CHF flows: CHF drops sharply on SNB rate cut

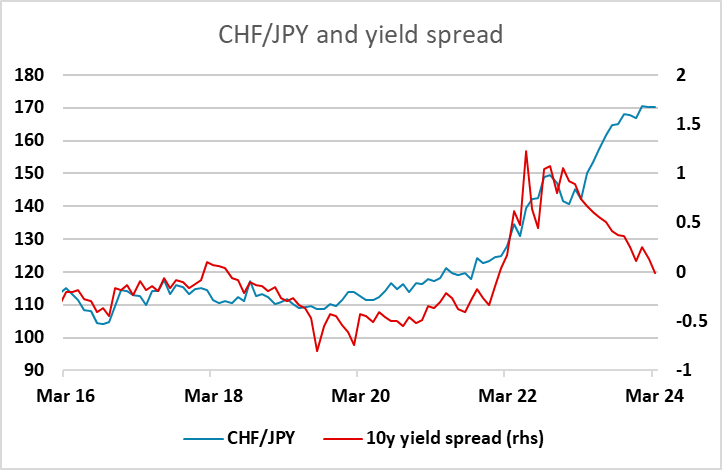

The SNB cut the policy rate 25bps. This was only seen as an outise chance before the meeting so the CHF has weakened and is likely to remain under pressure, although valuation only looks dramatically out of line against the JPY

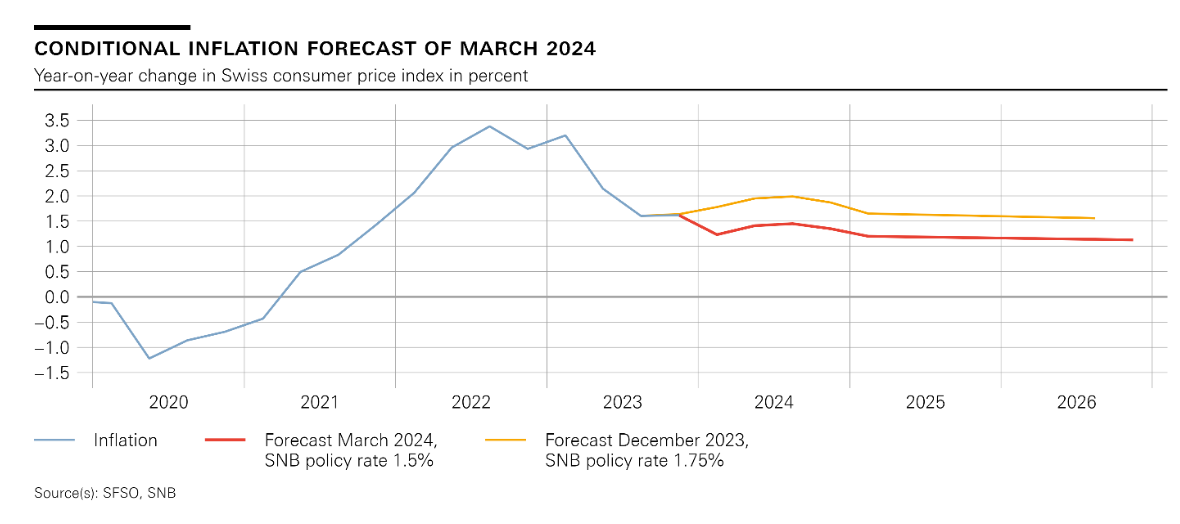

The SNB has cut the policy rate 25bps to 1.5% at today’s meeting, This had been priced as around a 40% chance ahead of the meeting, although only 22% of forecasters were looking for a cut in the latest Reuters survey. The inflation forecasts have also been cut sharply, with the 2025 forecast at 1.2% from 1.6% previously, suggesting scope for further rate cuts at upcoming meetings.

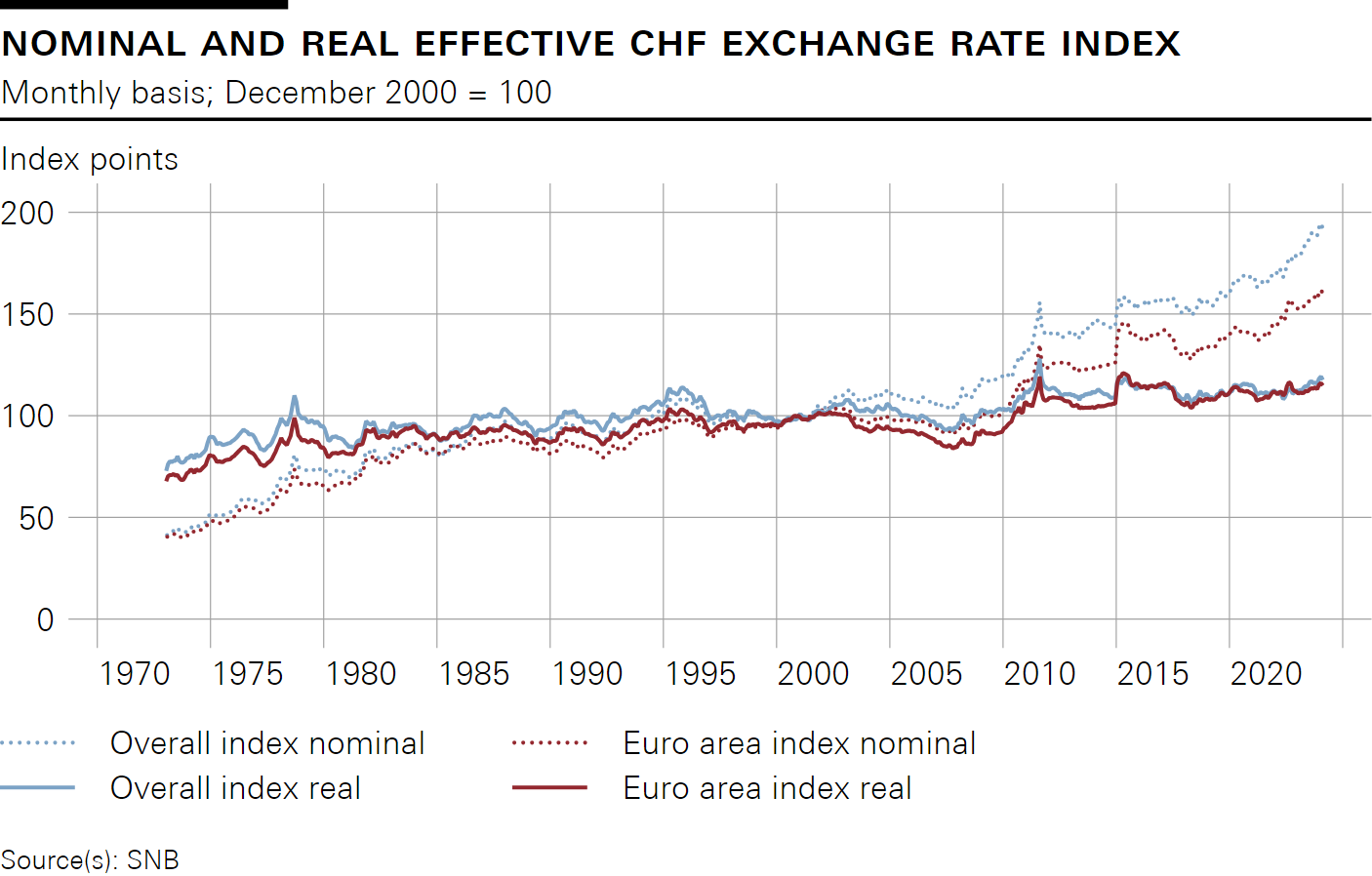

The CHF has fallen sharply, with EUR/CHF gaining a big figure to 0.9775. There is still some potential for further CHF declines against the riskier currencies if risk appetite remain strong. The SNB cited the strength of the CHF as a factor that had been weighing on inflation. However, it is notable that the strength in real terms has been relatively modest, with only the JPY seeing substantial real terms weakness against the CHF in recent years. CHF/JPY consequently looks like the pair with the most scope to decline.

The SNB decision will keep the CHF under pressure in the short term, but in practice this may only be a timing issue, as the SNB cut is likely to be followed in coming months by cuts elsewhere. We do see scope for EUR/CHF to edge higher towards parity, but this is likely to be a slow process, as the CHF strength in the last few years has been justified by the relatively low level of Swiss inflation, so no major valuation correction is likely against the EUR.