FX Daily Strategy: Asia, August 20th

Some downside risks to Canada CPI

USD/CAD nevertheless biased lower on positioning

USD under general pressure

Some downside risks to Canada CPI

USD/CAD nevertheless biased lower on positioning

USD under general pressure

Tuesday looks like being another relatively quiet day, with just Canadian CPI in the way of significant data. Even this looks unlikely to move a market that is 100% priced for a 25bp rate cut on September 4. We expect CPI to rise by 0.2% in the month both overall and ex food and energy, the latter in line with June’s outcome and three of the last four months. We expect energy to be neutral after declining in May and June. This is somewhat weaker than the market consensus, which looks for a 0.4% headline increase. But it won’t be enough to get the market thinking about a 50bp BoC cut on September 4th, and any increase in rate cut expectations is likely to be focused more on 2025 and 2026 than this year. Even then, with nearly 200bps of rate cuts priced in by the end of 2025, it’s hard to see a big decline in short term CAD yields.

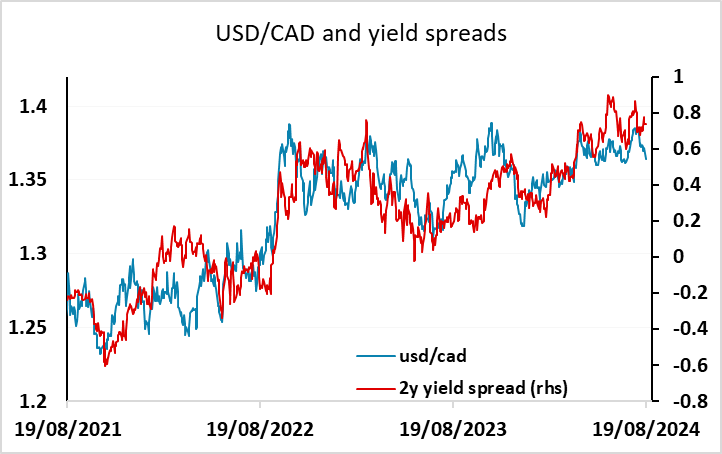

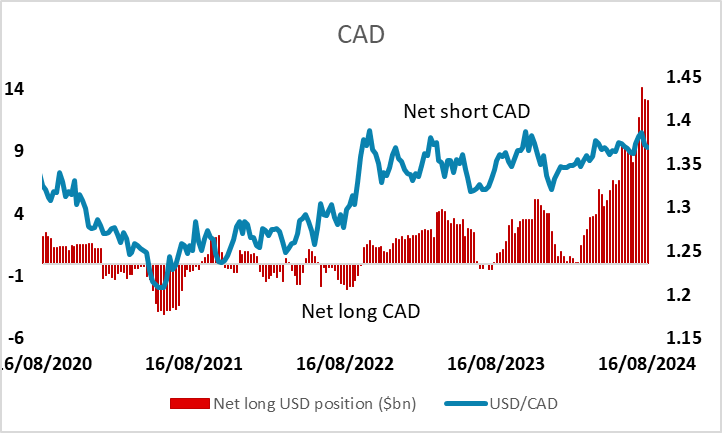

As it stands, the CAD has somewhat outperformed yield spreads in the last couple of weeks, helped by the generally more negative USD tone. But with little further downside for CAD yields, there may be more CAD upside scope on stronger CPI data than there is downside on weaker data. Positioning also looks to be a factor, with the CFTC data still showing a huge speculative net short CAD position outstanding, while positioning is now quite modest in other USD pairs. Longer term, we would still expect USD/CAD to progress towards 1.30, so we may continue to see some mild downside pressure on neutral data.

In general, Monday saw some USD weakness, particularly against the JPY and AUD. There is some anticipation of dovish Fed comments coming out of the Jackson Hole symposium this week, and maybe also some worries about potential negative reactions to the benchmark revisions to non-farm payrolls, which are expected to significantly reduce estimates. But it will take a lot to convince the Fed to ease more than 25bps in September, and with the market already pricing 31bps of easing, and comments from Powell may push towards higher rather than lower US yields. Nevertheless, ahead of Jackson Hole the downward pressure on the USD might extend.