FX Daily Strategy: APAC, Sep 25th

US GDP data could take the edge off USD strength

USD gains not driven by higher US yields

JPY weakness remains a major feature

SNB could protest CHF strength

US GDP data could take the edge off USD strength

USD gains not driven by higher US yields

JPY weakness remains a major feature

SNB could protest CHF strength

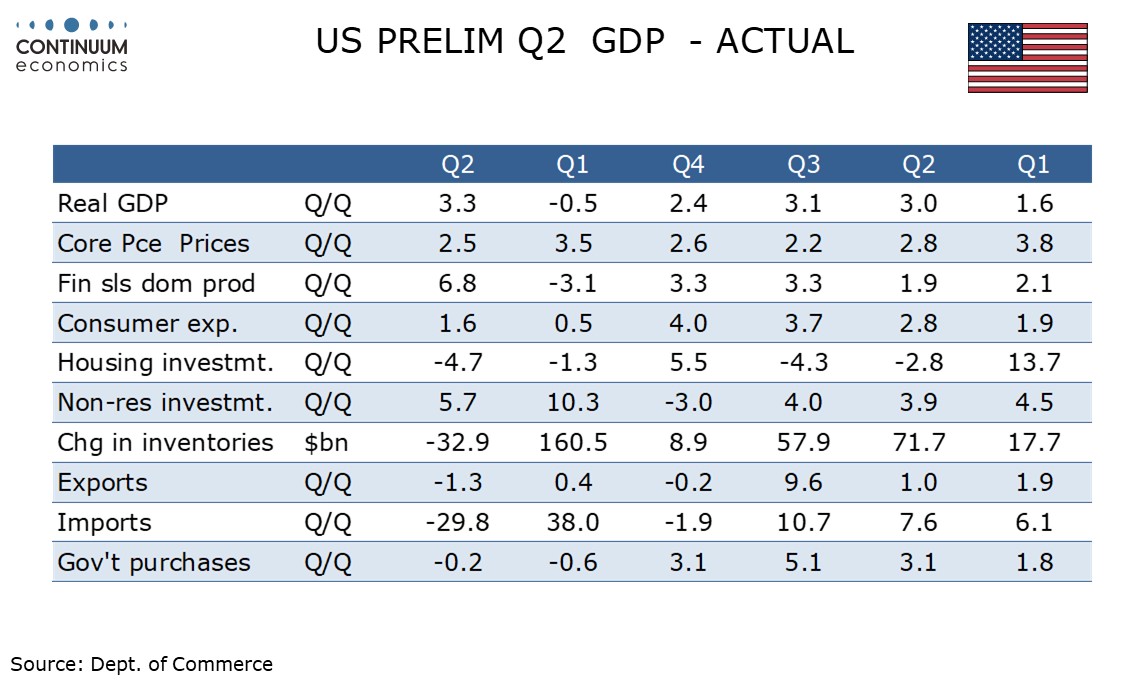

The main focus on Thursday should be the final estimate of the Q2 GDP data. We do not expect any significant revision in the third (final) estimate of Q2 GDP from the second (preliminary) estimate of 3.3%. However the data will include historical revisions, and here risk is on the downside, particularly for 2024. Employment was revised significantly lower, by 911k or 0.6%, in the preliminary estimate for the March 2025 non-farm payroll benchmark and that suggests downward revisions to personal income in the four quarters to Q1 2025. The Fed will also be watching the price indices for historical revisions, though we do not expect any substantial revisions here. Core PCE prices rose by 2.5% annualized in the preliminary Q2 data.

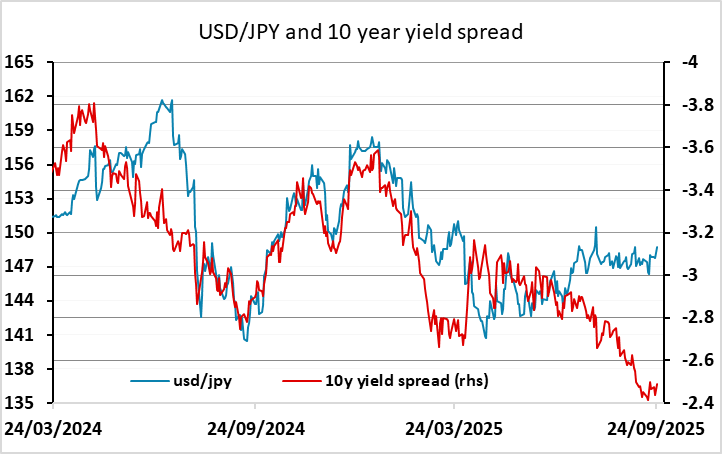

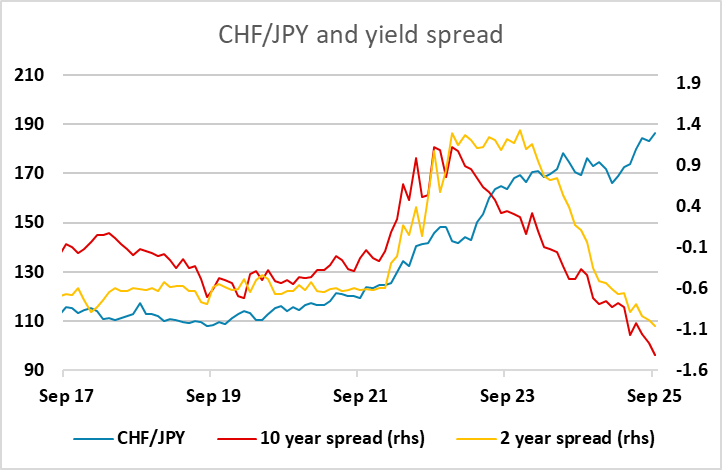

The USD was strong on Wednesday, with Powell’s comments on Tuesday being cited by many as a cause. However, while it could be argued that Powell’s comments were slightly on the hawkish side, there was no significant move in US yields, so it’s hard to argue that his comments were behind the stronger USD. For the EUR, the weaker than expected IFO survey could be seen as a reason for weakness, but USD strength came across the board. USD/JPY consequently looks the most anomalous, reaching its highest level since September 3, while CHF/JPY hit yet another all time high. It’s hard to see this as a result of Powell’s comments, so we are inclined to look at the USD strength and JPY weakness as primarily technical. A downward revision in historic GDP could take the edge off USD strength, although in practice it’s not clear that it would make much difference to Fed policy or yields. The jobless claims data may be more significant for policy and yields after last week’s decline.

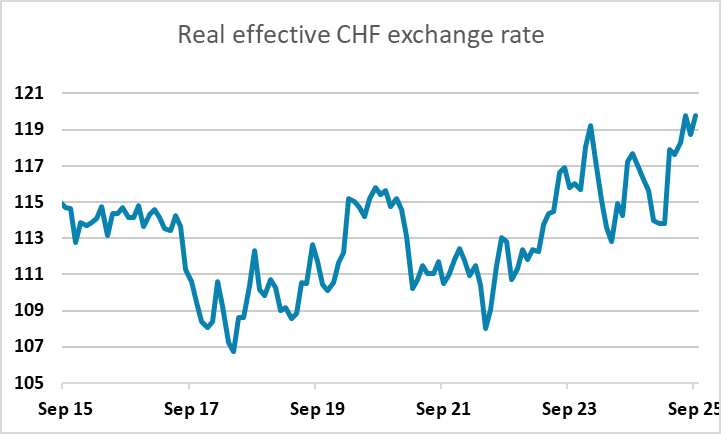

Given the strength of the CHF, the SNB monetary policy meeting will be a focus for FX markets. However, of 41 forecasts in the Reuters survey, only one (non-Swiss) is looking for rates to be cut to negative and a cut is priced as less than a 5% chance. There is nevertheless scope for some impact on the CHF if the comments from the SNB suggest the currency is excessively strong and the SNB might be prepared to act in the FX market. The real effective CHF exchange rate is at its highest since the early 2010s, and with the background of a 39% tariff from the US is certainly higher than the SNB would like. Whether intervention would be contemplated or effective is debatable, but there is some risk of a CHF negative statement.