NOK, SEK, JPY, EUR flows: NOK dips marginally on CPI, USD firm

Norwegian CPI weaker than expected, but reaction is mild USD remains strong against EUR and JPY

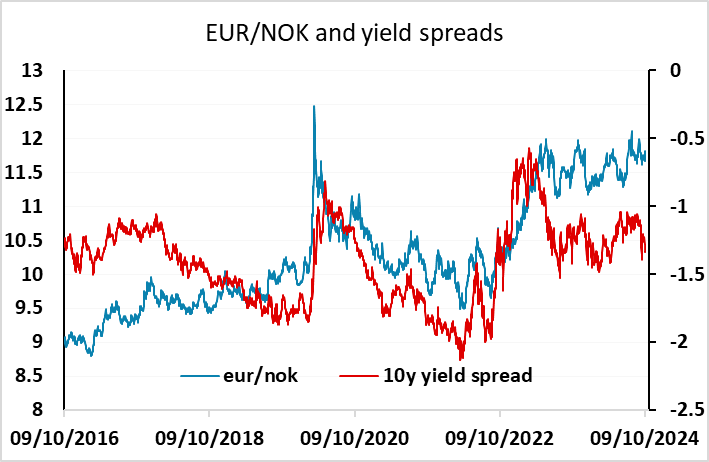

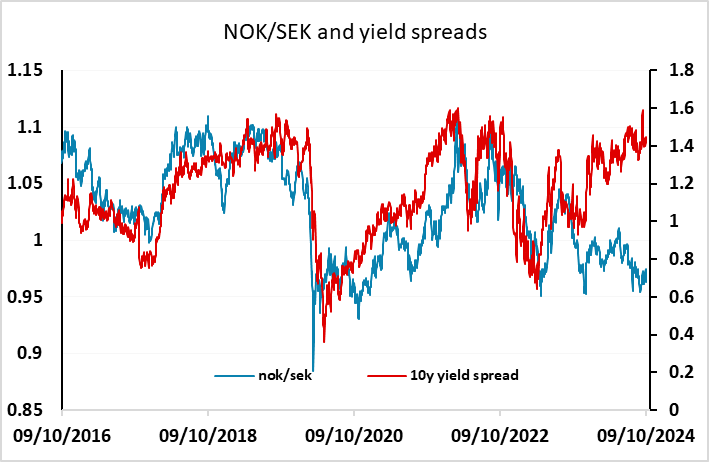

Norwegian CPI has come in on the soft side of expectations, and EUR/NOK has moved higher in response, albeit not particularly sharply. While EUR/NOK has edged up to test 11.80, it is still 5 figures below yesterday’s high, and at these levels it’s hard to make a case for significant NOK losses. While there is scope for short term NOK yields to drop, as the market is currently only pricing a 40% chance of a 25bp rate cut by year end, yield spreads would even then still suggest there is NOK upside from here. SEK is performing better this morning, helped by the stronger than expected August GDP number, which showed a 1.1% gain after the 0.9% decline in July. But these numbers are so volatile that they lack real significance, and the Riksbank still looks likely to be easing rapidly over the coming months. NOK/SEK therefore still looks good value after the dip of the last couple of days.

Elsewhere, the USD has been generally firm overnight, gaining against both the EUR and JPY. The AUD has been more resilient, boosted by strong Chinese equities on the back of more stimulus promises. The focus will be on the US CPI data later, but the stronger USD tone will be had to oppose unless the data is clearly on the weak side.