U.S. March Advance Goods Trade Deficit - Increases risk of negative Q1 GDP

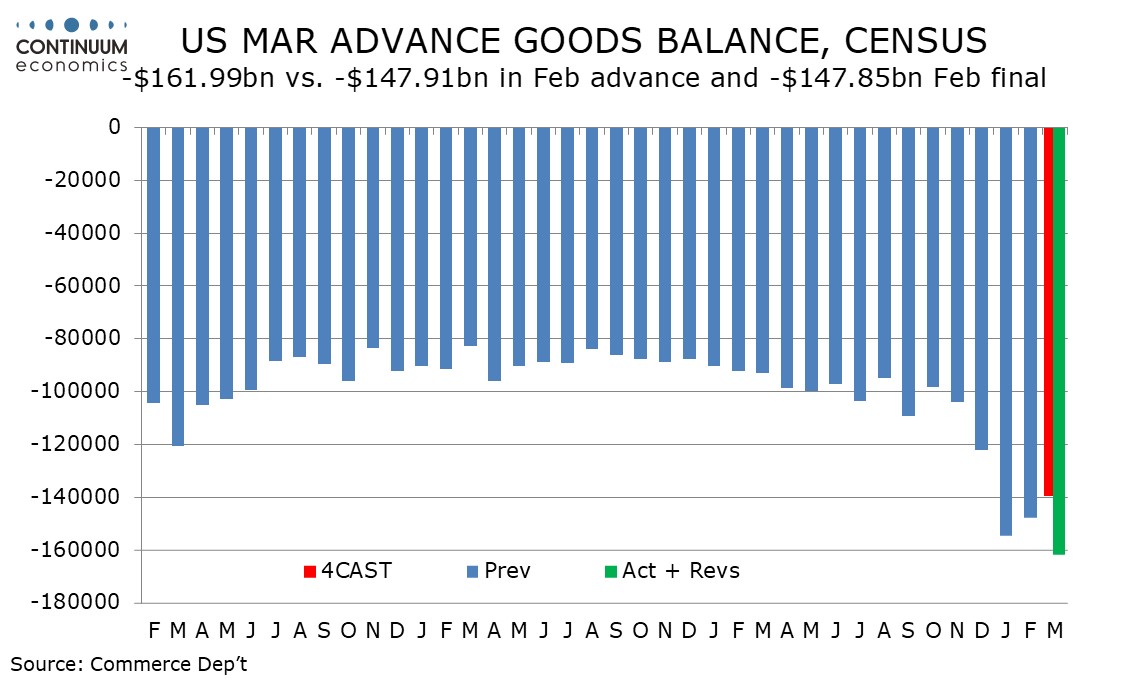

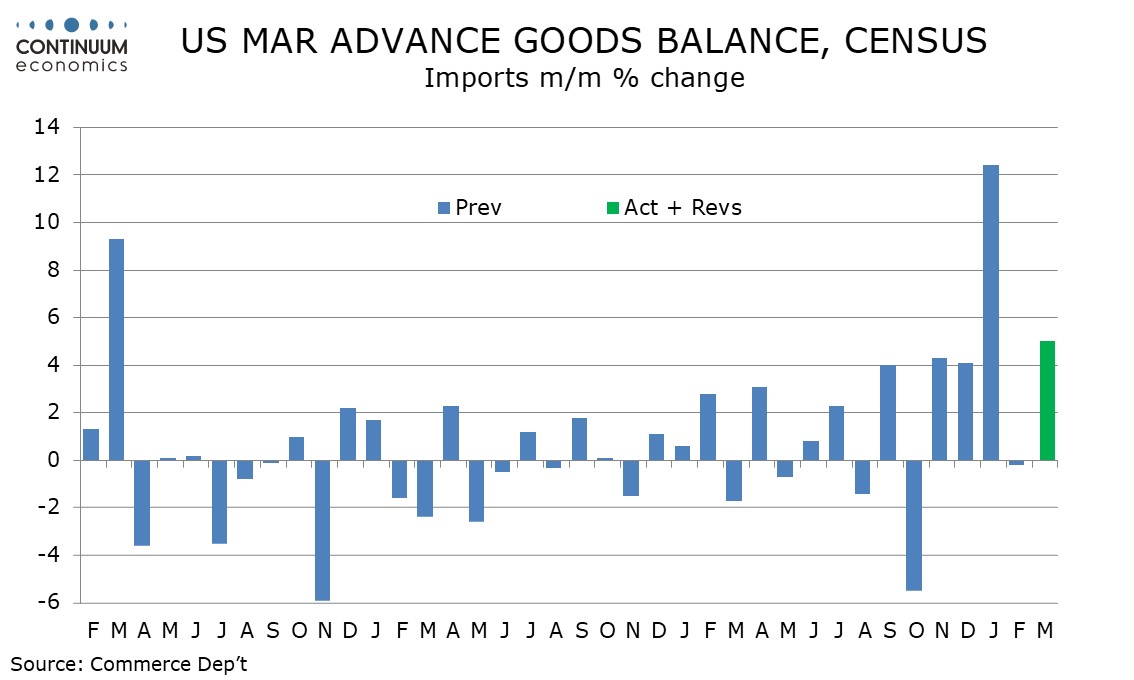

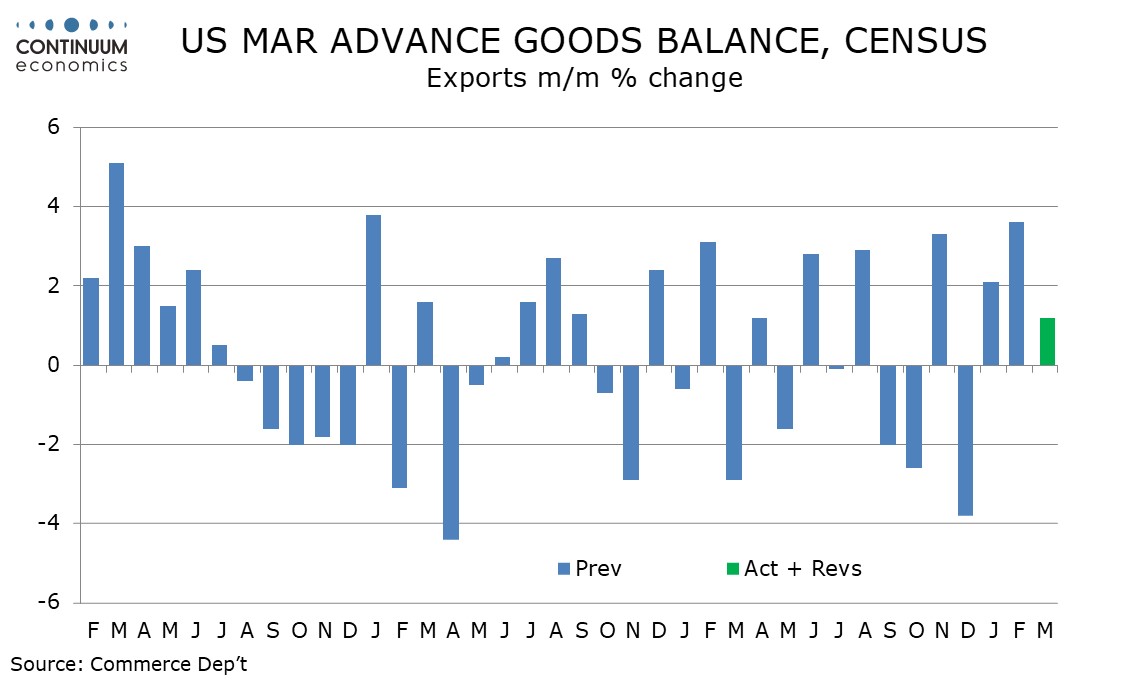

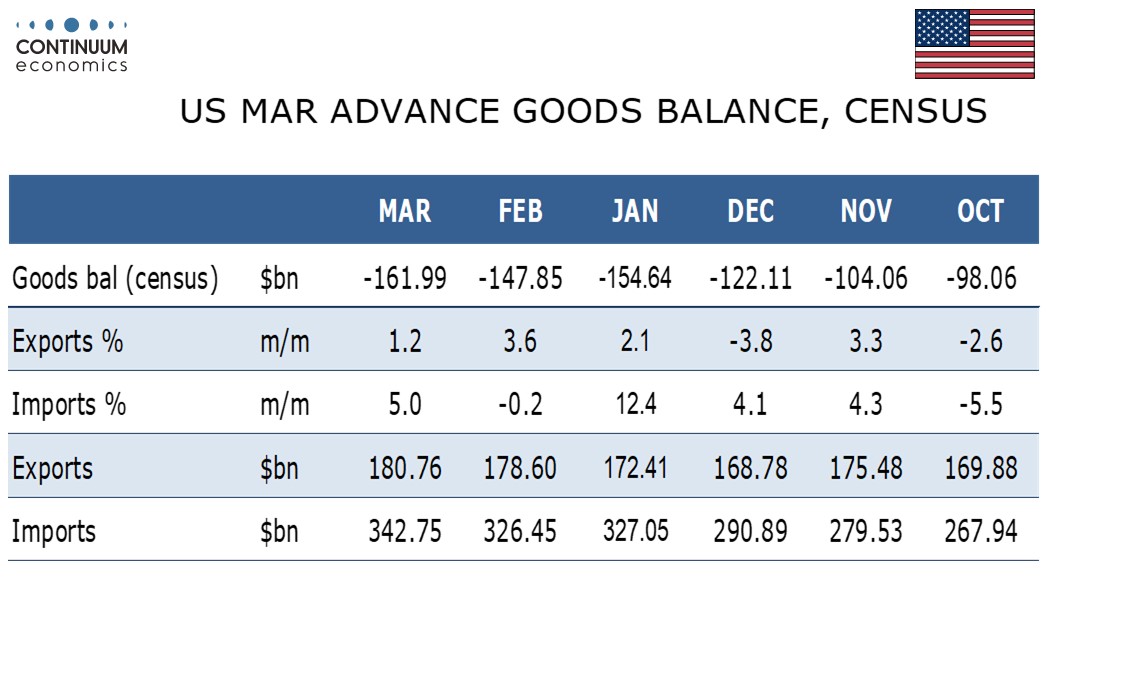

March’s advance goods trade deficit of $162.0bn from $147.8bn in February is significantly wider than expected as well as a record high and adds to the risk of a negative Q1 GDP outcome. Exports rose by a respectable 1.2%, but imports surged by 5.0% ahead of the April 2 tariff announcement.

In January export strength was led by industrial supplies, in particular finished metal shapes, but these slipped by 13.5% in March after a 4.6% dip in February. March’s import strength was led by a 27.5% surge in consumer goods, with autos also firm with a rise of 6.6%. The exports rise was led by autos, which rose by 7.7%.

Advance wholesale inventories were quite firm with a second straight rise of 0.5% but advance retail inventories were weak with a second straight fall of 0.1%. GDP arithmetic is particularly trickly this quarter as we need to consider where Q1’s massive surge in imports ended up.

The strength of industrial supplies in January suggests much of the imports gain went into stronger business investment, while the strength of consumer goods imports in March matches a strong March retail sales report, but consumer spending still looks quite subdued in Q1 as a whole given a weak January.

Inventories do look set to see some pick up in Q1, but it is difficult to see sufficient strength in business investment, consumer spending and inventories combined to fully offset the negative from net exports that trade data is implying. In fact simple arithmetic suggests a weaker GDP outcome than our -0.5% forecast, but with payrolls still increasing through Q1 a sharp negative in GDP looks unlikely.

If Q1 GDP does come in sharply negative with only net exports showing clear weakness, a second straight decline in Q2 cannot be assumed because net exports are likely to significantly improve in Q2 as imports correct lower, even if increased weakness is likely elsewhere in the Q2 GDP detail.