FX Daily Strategy: N America, April 12th

GBP downside risk on UK GDP

SEK favoured as CPI set to pop higher

USD to maintain recent strength

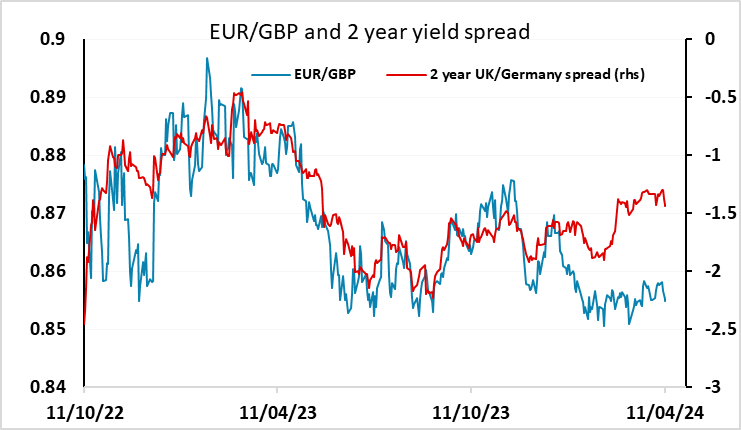

GBP has risen modestly after the UK February GDP data. February was in line with expectations at 0.1% m/m, but an upward revision to January has pushed the 3m/3m trend up to 0.2% - the highest since October last year. In truth it’s much too early to say that the UK economy is doing anything other than bumping along close to zero growth, and the Bank of England is in any case much more focused on wage and price developments than real output, but at the margin this makes an early rate cut slightly less likely. EUR/GBP has dipped below 0.8550 to its lowest this month, and has scope to around 0.8530. However, this is significant short term support, and next week’s labour market and CPI data is more likely to determine the next significant move.

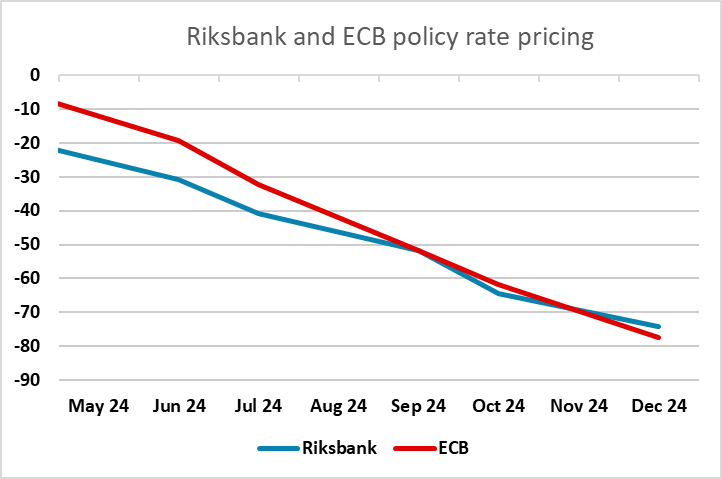

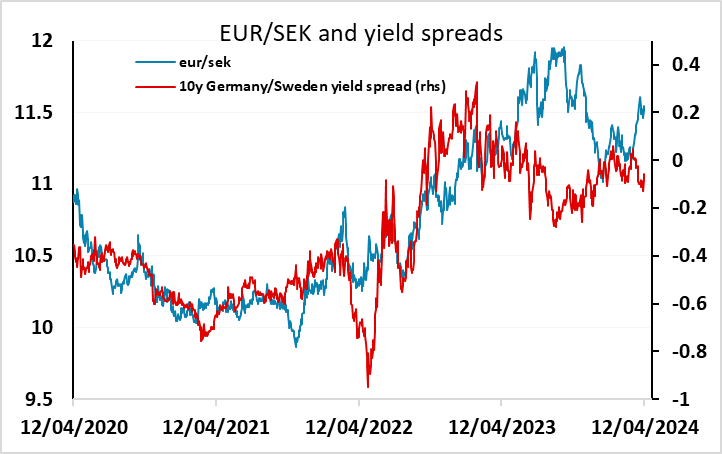

Swedish CPI data has come out significantly below market expectations, with the core rate falling to 2.2% from 2.5%, against market expectations of a rise to 2.6%. This will increase the market expectations of a Riksbank rate cut in May, and a cut is now fully priced for June, while the market pricing of the probability of an ECB June cut has been pared back after yesterday’s ECB meeting. We still doubt that he Riksbank will be cutting rates before the ECB, particularly if the SEK continues to trade soft, and this limits the potential upside for EUR/SEK. EUR/SEK has gained a few figures on the data, but should come up against significant resistance in the 11.55-58 area.

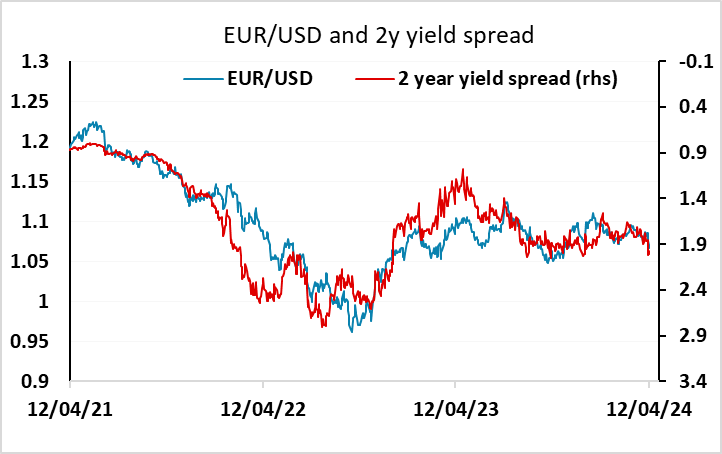

The USD looks likely to at least hang onto the gains made post-CPI, with the market finally starting to see some differential between Fed and ECB policy. While we aren’t entirely convinced that the Fed will be leaving the first hike until September as the market is currently pricing in, as the CPI data are still open to interpretation, it does seem as if the relative strength of the US economy is starting to lead to a relatively more hawkish view of the Fed. While this continues, expect downside pressure on EUR/USD, with a break to new lows for the year below 1.0695 likely to be seen.