JPY flows: JPY weakness extends

JPY weakness extends on dovish comments from Ishiba against background of better regional risk sentiment

JPY weakness has remained the main theme overnight, with USD/JPY hitting its highest since August 20 on the back of the comments from PM Ishiba yesterday, indicating that now was not the time for more monetary tightening. While this is clearly a less hawkish stance than expected, the markets were never pricing in any significant tightening this year, and only had a 25bp rise in rates by the end of 2025 priced in. The immediate risk of tightening has been reduced marginally, with nothing now priced in for October, but there was less than 2bps priced in in any case, while there are now 5bps priced in for December, down from 7bps. There is still a 25bp hike priced in for end 2025. So the JPY weakness is about sentiment rather than actual moves in rate expectations, and has been helped in the last week or two by the recovery in risk sentiment in Asia as Chinese equities have rallied on the promises of Chinese stimulus.

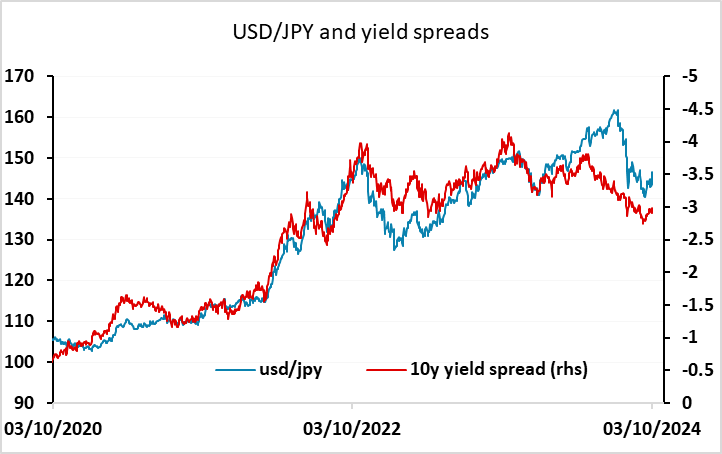

For now, it is hard to oppose the JPY’s downward momentum, particularly against the USD, which is seeing some general strength on the back of firm US data and rising Middle East tension. Nevertheless, yield spreads remain at levels that look more consistent with USD/JPY in the low 140s than the high 140s, and we would still regard JPY weakness as being corrective in the longer term scheme of things. But in the short run, a strong employment report could see a test up towards 150 and the 200-day moving average at 151. EUR/JPY is already close to the 200 day moving average near 164, so we less upside scope there, with any JPY weakness form here more likely to be USD driven.