GBP flows: GBP up small on better than expected GDP, but...

GBP gains modestly as November GDP rises more than expected. But underlying trend remains weak and GBP still looks vulnerable

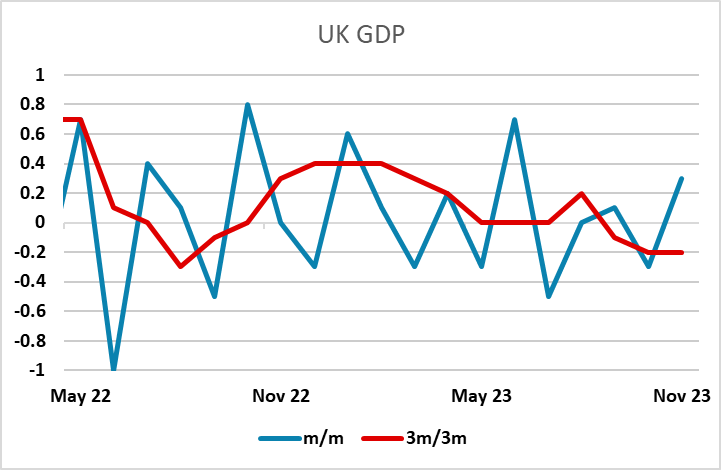

GBP is initially slightly firmer after November GDP came in at 0.3% - slightly above the 0.2% expected. However, the 3m/3m trend is still weak after October’s 0.3% decline, and while a flat quarter is likely, a flat December would only mean a flat quarter because of rounding. The trend appears to be declining, and while the market has seen some encouraging signs from stronger than expected UK services PMI in the last couple of months, we fear this may be a false dawn as the impact of higher interest rates will be increasingly negative in the coming months.

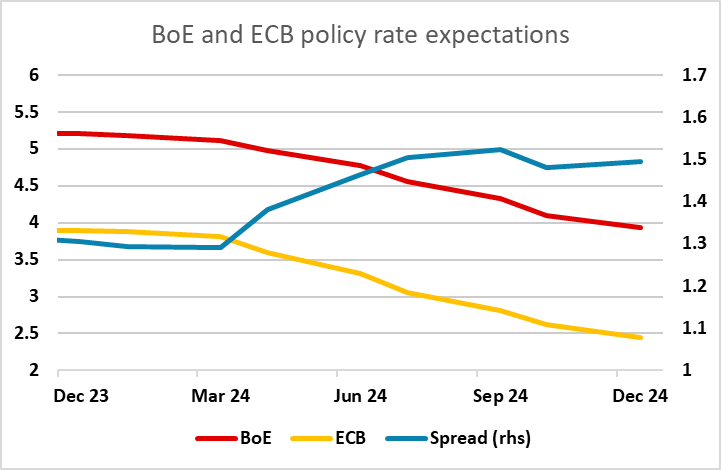

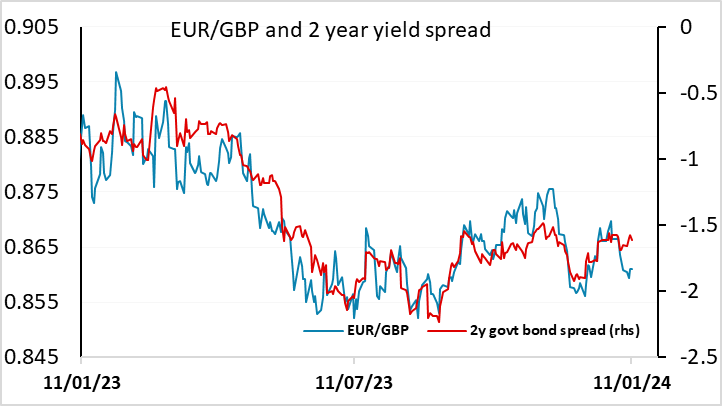

For GBP, we see little upside scope, as EUR/GBP is starting from a position that looks low relative to current short term yield spreads, and we also see more scope for UK yields to decline as UK data weakens, both because of the higher starting point and because the market currently prices a slower pace of BoE rate cuts. The stronger than expected monthly number will mean some initial GBP strength, but expect EUR/GBP to hold above 0.8550.