FX Daily Strategy: N America, August 14th

CPI data the main focus on Wednesday

But RBNZ stole the spotlight

USD remains soft but downside limited against EUR

GBP may reverse Tuesday gains if CPI comes in as expected

SEK may be vulnerable to softer CPI

CPI data the main focus on Wednesday

But RBNZ stole the spotlight

USD remains soft but downside limited against EUR

GBP may reverse Tuesday gains if CPI comes in as expected

SEK may be vulnerable to softer CPI

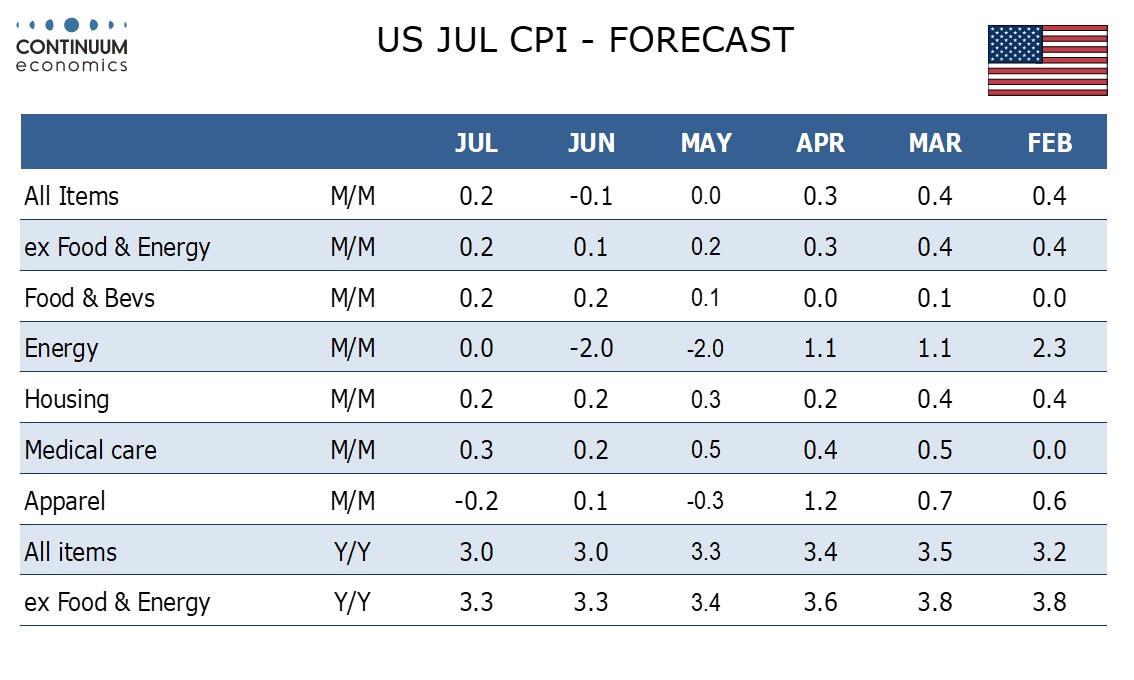

US CPI data is the main focus on Wednesday. We expect CPI to be acceptably subdued, but a little stronger than the preceding two months with gains of 0.2% both overall and ex food and energy. We expect the core rate to rise by 0.23% before rounding, up from 0.065% in June and 0.163% in May. Our forecasts are in line with consensus, and consequently unlikely to trigger a significant reaction. However, after the weaker than expected PPI data on Tuesday, the USD has come under a little pressure, and the USD tone will probably remain soft unless the CPI data is on the strong side.

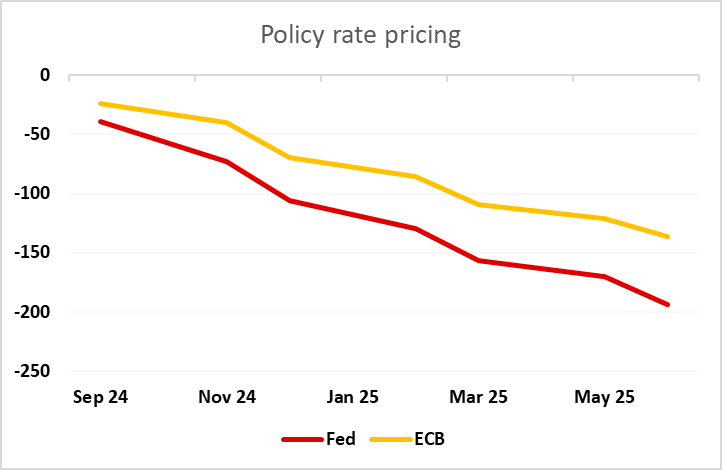

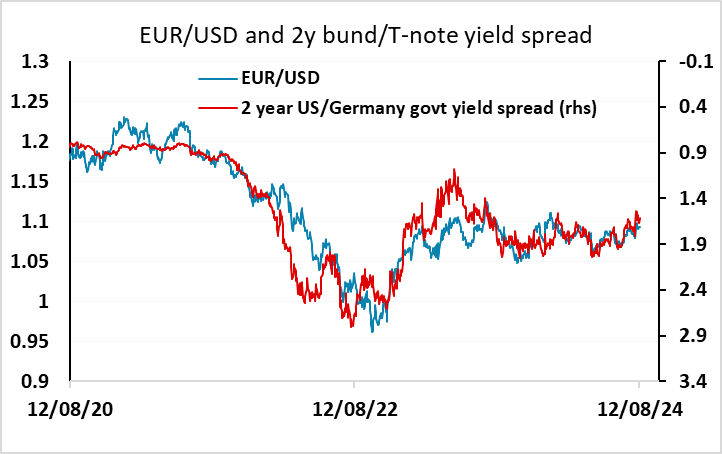

Having said this, the market is pricing for the September FOMC as being around a 50-50 call between a 25bp and a 50bp rate cut, and at this stage we would see a 25bp move as much the more likely, as the data has softened a little but could hardly be called surprisingly weak. So while the USD may remain a little soft, it will require further evidence of weakness if we are too see significant losses against the EUR, with current short term yield spreads consistent with EUR/USD remaining fairly stable. There remains a stronger case for JPY gains, as yield spreads have been pointing sub-140 for some time, but JPY gains will continue to be hard to achieve as long as risk sentiment remains well supported.

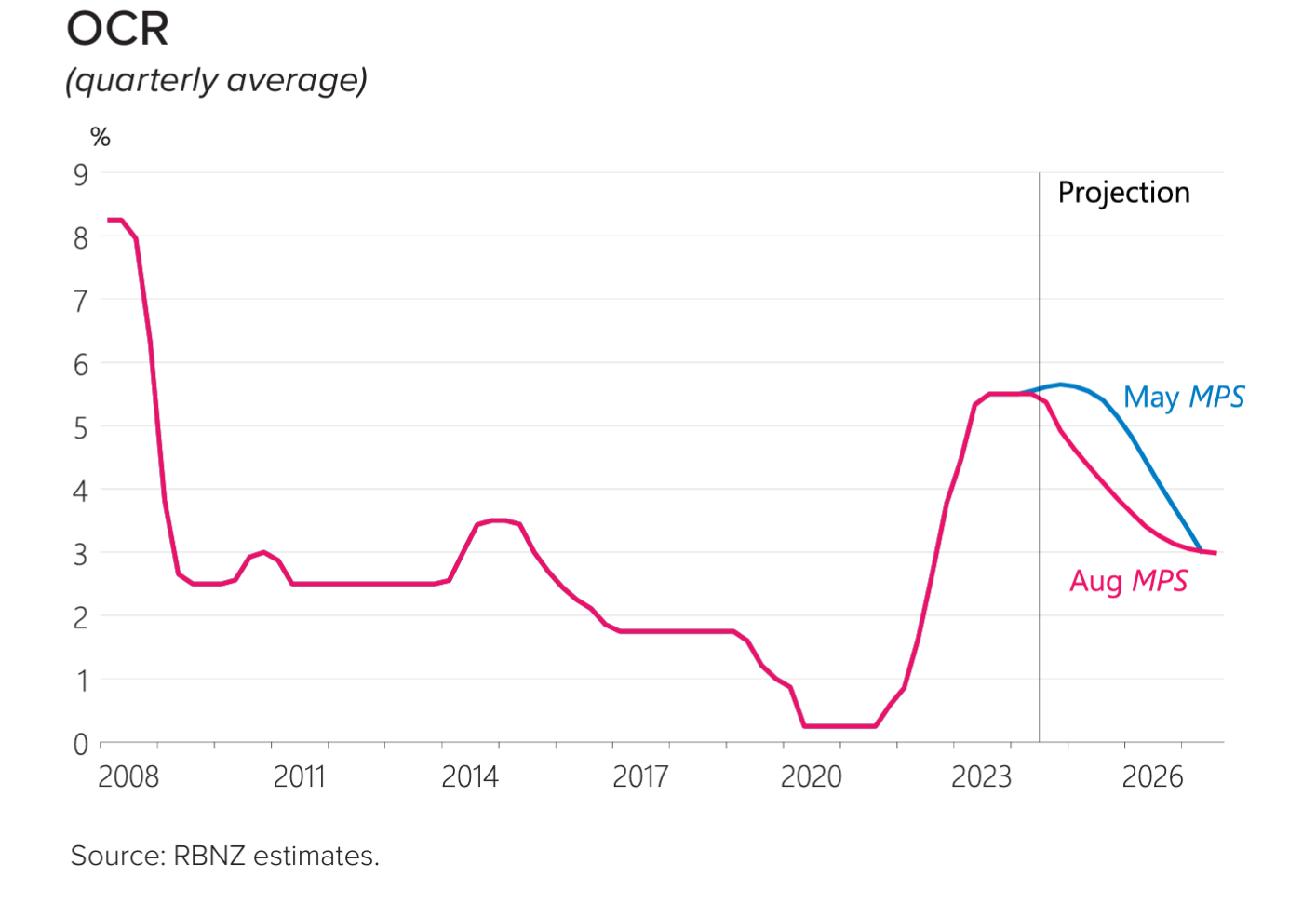

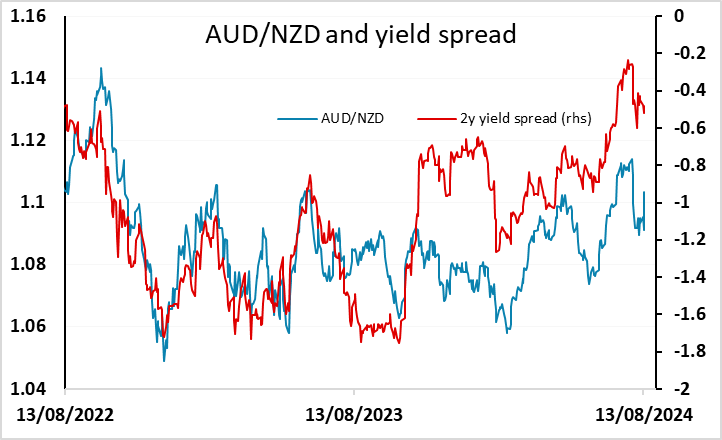

Overnight the RBNZ cut its cash rate by 25bp to 5.25% in the August meeting with significant revision in their forecast and expects inflation to return to three percent in September 2024. The RBNZ reinforce their view that inflation will continue to tread lower after Q2 CPI came in lower than forecast at 3.3%, shaking off the hot labor report in Q2. They cited "Surveyed inflation expectations, firms’ pricing behaviour, headline inflation, and a variety of core inflation measures" are all aligning with their forecast, which was revised significantly. The OCR forecast has been revised lower to 4.92% in December 2024 from 5.65% and at 3.85% in December 2025 from 5.14%. The OCR path shows continuous easing until year end 2026 at 3% terminal rate. Q2 2024 CPI has been revised lower to sub-two percent from three percent.

The market was tilted towards a hold from the RBNZ as Q2 CPI remains above 3% at 3.3% y/y while the latest labor report came in red hot with higher participation rate and headline figures. Yet, preliminary data point towards further moderation in the first months of Q3 2024. The August meeting is a turning point for the RBNZ as they entered the easing cycle. The inflation picture seems to be cooling rapidly in the recent months and prompted the RBNZ to ease earlier than expected. However, the labor market remains red hot and could be a speed bump for RBNZ's smooth cutting plan if wage growth picks up.

EUR/GBP traded 20 pips higher to 0.8570 after the weaker than expected July CPI data, which saw the headline y/y rate rise less than expected to 2.2% and the core rate fall more than expected to 3.3%. There was a modest decline in service sector inflation to 5.7% from 6%, and this may be seen as supporting the case for more rate cuts going forward. As it stands, the market is only pricing around a 35% chance of a UK rate cut in September, with November fully priced for a 25bp cut. Today’s data may slightly increase the chances, but at this stage a September move is still probably less than a 50% chance. Recent GBP strength has been as much about optimism on UK economic prospects as about expectations of tight policy, as GBP is trading above the level that looks consistent with recent moves in yield spreads. For the moment, this optimism is likely to be sustained, especially after the lower unemployment rate reported yesterday, so for now we would expect EUR/GBP to hold below 0.86, although in the longer run GBP still looks somewhat overvalued.

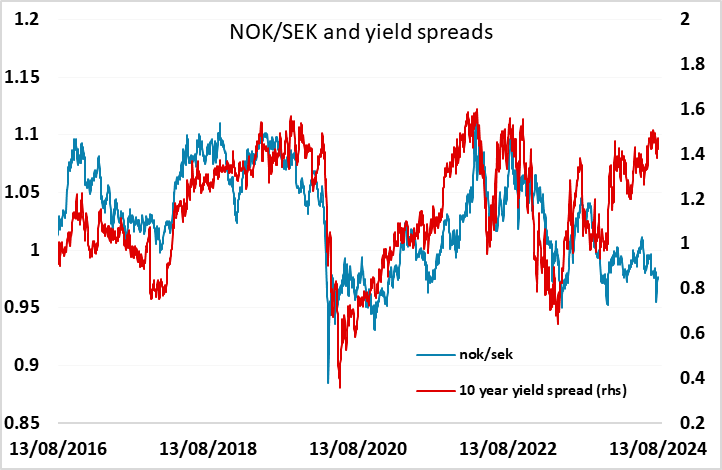

Swedish CPI was slightly stronger than expected at 1.7% y/y on the targeted CPIF measure, with the headline measure also above consensus at 2.6% y/y. EUR/SEK has dipped around 3 figures since the release, now sitting below 11.50. While yield spreads aren’t particularly supportive for the SEK, the SEK does tend to act a little like a super-EUR, benefiting against the EUR when the USD weakens and EUR/USD’s rise above 1.10 may consequently also be helping SEK sentiment. Still ,we don’t see a strong case for SEK strength here, with the NOK in particular looking good value against it having underperformed through this year.