FX Daily Strategy: APAC, July 17th

US retail sales to show mild slowing, but impact likely to be modest

USD may nevertheless manage a further recovery

AUD likely to be resilient to employment data

GBP could rally if UK wage data fails to decline

US retail sales to show mild slowing, but impact likely to be modest

USD may nevertheless manage a further recovery

AUD likely to be resilient to employment data

GBP could rally if UK wage data fails to decline

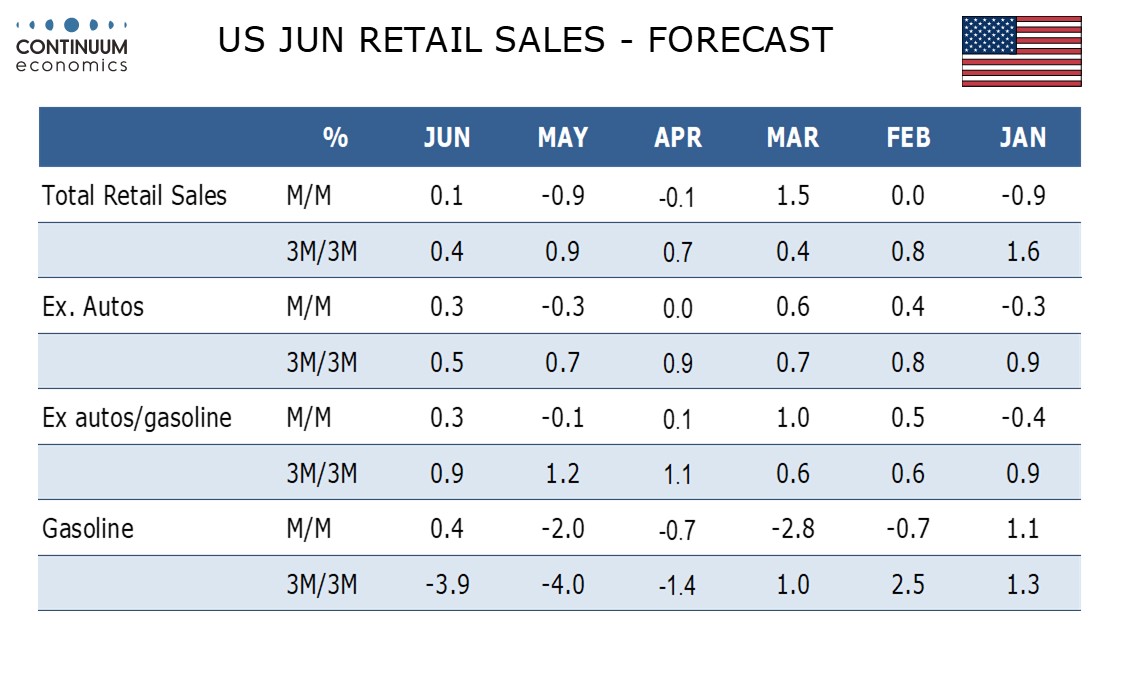

Thursday sees data from across the globe. The US retail sales data will garner the most focus. We expect a 0.1% increase in June retail sales to follow two straight declines, with a 0.3% increase ex autos that will reverse a 0.3% May decline. Ex autos and gasoline, we also expect a 0.3% increase, after a 0.1% May decline that followed a 0.1% April increase. Our forecasts are in line with consensus, and suggests a slowing of the underlying trend after a strong Q1. However, the data are of limited significance in that the strength of retail sales in Q1 wasn’t really reflected in strong consumer spending overall. The softer tone to US yields on Thursday after the weaker PPI data may continue on the back of the retail sales data, but there will also be interest in the usual Thursday jobless claims data and the Philadelphia Fed survey.

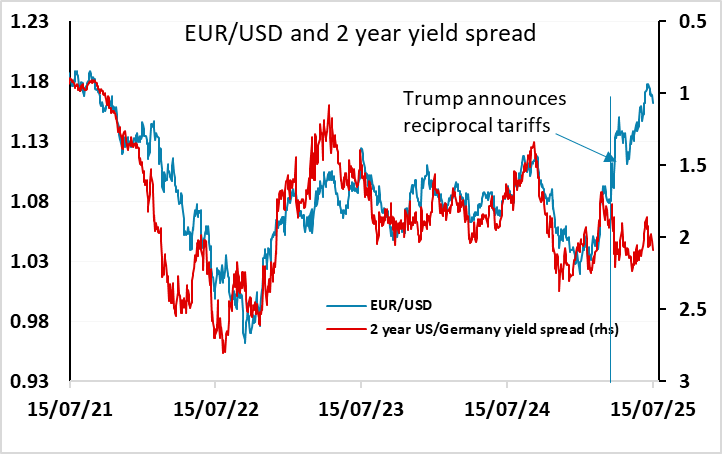

Despite the decline in US yields after the PPI data, the USD gained ground against the EUR and the other riskier currencies on Wednesday, at least until the report that Trump had asked Republican lawmakers whether he should fire Fed Chair Powell. The rationale for USD strength was not clear, but it may reflect some rethinking of the break with the yield spread correlation seen after the reciprocal tariff announcement in early April. If the market is taking the view that the tariffs are having much less impact than anticipated, there is less reason for a sea change in the behaviour of the USD. The move may also be seen as a simple technical correction after the extended USD decline from early April. At this stage, with the size and impact of tariffs still very uncertain, we wouldn’t look for a major USD recovery, but even a modest correction could see a move to the low 1.15s in EUR/USD, assuming there is no action on Powell which would certainly be very USD negative.

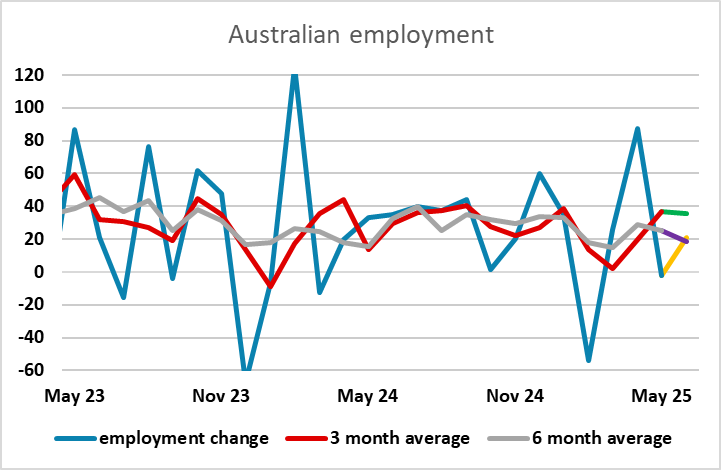

Ahead of the US data there is employment data from Australia. While the series has been choppy the underlying employment trend has been fairly stable at around 30k a month. The consensus of a 21k rise in employment in June would maintain that trend, so shouldn’t see any major AUD reaction. However, we continue to see some AUD upside risks and expect an eventual break to the upside of the 0.64-0.66 range.

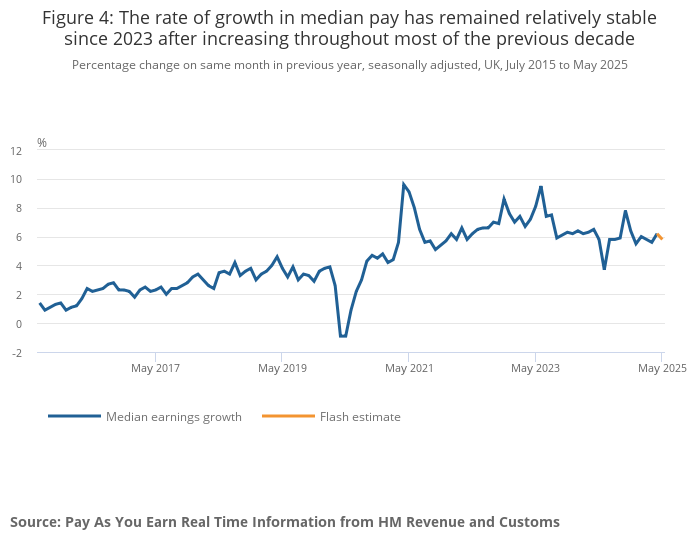

In Europe, the UK labour market data will be a focus, with the market anticipating a further slowing in wage growth and employment growth, with the more up to date HMRC statistics increasingly more of a focus than the ONS data. After Wednesday’s stronger than expected CPI data, any strength in the earnings data could be expected to boost GBP, which didn’t manage to hold onto the initial gains after the CPI numbers.