FX Daily Strategy: N America, December 16th

US employment data likely mixed and of limited impact

JPY and AUD remain the most attractive G10 currencies

PMIs favour GBP

UK labour market data mixed

US employment data likely mixed and of limited impact

JPY and AUD remain the most attractive G10 currencies

PMIs favour GBP

UK labour market data mixed

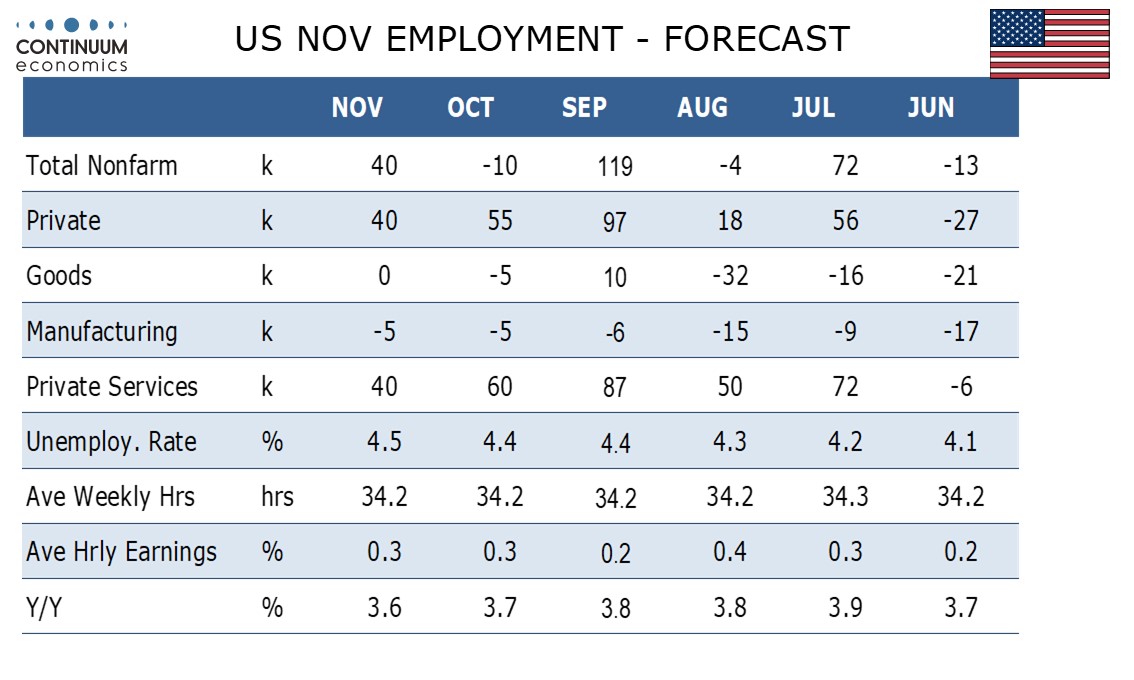

Tuesday sees the release of both the October and November US employment reports. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector. October is likely to see a sharp decline in Federal government workers as DOGE layoffs see the 6 months of salary that was provided after the layoffs run out. With these payroll releases being delayed, we have a little more information than usual to use in the forecasts. Our forecasts are stronger than ADP’s private sector estimates, which saw a 47k increase in October and a 31k decline in November, and also those of Revelio Labs, which saw overall payrolls down by 9k in November after a 15.5k decline in October. Revelio’s data for the private sector increased by 8k in October but fell by 19.4k in November. Still, the message is that November slowed from October in the private sector.

Our forecasts are broadly in line with the market consensus, but the reaction is unlikely to be dramatic unless we are some way away from market expectations, in part because the market has already formed an opinion on the underlying picture from the private sector data. The USD was a little softer in general on Monday, but the case for losses only looks clear against the AUD and JPY, with the EUR already outperforming spreads. The employment data, and the equity market reaction, may indicate whether the AUD or JPY should be favoured. The slightly softer tone to equities and the increased expectation of a BoJ tightening this week suggests the JPY may be better placed.

We also have US retail sales, housing starts and PMI data, with the retail sales data likely to be the most watched for the US. We expect a 0.4% decline in October retail sales in September, with autos set to be the main negative after the expiry of a tax credit for electrical vehicle purchases. Elsewhere however we expect subdued data, with a 0.1% increase ex autos and a rise of 0.2% ex autos and gasoline. The consensus is somewhat more optimistic, so our forecasts provide a further reason to favour a weaker USD and a stronger JPY.

Better than expected UK PMI have pushed GBP higher on the day, with EUR/GBP dipping on the favourable comparison with the Eurozone. However, we would note that the UK PMIs have very limited correlation with official data, and would take the UK numbers with a large pinch of salt. The Eurozone numbers do tend to better resemble official data, so there is some case for a softer EUR. The weak UK HMRC earnings and employment data earlier also don’t argue for GBP strength, even though the official ONS data were a little less weak than expected, with the HMRC data being more up to date.