FX Daily Strategy: Asia, February 13th

Some USD downside risks on US CPI…

…although the outlook is complicated by continuing US equity market strength

GBP vulnerable to weaker UK labour market data

Some USD downside risks on US CPI…

…although the outlook is complicated by continuing US equity market strength

GBP vulnerable to weaker UK labour market data

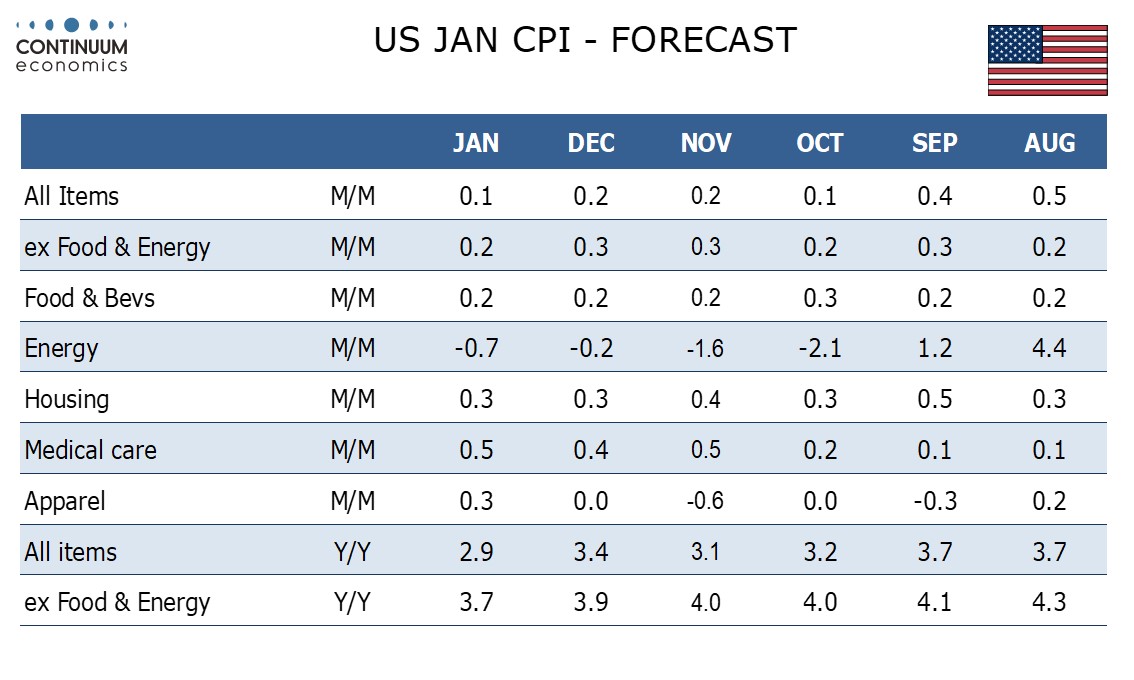

US CPI will be the main focus on Tuesday after what has been a very quiet period for data in the last week or so. We expect January CPI to increase by 0.1% overall and 0.2% ex food and energy, with our forecasts before rounding being 0.13% overall and 0.23% ex food and energy. Still, the ex food and energy rate would then be slower than the 0.3% gains seen in November and December ,and below the market consensus of 0.2% and 0.3% respectively. The risks should therefore be on the downside for US yields and the USD.

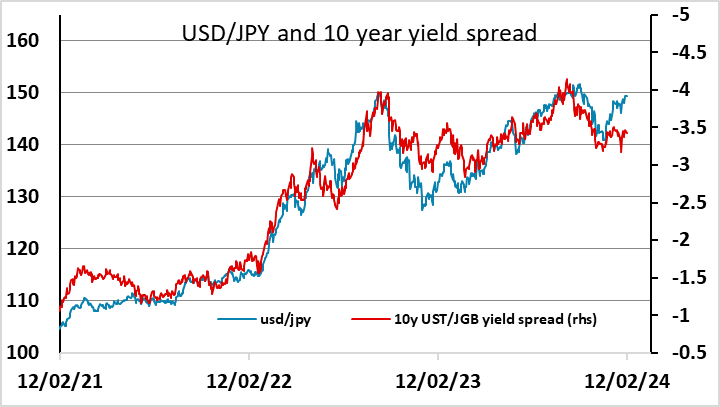

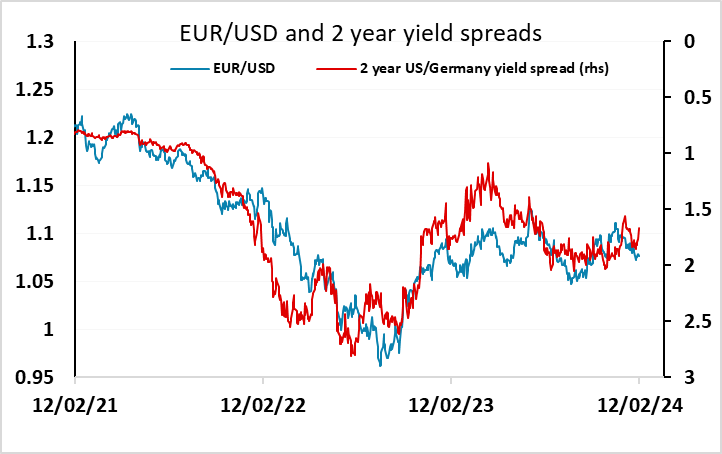

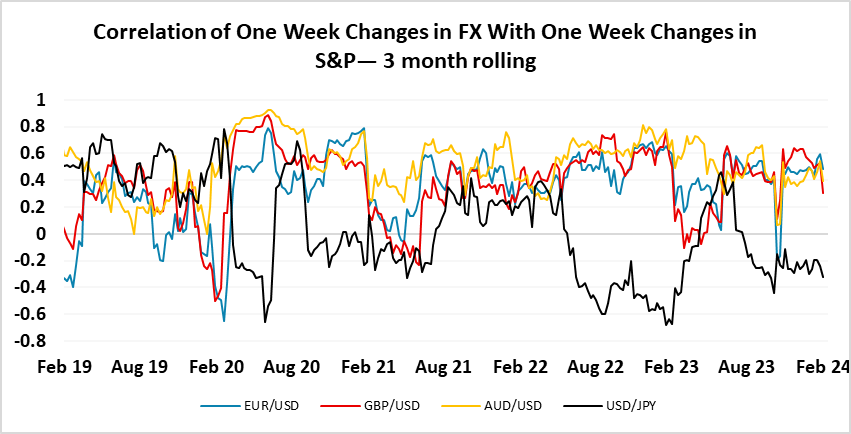

However, while the last few years have seen the FX market being dominated by movements in yield spreads, the correlation with yield spreads has faded at the beginning of this year in many currency pairs. It’s most notable in USD/JPY, which has remained well bid despite only very modest gains in US yields over Japan so far this year. However, it’s also the case that EUR/USD failed to gain on Monday despite a narrowing one the 2 year Germany spread with the US, which has been a reasonable guide to EUR/USD in the last few years.

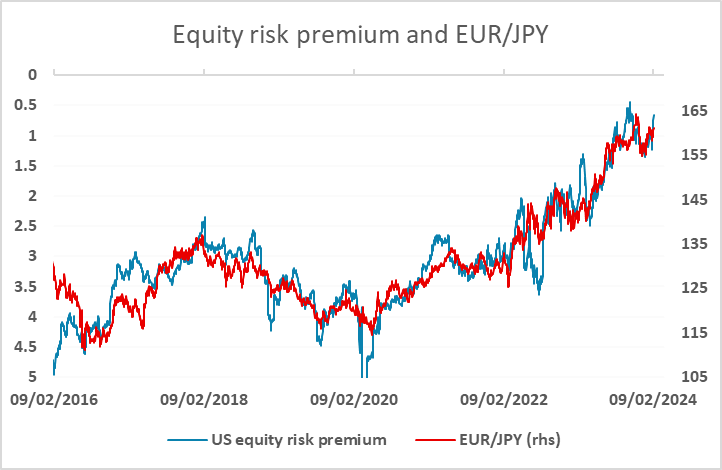

A lot of this disconnect looks to be related to equity market performance, particularly the strength of the US equity market. There is a strong historic correlation with JPY weakness and declines in equity risk premia, and the JPY has fallen back on the crosses as equity strength against a background of steady yields has led to lower risk premia this year. However, the USD has historically tended to be negatively correlated to equity market strength against the riskier currencies, and even against the JPY. This has continued in broad terms, but the USD has also tended to benefit from US equity market outperformance.

This makes the implications of the US CPI data harder to assess for the FX market. If there is a weak number that has a positive impact on US equities, both absolutely and relatively, it may moderate any negative yield spread implications for the USD, but would tend to be more favourable for the riskier currencies if equities were positively impacted by the data. Nevertheless, we do see some USD downside risks on the data as it is too early to conclude that the market is prepared to ignore US yield spread moves.

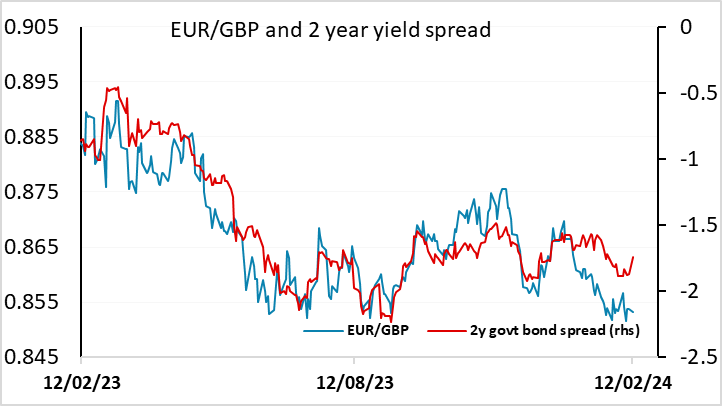

There is also UK labour market data, which has potential to impact the pound. Even though it is less of a focus for the market than the CPI and GDP data on Wednesday and Friday, it is of major importance for the BoE, and this week’s numbers are of greater interest as they should include some updated numbers after an ONS revamp of the labour market data. The revised numbers may show a softer than thought jobless rate and higher inactivity, but there will me as much weight on HMRC numbers regarding job dynamics. However, the average earnings figures will be the most closely watched and where we see regular pay growth (3 mth mov avg) slowing clearly towards 6% but the headline rate down around to just under 6%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing has already been seen. These numbers could be the beginning of a difficult week for GBP if, as we expect, they indicate declining underlying inflation pressures, and we do see some upside risks for EUR/GBP.