FX Daily Strategy: N America, June 18th

GBP edges up after CPI

SEK falls on Riksbank cut

USD to hold steady through FOMC

JPY weakness reaching extremes with risk premia likely close to lows

GBP edges up after CPI

SEK falls on Riksbank cut

USD to hold steady through FOMC

JPY weakness reaching extremes with risk premia likely close to lows

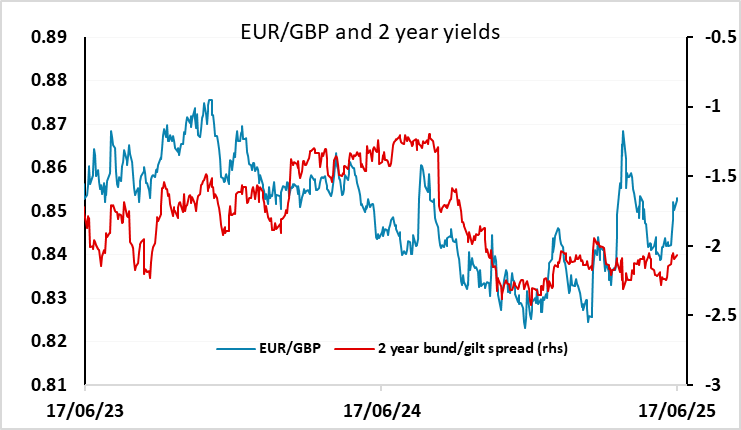

EUR/GBP has fallen around 10 pips in response to the UK CPI data which was very marginally on the strong side of consensus. While the 0.2% m/m gain in both headline and core was in line with expectations, the headline y/y rate fell slightly less than expected, dipping to 3.4% rather than the expected 3.3%. In practice, the data is in line with consensus, but EUR/GBP had moved higher in the last week since the weak labour market data and remains elevated relative to the movements in yield spreads we have seen. This data makes a rate cut from the BoE tomorrow even more of a longshot than it was, and should consequently limit the enthusiasm of the GBP bears to go into the meeting short GBP. The GBP recovery could therefore extend a little further, provided risk sentiment holds up through the day.

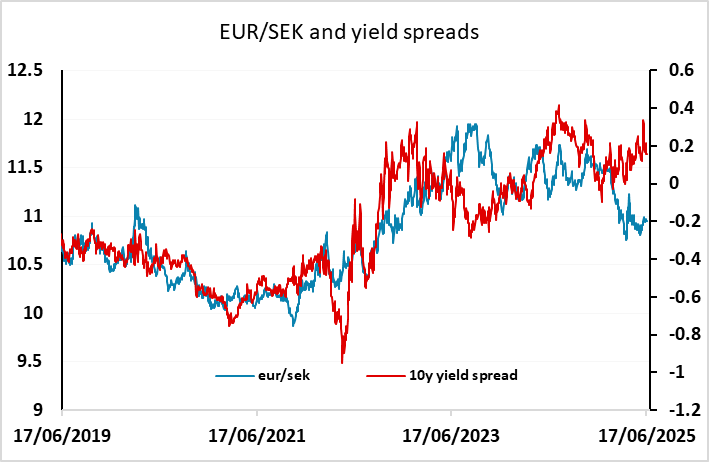

The Riksbank cut the policy rate 25bps as most expected, and suggested that there may be scope for further cuts this year. As it stands, there is a further 20bps of easing priced into the curve by the end of the year, so there may yet be scope to price in some more. The Riksbank cut their growth forecast for 2025 to 1.2% from 1.9%, saying the economy had lost momentum and was being hampered by tariffs and geopolitical conflicts. EUR/SEK has moved up 4 figures to 11.01 and we see scope for further gains from here as the SEK has outperformed yield spread moves in recent months. This made some sense when the Swedish economy was seen to be accelerating and the European equity market was on the front foot, as the SEK often leads the way in positive European growth cycles. But if a slowdown is underway and rates are being cut further, there may now be scope for the SEK to fall back more in line with the level suggested by yield spreads, which means scope for EUR/SEK well above 11.

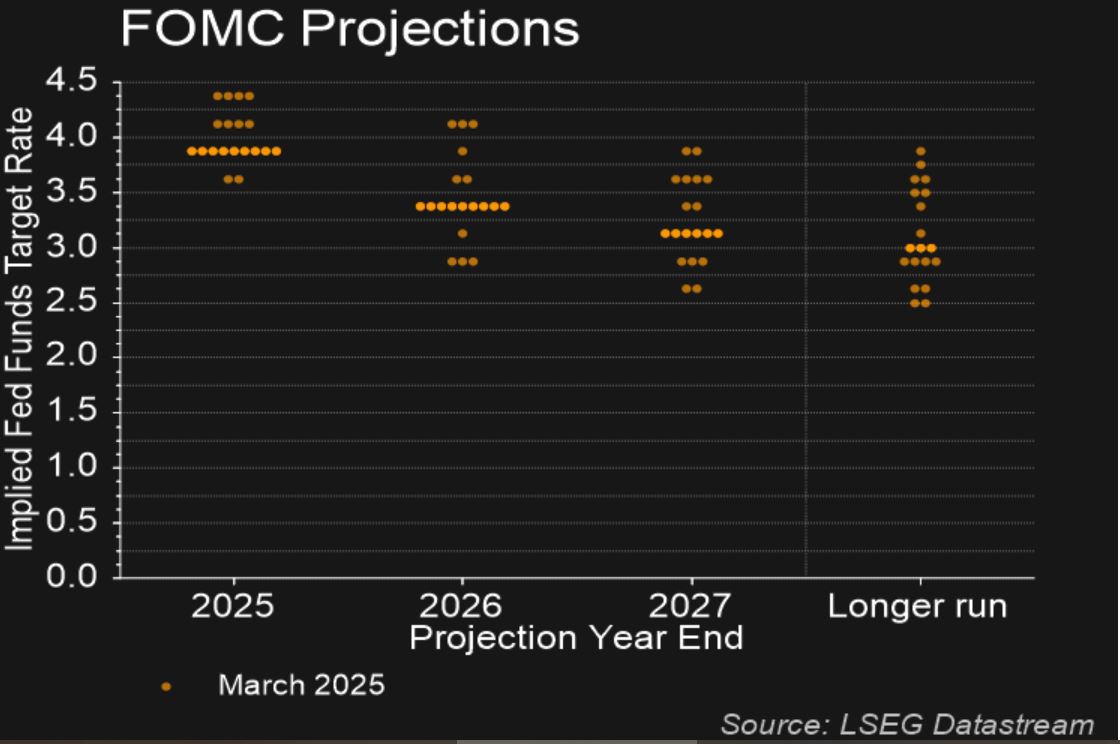

The FOMC decision will be the main US focus on Wednesday, although there is no real doubt that the Fed will leave rates unchanged. We expect only marginal changes to May’s statement and the Fed’s median forecasts from March, with no change at all in the median dots on rates. Chairman Powell at the press conference may welcome recent signals on inflation, but given uncertainty over tariffs, will state more information is needed before easing. As it stands, the market is pricing a 25bp Fed cut in either September or October, and the most that can really be expected from the meeting is for the market to be pushed to one or other of these. Inasmuch as the inflation data have been marginally on the soft side, the bias may be towards the cut being brought forward towards September. Even so, we wouldn’t expect any notable USD impact, with EUR/USD in particular quite in sensitive to movements in yields spreads of late. For the moment, with geopolitics having largely usurped tariffs as the main news and main focus of the US administration, economic news looks likely to play second fiddle. But even the Middle East news hasn’t tended to have a sustained market impact, so in the absence of more news on tariffs, broad USD stability looks likely to be the order of the day.

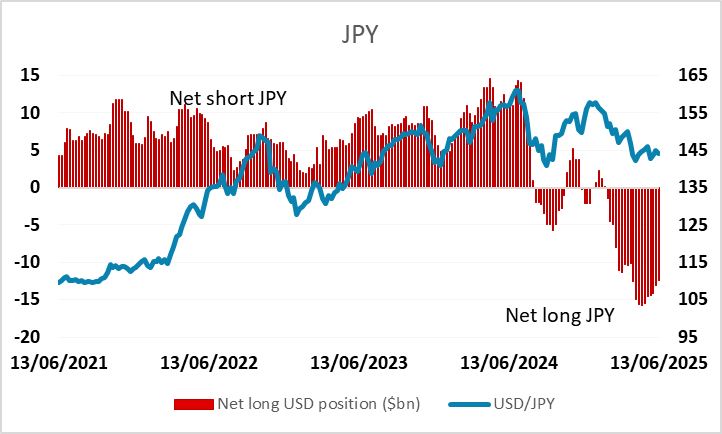

While we don’t see a big general move in the USD, there is scope for moves on the crosses, driven by risk sentiment. The JPY has been under pressure for some weeks, in part no doubt due to speculative positioning, which has been long JPY for some time according to the CFTC data, but mainly because of the resilience of risk appetite in the face of both tariff and geopolitical threats. But we see very limited scope for further equity market gains in the absence of a significant decline in yields, so JPY risks should now be shifting to the upside.

CFTC data on speculative USD/JPY positioning