FX Daily Strategy: N America, March 25th

USD and equity recovery looks partly technical

Conference Board consumer confidence could determine if rally extends on Tuesday

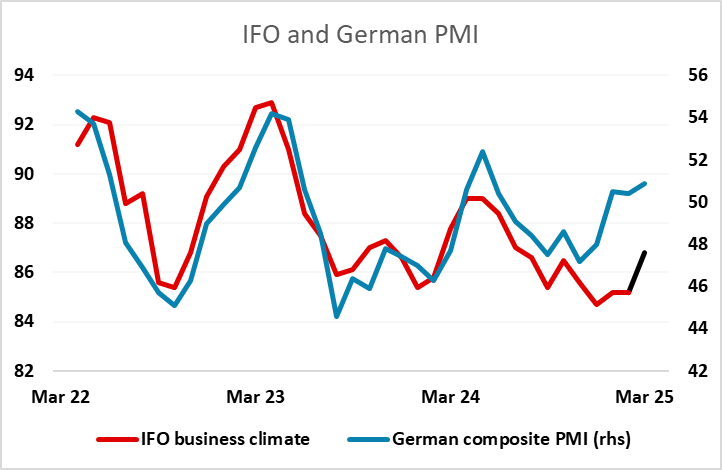

EUR will be focused on IFO, which looks low relative to the PMI

JPY weakness looks excessive but unlikely to turn while equities gain

USD and equity recovery looks partly technical

Conference Board consumer confidence could determine if rally extends on Tuesday

EUR will be focused on IFO, which looks low relative to the PMI

JPY weakness looks excessive but unlikely to turn while equities gain

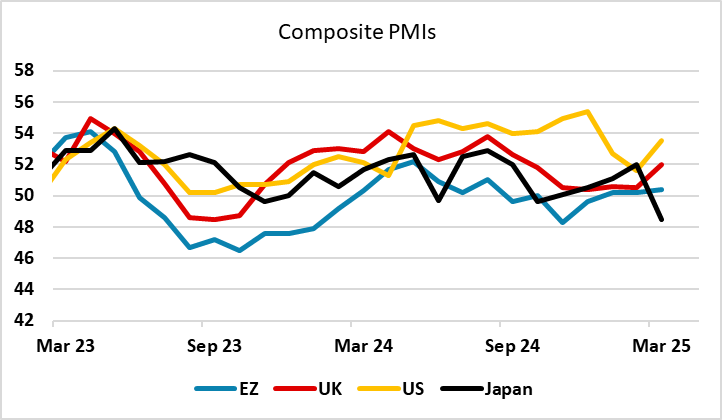

Monday saw a strong US equity market rally, driven by a combination of a strong recovery in the US PMI services index and some optimism that the Trump tariffs might be a little less aggressive than previously feared. In truth, neither of these provides a particularly strong rationale for a US equity (or USD) recovery. The March services PMI only partly reversed the decline seen in January and February, and the manufacturing PMI fell back sharpy after the gains seen in the previous two months. On tariffs, it remains very unclear what is going to be imposed and when, but significant tariffs have already been imposed, and delays only increase uncertainty, which is in any case likely to weigh on growth. Of course, the equity decline seen since the mid-February high was significant, and was due something of a technical correction, but it’s still very hard to argue that the equity market is anything other than very expensive at current levels. We wouldn’t expect the equity rally to gain much more steam from here unless we get something much more clearly positive on tariffs or economic performance.

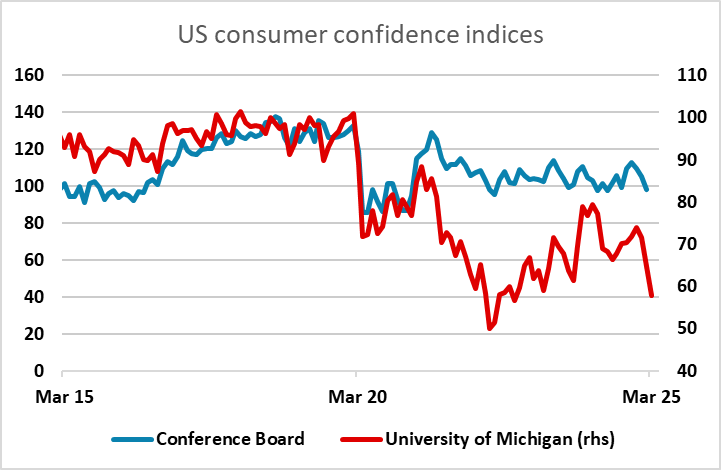

There isn’t anything of major significance out of the US on Tuesday, but there will be interest in the Conference Board consumer confidence data, which has dipped lower in the last couple of months. The Conference Board measure has been stronger than the University of Michigan measure, as it is more skewed towards the labour market, which so far still seems quite robust. But the declines of the last two months have taken it to near the post-pandemic lows. The consensus forecast is quite weak, suggesting a decline to the lowest level since January 2021. Such a weak number could be expected to reverse some of Monday’s equity and USD gains, but we would expect something a little less weak, even if we do see a further decline.

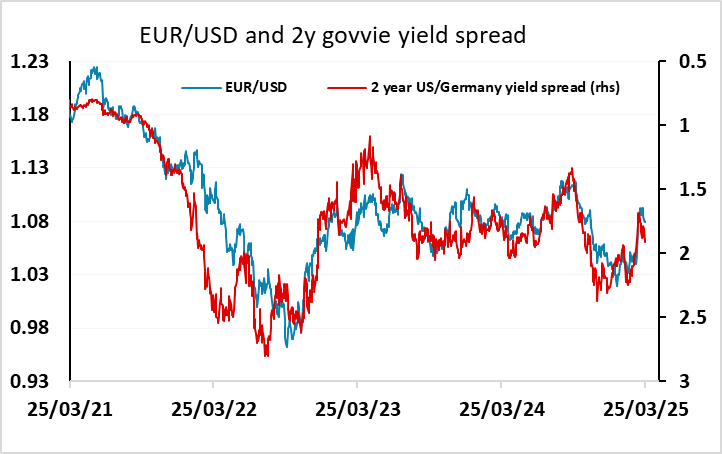

As it stands, the rise in US yields on Monday suggests there may still be some downside for EUR/USD, based on the strong correlation with 2 year yield spreads we have seen in recent years. The German IFO survey was essentially in line with consensus, with the main business climate indicator rising but still a little below the level suggested by the recent rise in the PMI index. Recent spread widening in favour of the USD still suggests some marginal downside risks for EUR/USD, but progress sub-1.08 will likely be slow.

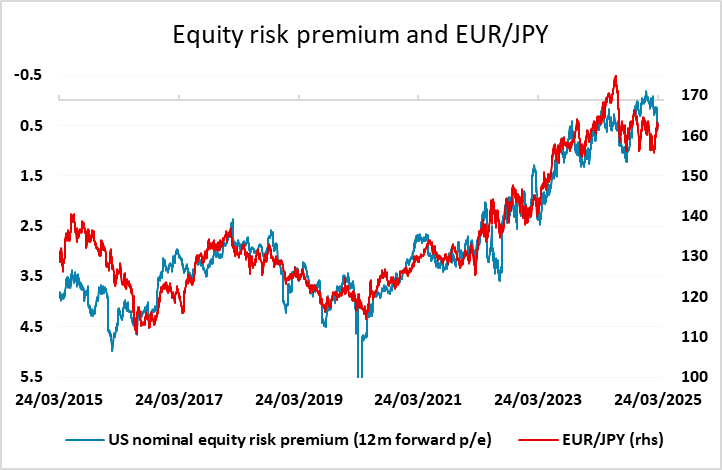

The JPY has been the main victim of the USD rally in the last couple of week, even though yield spreads still suggest USD/JPY should be closer to 140 than 150. The market looks to be being driven more by equity sentiment than yield spreads at the moment, with EUR/JPY broadly consistent with the long term correlation with equity risk premia. A turn lower in USD JPY will likely not be seen until or unless we see a turn lower in equities, but long term risks are clearly on the downside.