FX Daily Strategy: APAC, November 25th

September US data seems unlikely to significantly alter Fed intentions

Any further JPY weakness could attract intervention

GBP risks on the Budget look to be sharp losses or modest gains

AUD has potential to extend recovery in a more risk positive environment

September US data seems unlikely to significantly alter Fed intentions

Any further JPY weakness could attract intervention

GBP risks on the Budget look to be sharp losses or modest gains

AUD has potential to extend recovery in a more risk positive environment

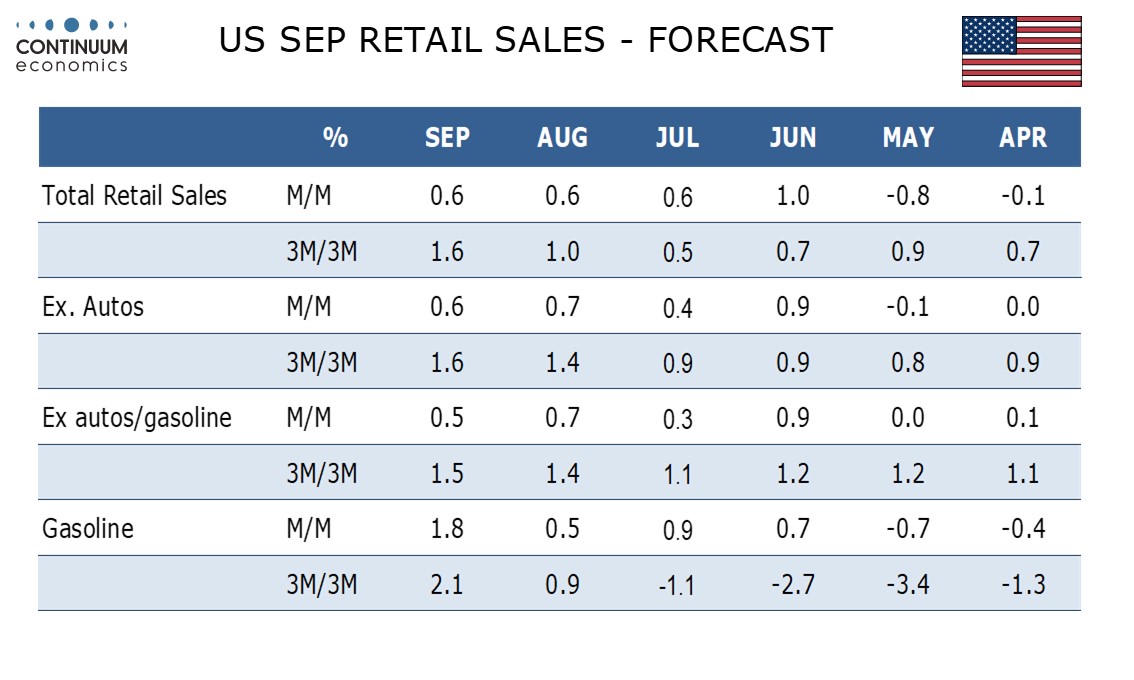

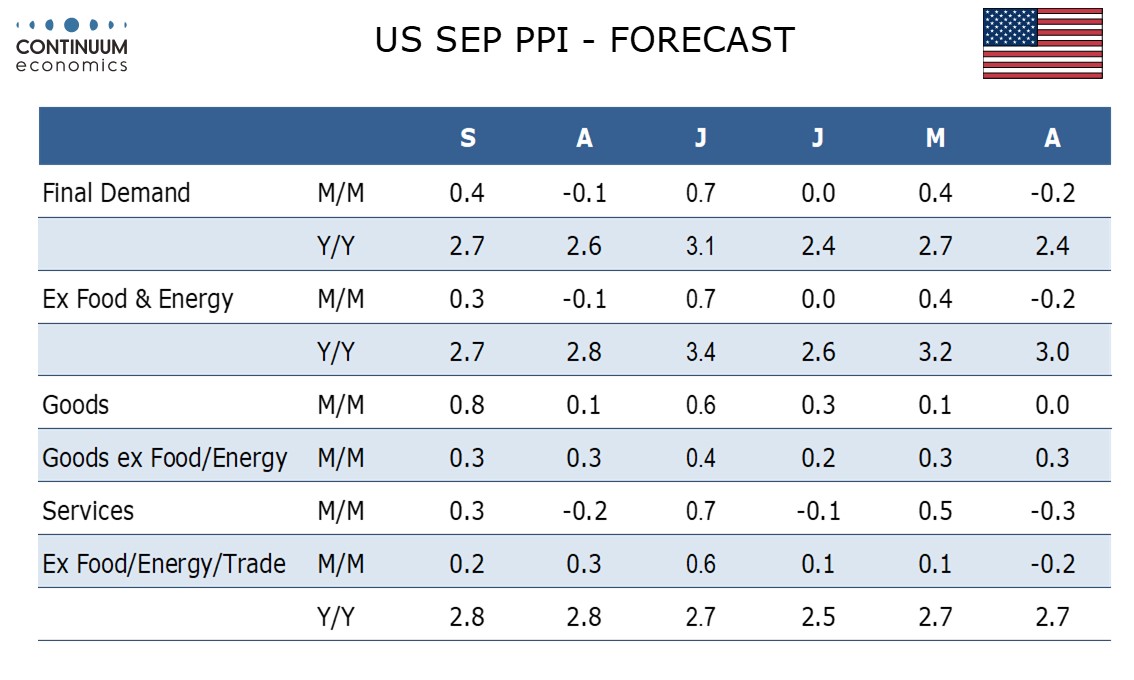

Delayed US data is starting to dribble out, with Tuesday seeing PPI and retail sales numbers for September. We expect September PPI to rise by 0.4% overall and 0.3% ex food and energy. Ex food, energy and trade we expect a moderate 0.2% increase after gains of 0.3% in August and 0.6% in July. We expect a third straight 0.6% increase in retail sales in September, with slightly over half of the increase coming in prices, leaving only moderate growth in real terms. We also expect 0.6% increase ex autos but a slightly weaker 0.5% increase ex autos and gasoline. Both our forecasts are slightly above consensus, but it seems unlikely that they will have any impact. While the Fed decision is a close call, and all the data might consequently have some impact, it’s hard to see Powell’s mind being made up by data from September, and it is looking as if it is essentially Powell’s call, as the declared hawks and doves on the FOMC are fairly evenly split. Still, at the margin our forecasts suggest upside risks for the USD.

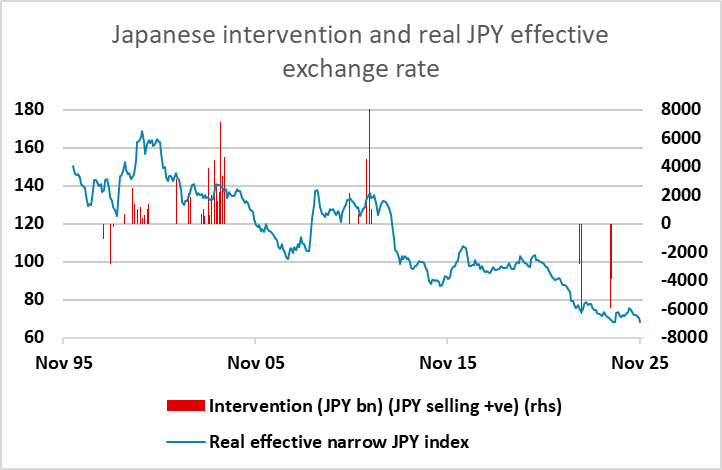

A more risk positive picture on Monday produced some renewed JPY weakness on the crosses, and makes the Friday JPY rally look even more like just a correction in the underlying downtrend. It still looks likely to be necessary for the Japanese authorities to get involved with FX intervention to halt the JPY decline. This could come as early as Tuesday if we see another risk positive day. While some don’t expect any action until or unless USD/JPY breaks above 160, we would expect the Japanese authorities to be more focused on the real trade-weighted JPY, which has already breached all time lows and provides ample reason for action if we see further JPY weakness.

GBP will also come more into focus on Tuesday ahead of Wednesday’s Budget, with the latest leaks suggesting measures may be less contractionary than previously thought, with measures that are likely to be redistributive towards those on lower incomes. It is unclear how this will be received in the markets. Such measures may be perceived to be a less contractionary way to make net savings, as lower income households have a higher propensity to consume, but the markets may also be unhappy if the measures are perceived to be damaging for incentives or insufficiently robust to shore up the public finances. It’s hard to see a big GBP rise on the news, but the most likely outcome may be small GBP gains if the measures are seen to effectively plug the £20bn+ perceived fiscal hole. However, there are risks of sharper GBP losses if the measures are seen as either too harsh or too easy.

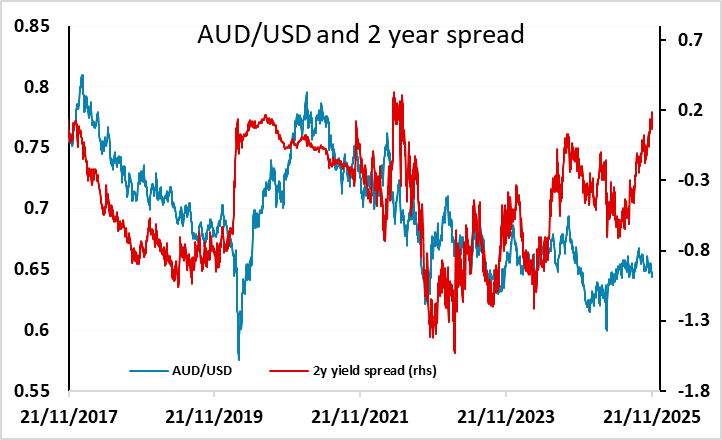

While the AUD started the day quite soft on Monday, it rallied a little through the session helped by the more risk positive tone, and still looks to offer very good value base don the historic relationship with yield spreads. It remains vulnerable to risk downturns, but optimism around Fed easing and a possible Ukraine peace deal suggest we are likely to see some stabilisation in risk sentiment after a couple of weeks of weakness which should allow the AUD to regain some lost ground.