expectations of increased European spending that have emerged in the last week, but European equities have been outperforming since the beginning of the year. To some extent this is simply about value. In spite of the recent gains in European equities valuations are no more than modestly expensive by historic standards, while the US market remains close to its most expensive since the turn of the century. Nevertheless, we are a little sceptical of the scope for further European equity strength given rising European bond yields, still sluggish European growth, concern about tariffs and potentially a weaker US market. On any significant equity sell of the European market has tended to suffer more than the US in the early stages. EUR/USD may have scope to near 1.10 based on recent yield spread moves, but we wouldn’t count on any further strength based on equity market strength.