FX Daily Strategy: N America, May 16th

US data unlikely to move markets

Japanese GDP has little impact

AUD weakness looks overdone

US data unlikely to move markets

Japanese GDP has little impact

AUD weakness looks overdone

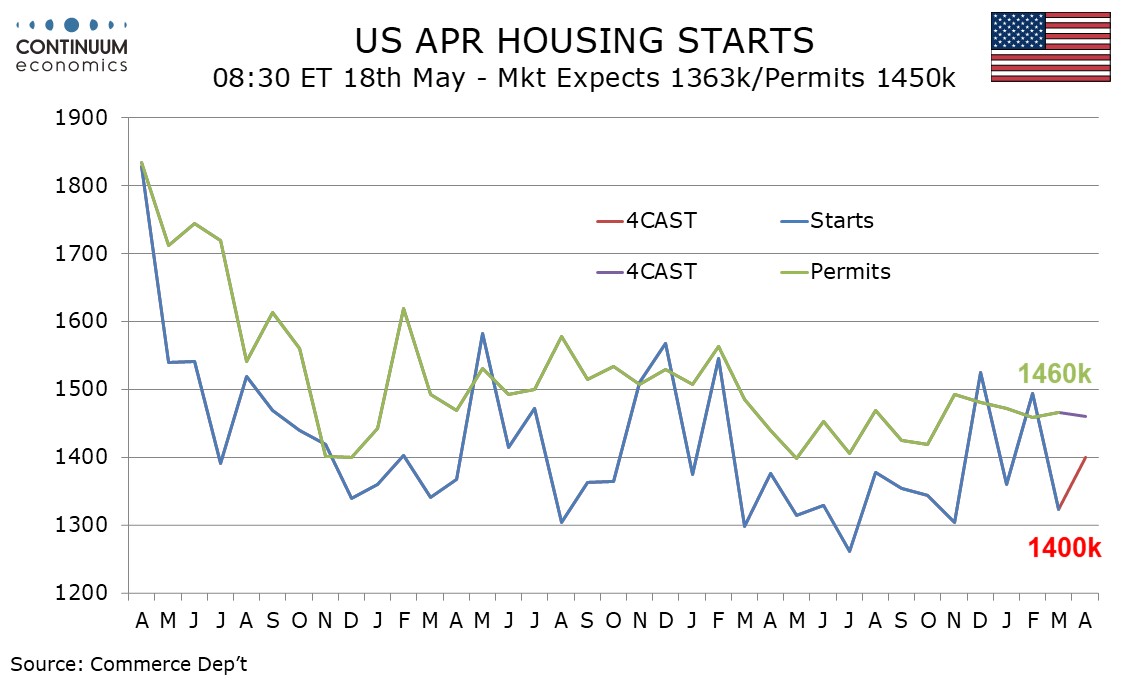

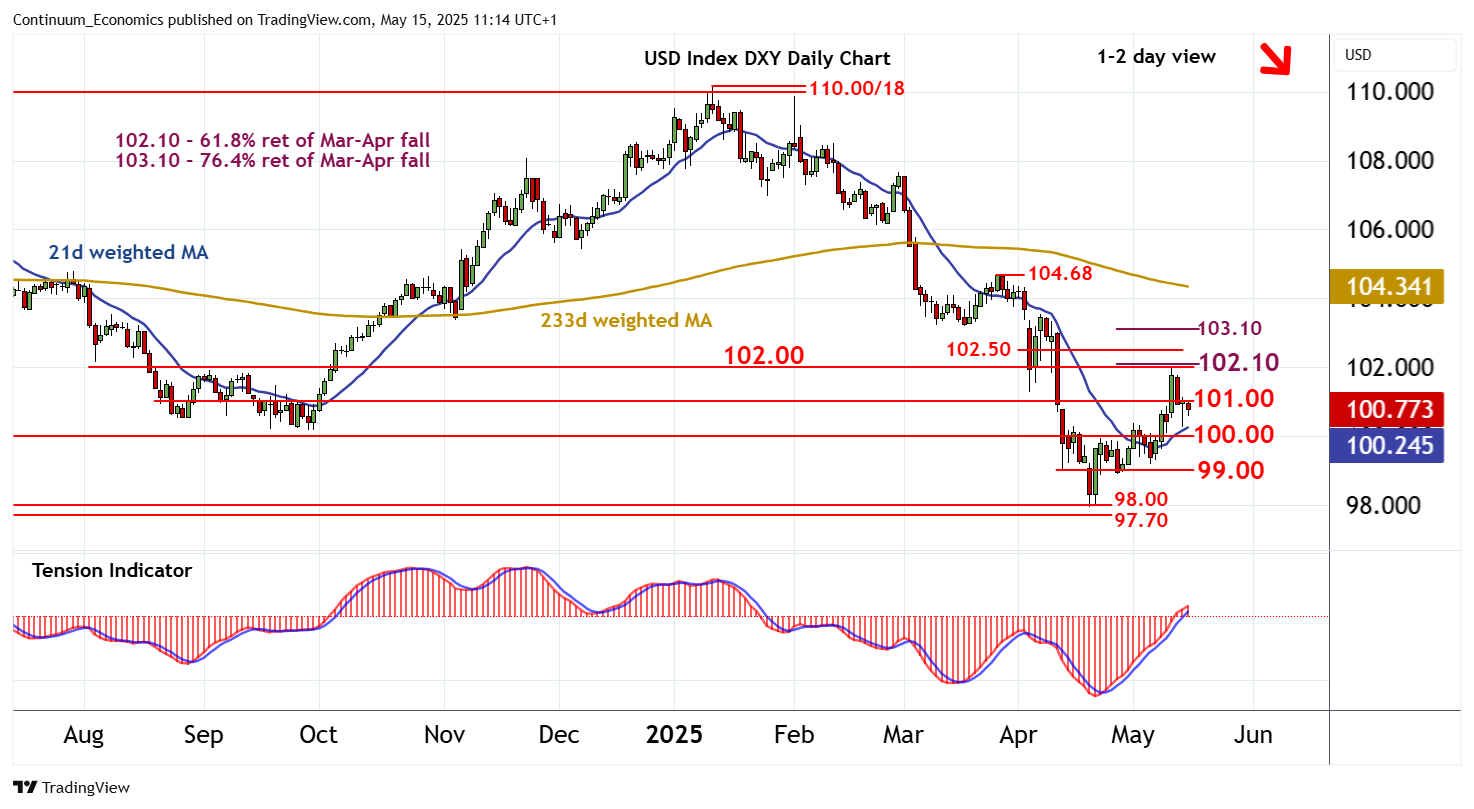

Friday is a relatively quiet calendar, with the April housing starts and May University of Michigan survey in the US, and Q1 GDP data from Japan. We expect April housing starts to rise by 5.7% to 1400k after a fall of 11.4% in March, while permits fall by 0.5% to 1460k after a 0.5% increase in March. While starts have been more volatile than permits in recent months, the trend continues to have little direction. Some recovery seems likely in the UMich survey, with inflation expectations also likely to decline, but neither report seems likely to have much market impact. At this stage the USD looks like stabilising close to current levels until we get more information on the impact that the tariffs are having on growth and inflation in the next couple of months.

Japanese GDP came in marginally weaker than expected at -0.2%, but there was no significant JPY impact, and the JPY continues to show a slightly firm tone now that the initial impact of the US/China tariff reduction has faded.

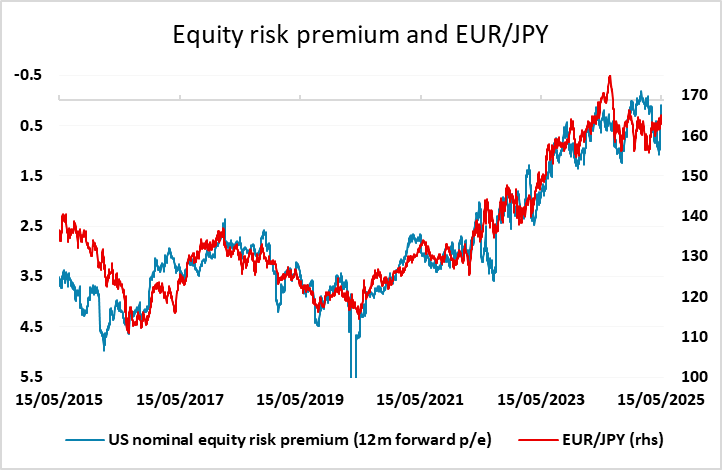

The JPY has managed a better performance in the last few days after sliding lower over the last month, helped by some softening of risk sentiment after the surge on the announcement of the reduction of US/China tariffs. We still see longer term upside scope for the JPY, as he current low level of US equity risk premia looks unsustainable in the longer run, and the positive correlation of the JPY with US risk premia is consequently likely to mean an extended JPY recovery medium term. But for now if US equities hold near current levels, as seems likely in the absence of further significant news, we would expect some stabilisation of the JPY near current levels.

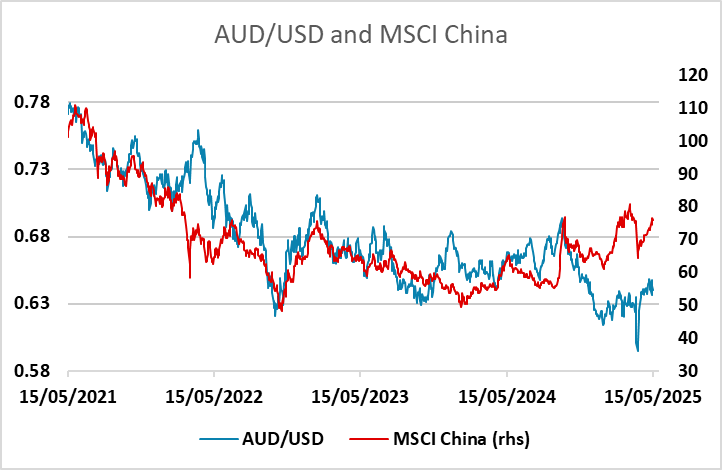

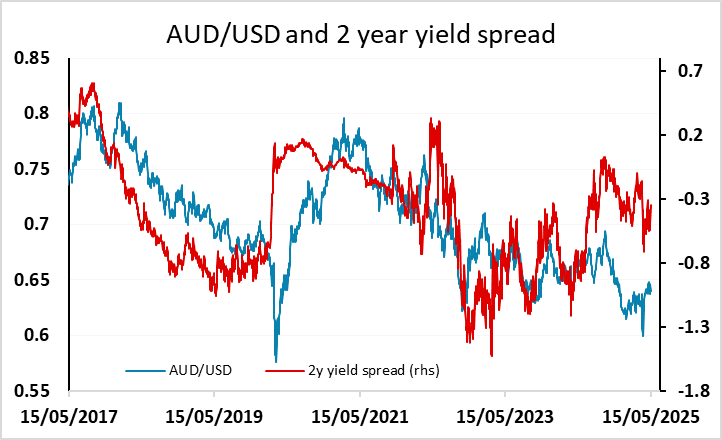

Most FX pairs look relatively stable, but it was notable on Thursday that AUD/USD fell back below 0.64 despite a very strong Australian employment report and relatively modest moves in equity and bonds markets. The AUD continues to look somewhat undervalued relatively to its usual relationship with yield spreads and equities, and the dip below 0.64 should prove a buying opportunity provided we don’t see equity markets move significantly lower near term.