EUR, JPY flows: Squeeze on long JPY positions

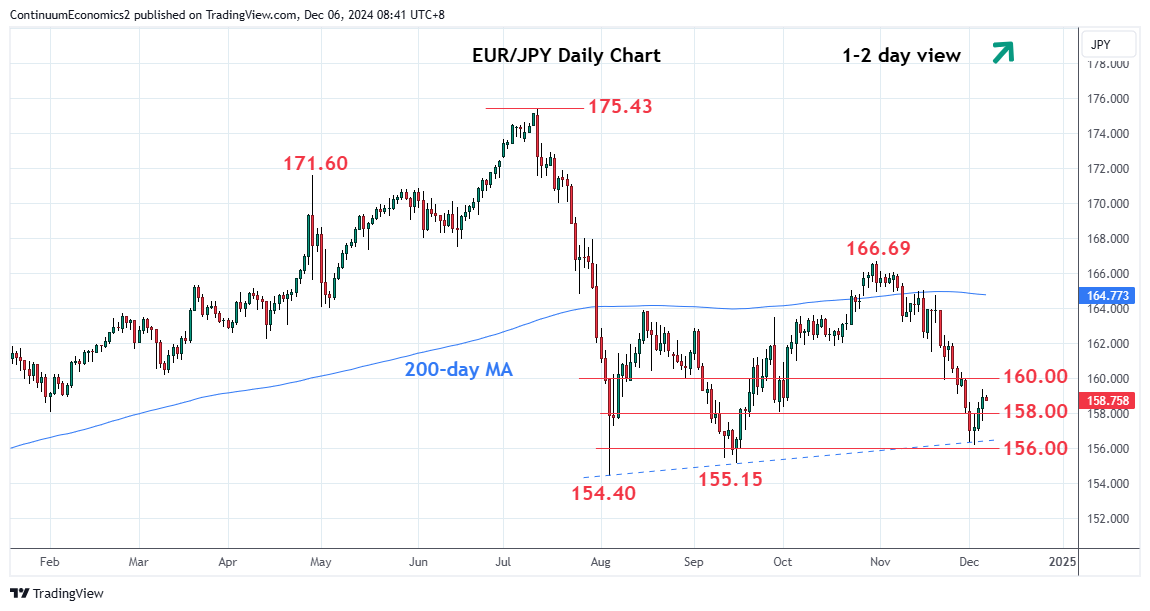

EUR/JPY recovering but 160 likely to be toppish

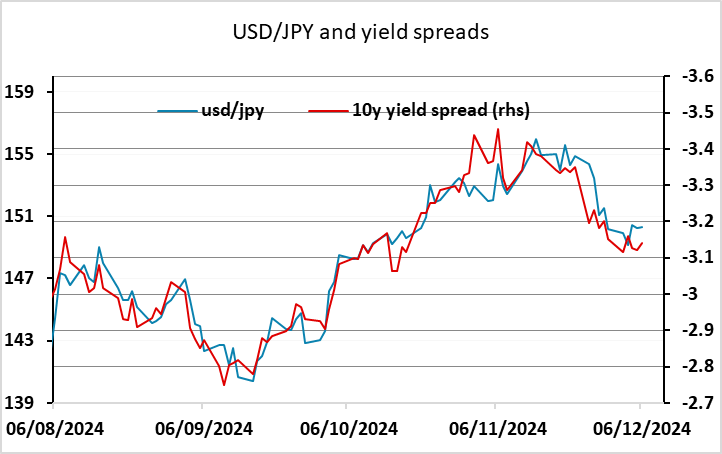

We’re seeing a modest squeeze on long JPY positions in this morning’s European trading, particularly on the crosses, with EUR/JPY testing back towards yesterday’s highs. There isn’t much case for JPY weakness based on the movement we have seen in yield spreads, but EUR/JPY has fallen sharply in the past couple of weeks, and with the French government collapse now behind us, there is scope for some lightening of positions ahead of the US employment data.

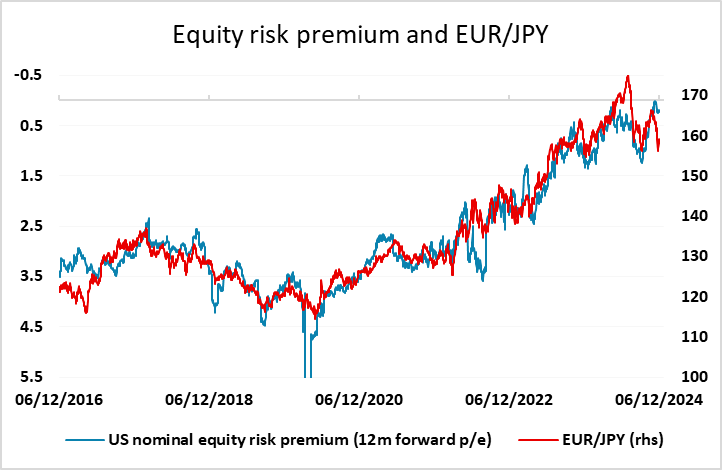

The EUR/JPY correlation with US equity risk premia, which has held up well in recent years, has started to break down with the EUR/JPY decline in the last few weeks, but if equities stay firm it may limit the enthusiasm of the JPY bulls. The JPY is also likely more vulnerable in the short run to a strong US employment report. Technically, there may be a little further to go in the correction, with some short term target levels near 160, but we would regard levels near 160 as a medium term selling area.