EUR, SEK, NOK flows: SEK little changed after GDP

Better than expected Swedish GDP still doesn't justify recent SEK strength

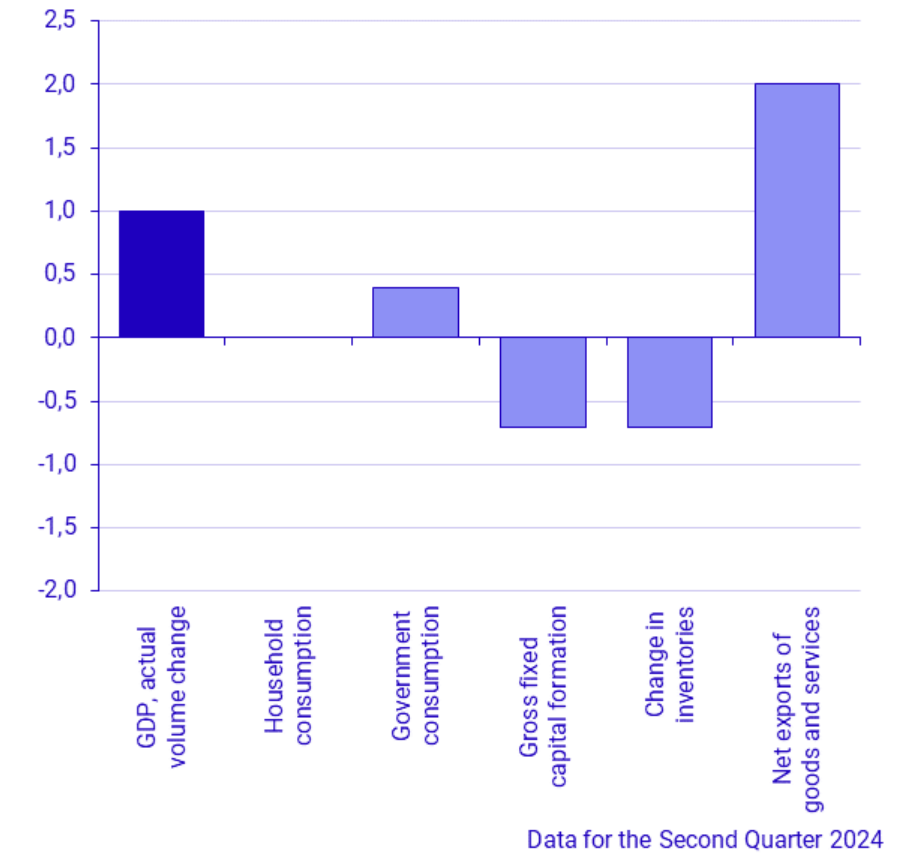

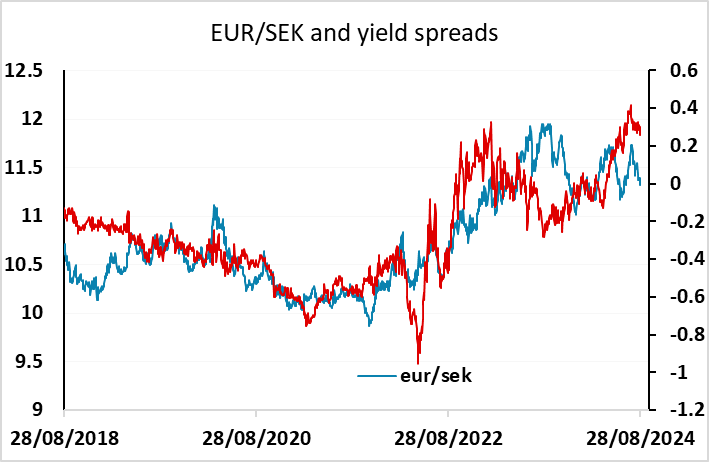

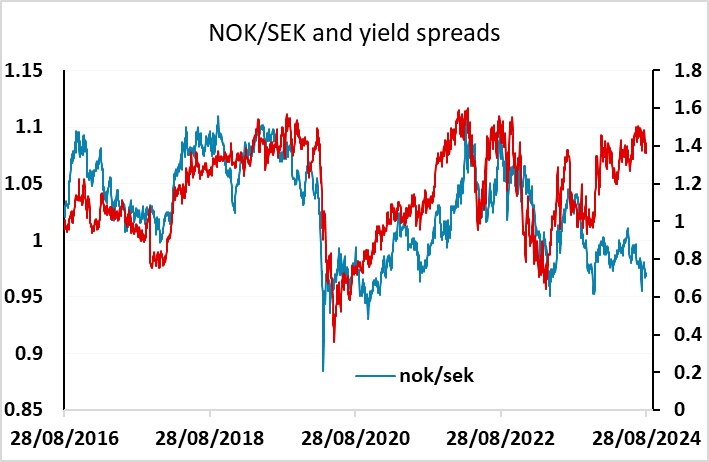

Swedish Q2 GDP has been revised up from -0.8% to -0.3%, which is significantly better than expected following the 0.7% gain in Q1. However, the improvement was largely due to positive net exports, and the market reaction has been modest, with EUR/SEK initially dipping but recovering back to pre-data levels. The SEK continues to trade somewhat above the levels that look justified by current yield spreads, especially against the NOK, and with GDP still only up 0.5% y/y, and the Riksbank on the dovish side, it still looks vulnerable, but it is hard to oppose the strong performance seen in the last couple of months.

The focus for the EUR this morning should be on the preliminary August CPI data out of Spain and Germany. Risk sentiment is mixed with the Nvidia results last night seen as less good than they appeared but the NZD getting a boost from a very strong ANZ business survey.

Contributions to Swedish GDP % y/y