Sweden Riksbank Preview (Feb 1) Clearly Improving Inflation Picture Accepted?

It is ever clearer that the Riksbank has finished its hiking, this borne out by the unchanged policy decision last month and by the same decision due at policy verdict due on Feb1. The question now turns to policy easing. Recent data have continued to be been mixed, with slightly perkier tones to the real economy backdrop, largely due to firm exports, something that has warranted a slight upgrade to our GDP outlook, albeit still seeing a second successive drop in GDP this year. But both the much weaker underlying inflation picture (Figure 1) and what may be growing Board concerns about financial stability risks inter-related with growing weakness in bank lending and deposits have argued for the policy rate staying at the 4.0% level it rose to in September. Indeed, they argue for an easing in policy, something we think may occur in by the next quarter, this made all the more possible by the more frequent Board meetings that the Riksbank Board has reverted to.

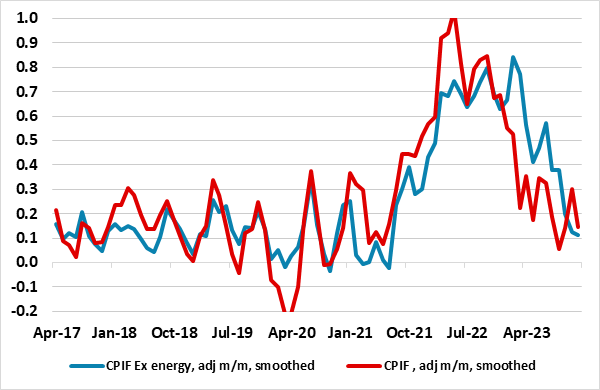

Figure 1: Inflation Pressures Slumping?

Source: Stats Sweden with seasonal adjustment made by CE and smoothed is 3 mth mov avg

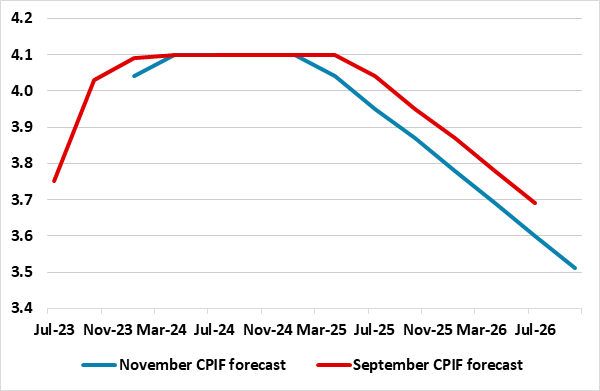

Notably, the Riksbank is not formally ruling out a further hike but still predicts that on current policy inflation will return to target and stay there in the latter part of its 2-3 year forecast horizon, albeit with some volatility due to energy prices. After, an unprecedented 400 bp cumulative rate rises seen in 19 months, the Riksbank is not suggesting any near-term policy reversal but did brought forward slightly its anticipated first easing (Figure 2) to early next year. We think instead that rate cuts may not only emerge well before mid-2024 but that around 100 bp of such easing is in the offing this year, half by summer. This reflects the even more sizeable output gap the Riksbank is anticipating persisting out to 2026, embracing a cumulative near-2 ppt GDP drop by mid-2024, this partly responsible for the already slumping price pressure picture. It is likely however, that the Riksbank will echo other DM central banks in playing down the likelihood of easing as early as we and markets envisage

A Change in Meeting Scheduling

The number of Riksbank monetary policy Board meetings has varied over time. However, the Board now sees a need to increase the number of ordinary monetary policy meetings to eight per year from the previous five. The rationale is to make it easier for the Riksbank to adapt monetary policy more rapidly to the prevailing situation and communicate a coherent view on economic developments more often. Rather than at every meeting, only at four of the eight monetary policy meetings, will there now be a Monetary Policy Report with forecasts including an interest rate path will be published. No new forecasts will be published at the other four meetings and this includes the looming one set to give its verdict on Feb 1 where a more limited monetary policy update will instead be provided. However, the Board will be clearly reassessing the economic outlook!

Plunging Price Pressures?

Regardless, the Riksbank inflation outlook retained a much more explicit admission that policy is restrictive, as the Riksbank has taken policy to a terminal rate of around 4% it signaled in June and that this will be adhered to well into 2025. But while this outlook encompasses particularly weak domestic demand, it skates over some of the reason for this as well as the increasing recent repercussions in the form of a broader fall in inflation. Admittedly, the Riksbank has begun to accept an improving inflation picture and outlook, noting that while ‘inflation has fallen and inflationary pressures have clearly eased’.

Driving this change of view have been recent CPI data. This did see the y/y rate slump with the CPIF almost back down to target, albeit mainly due to base effects which will reverse in the next set of numbers. Amid these distortions, a clearer perspective is provided by seasonally adjusted m/m readings (computed by CE) for both overall CPIF and the CPIF ex-energy. Indeed, such adjusted data show a very much softer profile of late, even excluding energy with the CPIF measure consistent with m/m outcomes averaging around 0.1% in the last few months. Thus, from our standpoint, the risks may be that inflation returns to target earlier and possibly undershoots target than the end-year schedule thought by the Riksbank.

Financial Stability Considerations

We would also suggest that the bond sales the Riksbank is carrying out (and apparently is considering ramping up) in order to reduce its balance sheet are also having an effect in buttressing the official policy hikes, they helping explain the marked drop in bank credit and deposits now occurring. This issue has not been something that the Riksbank has overtly acknowledged but that may be changing. The recent Riksbank Financial Stability Report very much stressed that higher interest rates are squeezing Swedish property companies, to which domestic banks are very exposed so that while the Swedish financial system is functioning well overall risks remain elevated. Moreover, it is clear that the Riksbank is aware of fragilities in the banking system, not least after last spring’s banking problems in the US and Switzerland which showed that banks can lose their deposits much faster than previously thought. It is aware how important it is that banks maintain credit supply and may now be considering negative growth rates for deposits and lending may be at least partly a result of supply problems as well as weak demand.

Figure 2: How the Riksbank Sees the Policy Outlook

Source: Riksbank

In perspective, we continue to think that the Riksbank is ignoring the broader impact of its policy tightening. After over a year of interest rate hikes, monetary policy is now more explicitly assessed to be contractionary and the Board underscores that it will continue regularly to evaluate how the economy responds to the policy rate hikes already implemented and will adjust monetary policy accordingly. In conclusion, we think hiking is not just paused but finished and we still see rate cuts starting from as soon as the next quarter.