FOMC Minutes from May 7 - Still concerned that inflation could prove persistent

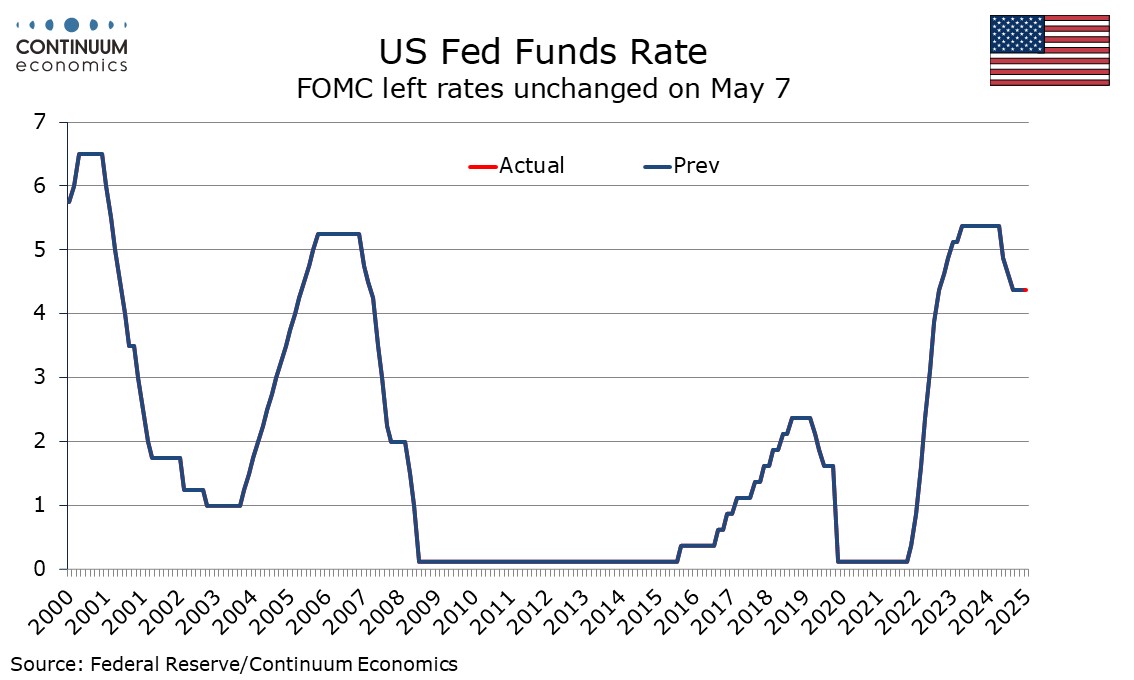

FOMC minutes from May 7 may be a little dated as tariffs on China have subsequently been reduced significantly, but there is no suggestion in any subsequent Fed commentary that the Fed is no longer concerned over the risks that the minutes outline. All participants judged that it was appropriate to leave policy unchanged and that the Fed was well positioned to wait for greater clarity.

The minutes clearly show that the decline in Q1 GDP was treated cautiously, with the surge in imports not appearing to be fully reflected in inventory and spending data. That almost all participants commented on the risk that inflation could be more persistent that expected, something that was also stressed in the previous minutes from March 19, suggests there will be no hurry to ease. They however also noted that the FOMC could face difficult tradeoffs under persistent inflation and weakening growth and employment outlooks. Labor market conditions were seen as roughly in balance and inflation as somewhat elevated.

The staff forecast for GDP was weaker than that in March and trade policies were expected to reduce potential GDP over the next few years. Unemployment was expected to rise above its natural rate by the end of this year and remain there through 2027. The inflation forecast was moved upwards, with tariffs expected to boost inflation markedly this year and to provide a smaller boost in 2026 before declining to 2% in 2027. Risks to activity were skewed to the downside with recession seen almost as likely as the downgraded baseline. Risks on inflation were seen balanced this year after an upward adjustment but thereafter risks were seen as skewed to the upside.

FOMC participants discussed the risks in some detail, considering risks on both sides and avoiding any clear conclusions, though in considering upside risks to growth and downside risks to activity a substantial list of worries was presented before moving on to factors that could mitigate the risks. Still, the risk that tariff-induced inflation could prove persistent seems to be the key concern.

The FOMC also considered its monetary policy framework, considering whether inflation risks have become more balanced compared to the pre-pandemic period when downside risks predominated. Participants noted a strategy of flexible average inflation targeting has diminished benefits in an environment with a substantial risk of large inflationary shocks or when risks of hitting the effective lower bound are less prominent. Participants indicated it would be appropriate to reconsider the average inflation targeting language. This was signaled by Chairman Powell in comments on May 15.